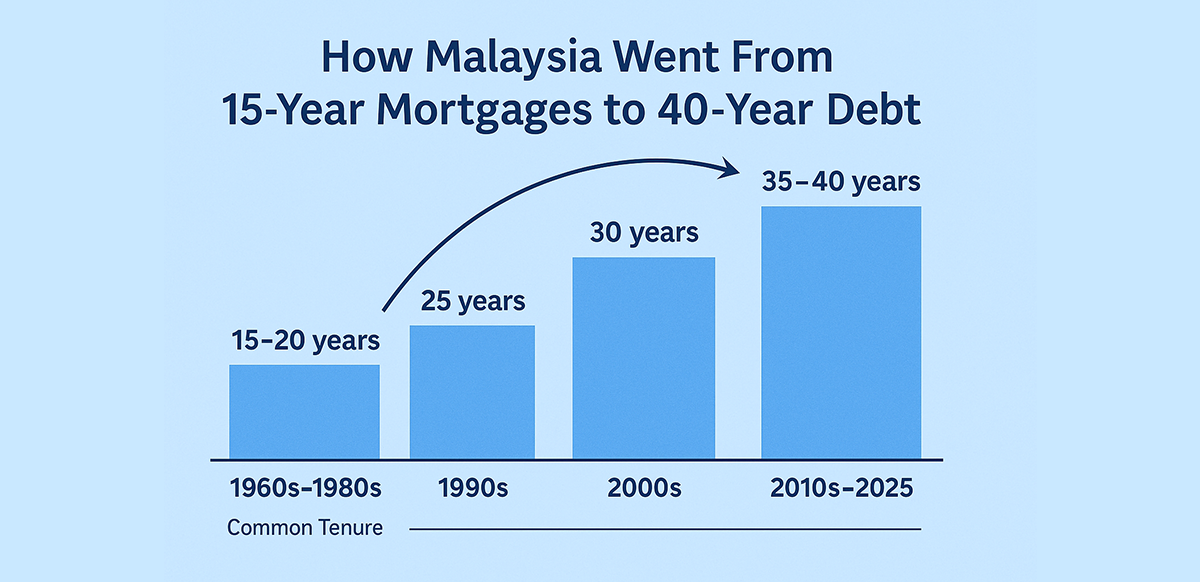

How Malaysia Went From 15-Year Mortgages to 40-Year Debt: The Hidden Shift That Trapped a Generation

Everyone has heard the same sentence from their parents:

“Last time, people paid off their houses in 7-10 years.”

People assume it’s because “things were cheaper back then.”

But that’s only half the truth. The real reason is this:

Malaysia’s property loan system was completely redesigned over 60 years — from short, conservative loans… to 35–40 year financial contracts that quietly transfer wealth from buyers to banks.

Here is the real timeline no one explains.

1. 1960s – 1980s

Common Tenure: 15–20 years

Maximum Tenure: 25 years (rare)

Banking was conservative, based on the British model

Property prices were low relative to income

Buyers needed 20%–30% down payment

A middle-class worker could pay off a house within 10 years

Most people owned homes before age 40, not finished paying at 65

Important point:

The “7–10 years” payoff story wasn’t the official loan term. It was because property was cheap enough that people could clear it early.

A house back then was something you worked to own — not a 35-year subscription to debt.

2. 1990s — The Asian Tiger Boom

Common Tenure: 25 years

Maximum Tenure: 30 years introduced

Malaysia urbanised and modernised rapidly

Developers moved from terrace homes to townships, condos, fancy launches

Property prices began climbing faster than salaries

To keep people buying, banks increased the loan tenure

The message changed from:

“Pay it off fast.”

to

“Don’t worry, we’ll stretch the loan so you can ‘afford’ it.”

Longer loan = lower monthly instalment

But also = more interest paid over more years

And banks get a bigger lifetime profit from each buyer

3. 1998 – 2008 (Post-Asian Financial Crisis)

Common Tenure: 30 years

Maximum Tenure: 30–35 years

After the 1997 crash, property wasn’t moving.

Instead of lowering prices, the system lowered the monthly instalment — by stretching the loan again. This is when the entire psychology of buying property changed.

Old mindset:

“I want to own this house.”

New mindset:

“As long as I can afford the monthly payment, it’s fine.”

Owning was no longer the goal. Servicing the loan became the goal.

4. 2009 – 2025 (The Modern Affordability Crisis)

Common Tenure: 35 years

Maximum Tenure: 40 years (or “up to age 70”)

This is the era we’re in now — where the system is basically out of ideas.

- Salaries stagnated

- Property prices detached from income

- Marriage rate dropped

- Household debt became one of the highest in Asia

The only way to make RM500k “look affordable” was to stretch it to 35 years

Not because buyers benefit…

…but because it helps:

✅ the developer sell

✅ the bank lend

✅ the government collect stamp duty and RPGT

✅ the agent close the deal

The buyer is the only one who carries the 30–40 year risk.

Summary Chart: 60 Years of Debt Stretching

| Era | Common Tenure | Max Tenure | Why It Changed |

|---|---|---|---|

| 1960s–80s | 15–20 yrs | 25 yrs | Property cheap, banks conservative |

| 1990s | 25 yrs | 30 yrs | Prices rising, loan stretched to match |

| 2000s | 30 yrs | 35 yrs | Post-crisis “affordability engineering” |

| 2010s–2025 | 35 yrs | 40 yrs | Prices too high, wages too low, DSR workaround |

Nothing got cheaper.

Nothing became more affordable.

Only the loan got longer.

Property didn’t become easier to own.

Debt became easier to stretch.

Why This Matters: The System Didn’t Solve Affordability — It Just Shifted the Burden

When a loan goes from 15 years to 35 years:

- The buyer’s life commitment doubles

- The bank’s profit doubles

- The developer still sells at full price

- The government collects the same taxes

- The borrower now retires still in debt

The whole idea of “property makes you rich” only worked when you could finish paying in 10–15 years and own the asset early.

Now, most people don’t “own property.” They rent money from the bank for 35 years — and call it ownership.

What This Means for Property Agents (The Part No One Tells You)

If you are a property agent, this is not just history.

It is the reason:

- Buyers hesitate

- Sales cycles drag

- “Buy now before price goes up” no longer works

- Younger buyers don’t buy just because they’re “supposed to”

- Increasingly, buyers see mortgages as a trap, not a milestone

Old agents sell fear of missing out. Future agents sell clarity, strategy, and exit logic.

| The Old Buyer | The New Buyer |

|---|---|

| Wanted a forever home | Wants flexibility and mobility |

| Believed property always appreciates | Questions interest, tenure, resale risk |

| Didn’t question 30-year loans | Considers renting + investing instead |

| Saw debt as “normal adulthood” | Doesn’t want to spend life paying a bank |

Agents who keep selling the old story will be ignored.

Agents who understand why buyers think differently will lead the market.

The New Role of a Property Agent

Not just: “Here’s a house, here’s a loan.”

But:

- ✔ “Here’s the exit risk if you buy wrong”

- ✔ “Here’s how loan tenure affects lifetime cost”

- ✔ “Here’s the difference between owning and being mortgage-owned”

- ✔ “Here are assets that don’t trap you for 35 years”

- ✔ “Here’s how to buy without wrecking your future flexibility”

The future top agent is not the best closer. It’s the best truth-translator.

Final Line

The Malaysian housing system didn’t suddenly break.

It evolved into a long-term debt machine that only works if buyers don’t question it.

The new generation is questioning it.

And the smartest agents will not fight that shift…

They will lead it.