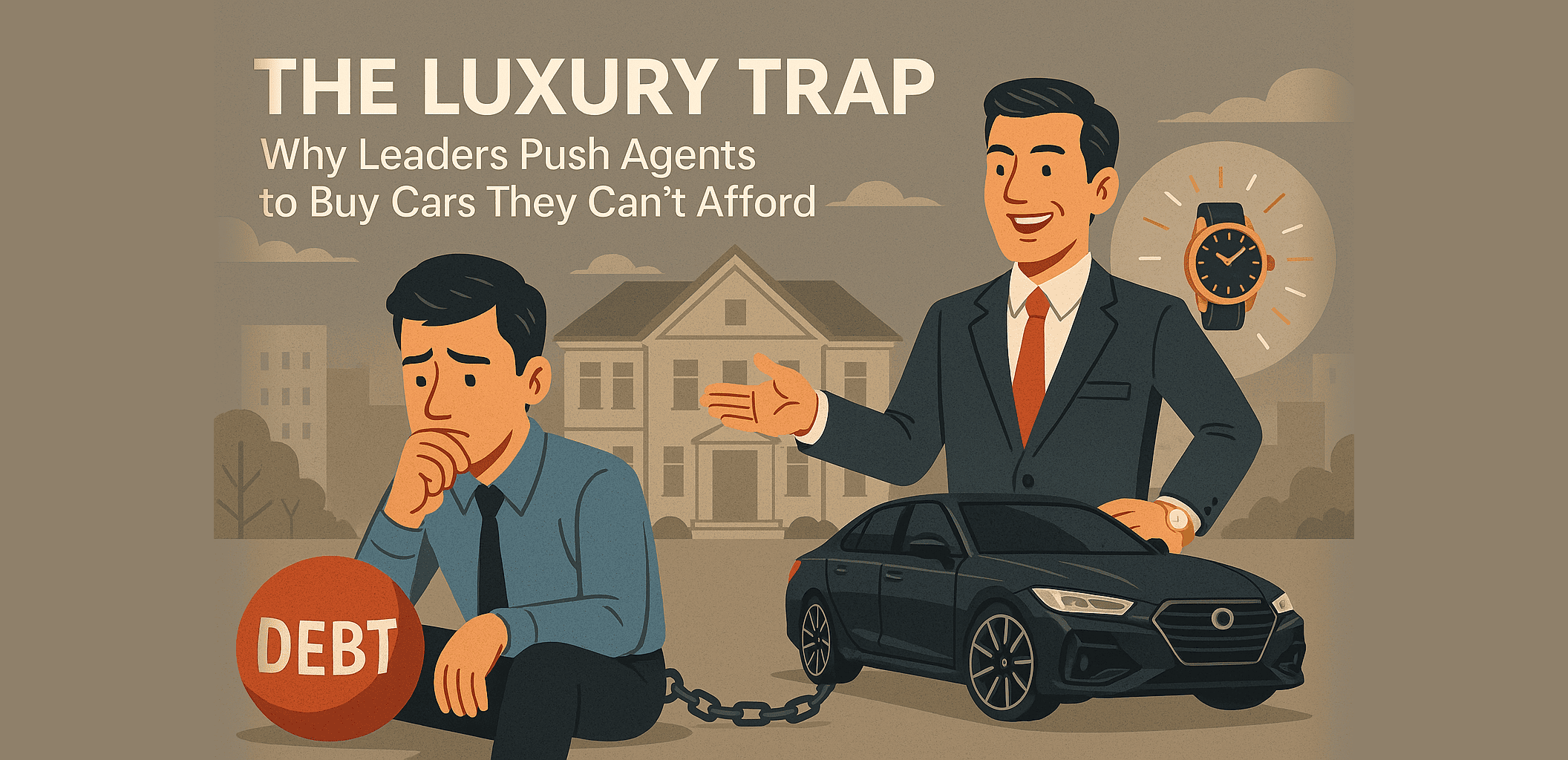

The Luxury Trap: Why Leaders Push Agents to Buy Cars They Can’t Afford

The Luxury Trap: Why Leaders Push Agents to Buy Cars They Can’t Afford

Scroll through any property leader’s social media and you’ll see the same highlights: sports cars, designer watches, luxury homes, overseas trips. It looks like success—and it’s meant to.

But in the property agency world, these displays aren’t just pride. They’re tools, mainly for recruitment and control.

Luxury as Proof of Success

In commission-driven industries like real estate, luxury is the shortcut to credibility. A flashy car or a branded watch sends an instant message: “I’ve made it, and you can too.”

For recruits—especially those chasing a way out of financial struggle—the lifestyle becomes the ultimate goal.

Recruitment by Aspiration

Leaders know growth doesn’t come only from sales, but from building teams. Flaunting luxury is the best recruitment ad there is.

A struggling individual doesn’t need a pitch; the Mercedes convinces them. Luxury becomes a magnet, selling the dream without a word spoken.

Debt as a Leash

Behind the scenes, leaders often encourage agents to commit to heavy spending:

- Houses

- Sports cars

- Luxury watches

Even when the agent isn’t ready. Why? Because debt creates loyalty.

An agent with big loans can’t afford to quit. They’re locked in, grinding harder out of fear of default. Leaders know this—and use financial pressure as leverage.

Banks enable it with easy credit: “Don’t worry, pay monthly. Your commissions will cover it.” But commissions are uncertain. Loan payments are not.

The Harsh Truth: Image Without Reserves

Many flaunting luxury are on a financial knife’s edge. As the saying goes: “Drives a BMW but has no money to pump petrol.”

The lifestyle is maintained for show, not for stability. No emergency fund. No investments. No buffer for a slow month. Just deal-to-deal, loan-to-loan survival.

It looks glamorous on Instagram—but the foundation is fragile.

The Double-Edged Sword

This strategy may boost short-term motivation, but it creates long-term damage:

- Burnout: Agents collapse under financial stress.

- High Turnover: Recruits eventually see the illusion and leave.

- False Success Markers: Image becomes more important than net worth or financial freedom.

A Smarter Path

True success isn’t measured by the car you drive—it’s by the reserves you build.

A sports car on loan is just a golden handcuff. Real professionalism is financial discipline: save aggressively, invest wisely, live within your means.

Leaders may sell the dream with flashy symbols. The smart agent looks beyond the illusion.

The Bottom Line

Leaders flash luxury lifestyles to attract recruits. They push agents into debt so loyalty comes not from passion, but from pressure.

It works on the surface—but underneath lies fragility, stress, and financial risk.

Real estate is already unpredictable. Don’t make it worse with unnecessary debt. It’s better to have cash in the bank than a car you can’t afford to fuel.

What do you think—does luxury motivate, or is it just a trap?