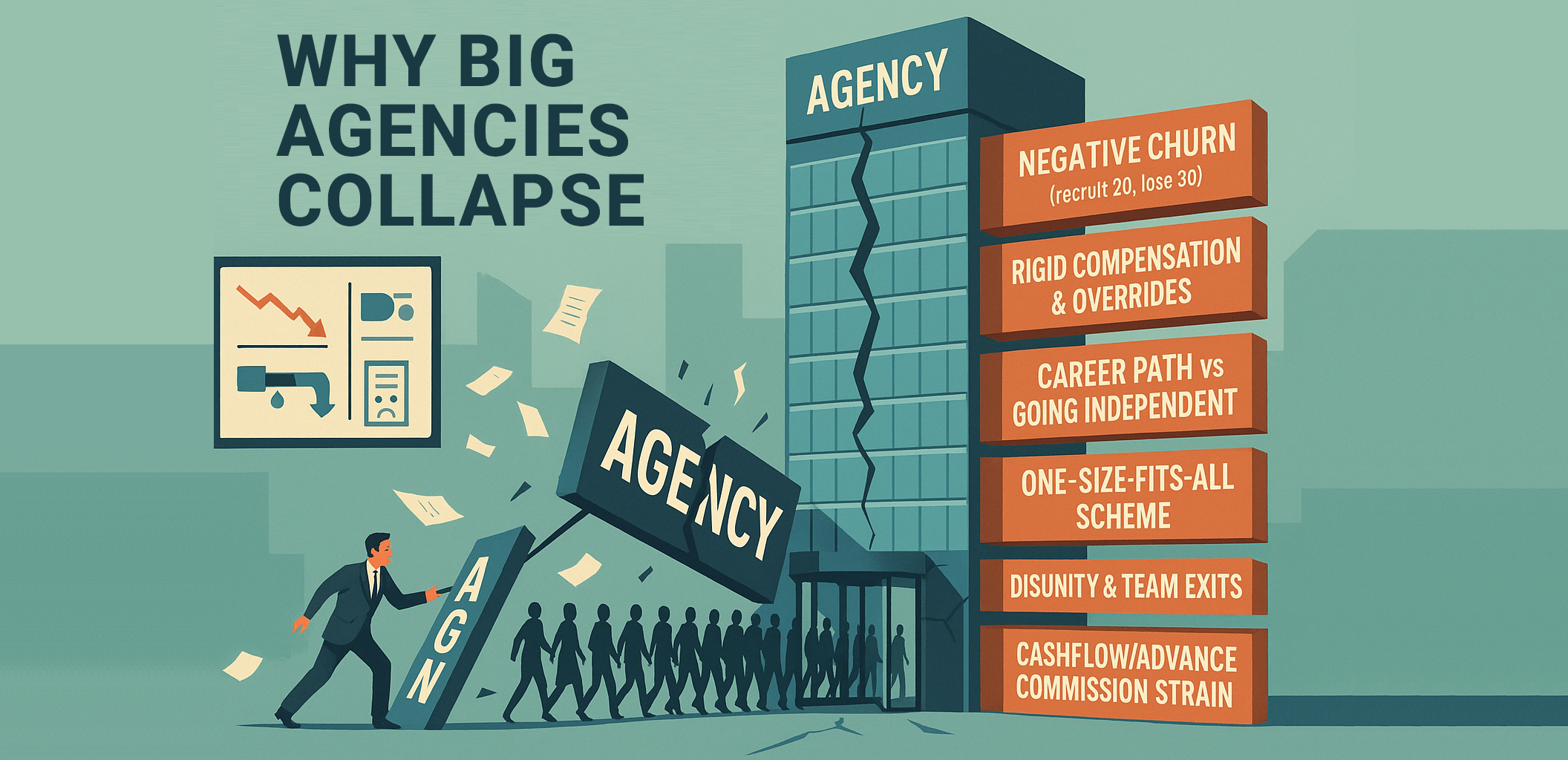

Why Big Agencies Suddenly Collapse — And Why It Keeps Happening

Every year in Malaysia, agencies with thousands of agents and branches seem to collapse almost overnight. One week they’re everywhere; the next, they’re fighting for survival.

The trigger is familiar: a team leader asks to meet, hands over a resignation letter, and an entire unit walks. One exit sets off another. Momentum reverses.

Below are six cracks that quietly widen until the building falls. No band-aids. No “quick wins.” Just the truth.

1) Recruitment & Retention: The Negative Churn Loop

You recruit 20, you lose 30. This isn’t random; it’s compensation design. When splits and overrides are uncompetitive or inflexible, agents park cases elsewhere to maximise take-home, then jump ship to firms that match their leverage. As headcount grows, the leakage accelerates because each team optimises for itself instead of the house.

2) “Career Path” That’s Harder Than Going Independent

Some firms publish ladders, but the criteria are so extreme—or the goalposts move so often—that anyone who can meet them might as well start a brand. Overrides feel like a permanent tax, autonomy is denied, and contribution beyond personal GCI doesn’t count. The result is simple: your best people are training under you to leave you.

3) Technology: Manual Houses Lose Talent

Even today, some agencies still demand paper forms and manual workflows. Meanwhile, competitors run end-to-end digital pipelines from listing to commission. If your process feels like 2009, top performers won’t join—and those who do won’t stay.

4) Culture & Policy: No System, Only Favouritism

At scale, the boss still behaves like the top salesperson. There’s no shared rulebook for co-broking, case-parking, or split disputes. Stars get exceptions, everyone else watches, resentment builds, collaboration fades, and then retention follows it out the door.

5) Trust Shocks (Beyond Any Single Counterparty)

Trust breaks whenever promises shift after the work is done. Classic developer example: teams sell 20 units on a “promised 5%,” and the payout lands at 2%. The same damage happens with back-dated split changes, delayed payroll, opaque clawbacks, or missing audit trails. Even if leadership is also a victim, agents decide the house can’t protect them, and loyalty disappears.

6) The Fast-Commission Death Spiral

New-project payouts often arrive two to three years after the Sale and Purchase Agreement. To keep talent, agencies advance commissions from reserves or borrowings. Ten clean projects can be erased by one bad one—abandonment, disputes, loopholes—so cash flow dies before profit arrives. This is a problem that shouldn’t even exist, yet it persists because agencies negotiate and absorb risk alone rather than together.

Other failure modes exist too. Regulatory non-compliance, errors with client/trust accounts, tax or statutory issues, governance failures, or litigation can each sink a firm. Any one of these can be fatal. Still, the six issues above are the recurring structural drivers behind most collapses.

The Root Problem (Behind All Six)

It isn’t training. It isn’t motivation. It isn’t marketing. You’re hardworking and smart; you’re playing inside a broken ecosystem few know how to fix.

The root problem is disunity. Every agency, every team, every leader runs a private system. There’s no shared operating standard, no collective leverage, and no real external co-broking fabric. Counterparties exploit the gaps. Agents optimise for themselves because the ecosystem gives them no reason to do otherwise. The house bleeds because the house is a logo, not a system.

The way out isn’t another patch. It’s unity on a standardised agency operating system—shared rails the whole industry can trust. ListingMine ERP is one concrete path in that direction.