How Many License Holders Do You Need in Your Agency?

Getting the ownership structure wrong isn’t just a paperwork error—it can freeze growth before you start, or worse, leave you personally liable for business debts.

The Short Answer

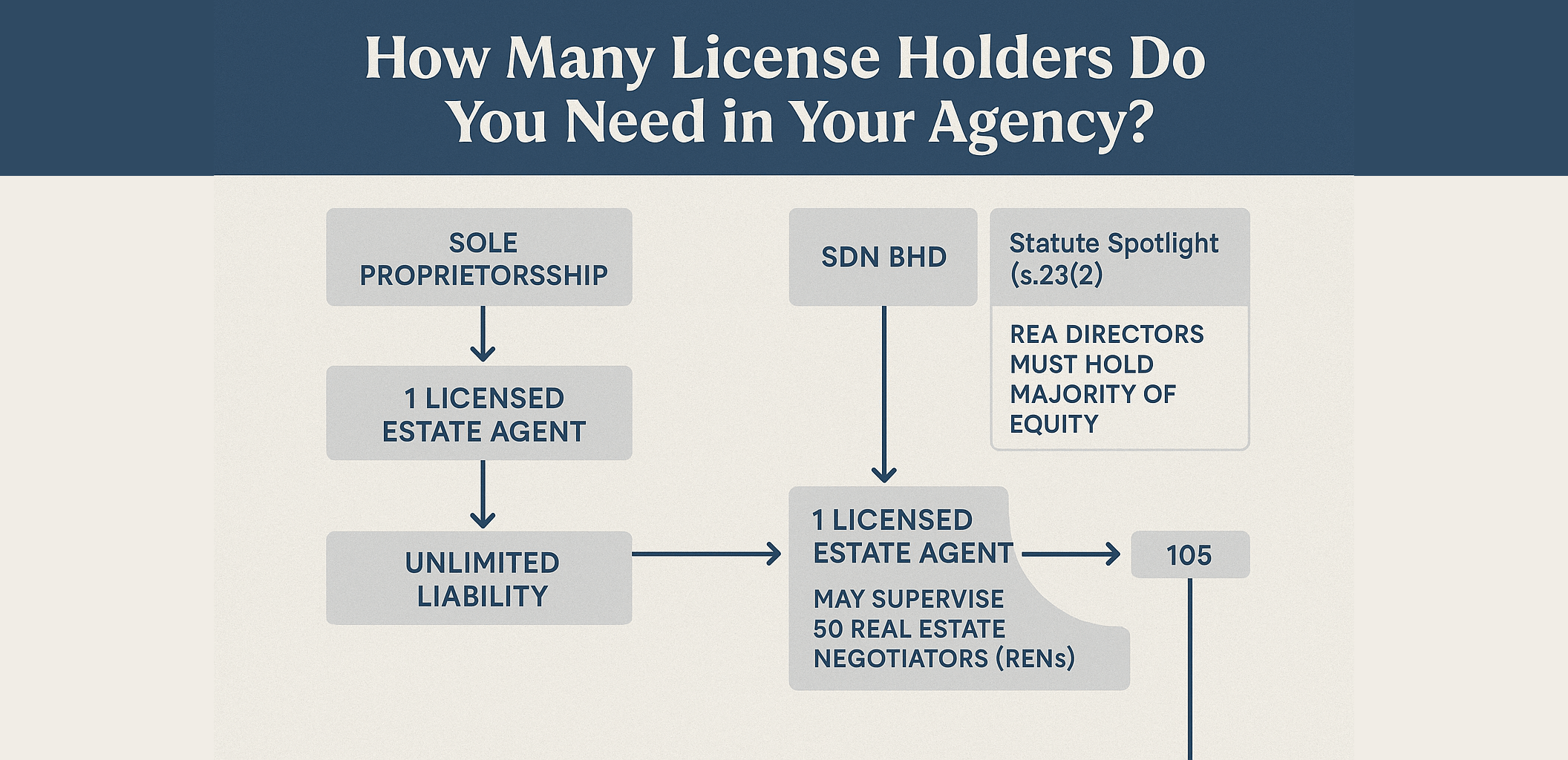

- Sole proprietorship: 1 licensed estate agent (REA). Fast to start, but unlimited personal liability.

- Sdn Bhd: Practical minimum 2 licensed REAs for resilience and coverage.

- REN capacity: Each licensed REA may supervise up to 50 RENs. Plan headcount in 50-REN steps (50/100/150…).

Sole Proprietorship: Simple, but Risky

A one-REA sole prop is lean and quick to set up. As exposure grows (agents, listings, client funds), most founders migrate to a Sdn Bhd to ring-fence risk and formalise governance.

Statute Spotlight (Act 242, s.23(2))

A firm licence will not be issued unless the majority of the shares in a company are held by one or more company directors who are registered estate agents.

Implication: In a company setup, structure equity and voting so REA directors clearly hold the majority at all times.

Sdn Bhd: Ownership & Headcount (Practical Guidance)

- Board/ownership design: If you include unlicensed shareholders, set board seats and equity so the statutory majority is locked in from day one—and survives transfers/exits.

- Scaling RENs: Secure additional REAs before crossing each 50-REN threshold to avoid issuance bottlenecks.

- Governance: Bake control mechanics into the constitution/SHA (pre-emption, compulsory transfer on cessation, voting alignment, drag/tag).

Common Pain Point: License Holders Are Scarce

Qualified REAs are in demand. To attract them as director-shareholders, offer a compelling package:

- Meaningful equity with clear decision rights

- Defined senior role (compliance, supervision, training)

- Competitive overrides/fees tied to REN headcount and supervisory load

- Operational support (admin, trust-account processes, marketing)

Planning Checklist (Use Before You File)

- Does your cap table always preserve the REA majority (including transfers and exits)?

- What’s your 12–18 month REN plan? Add REAs ahead of each 50-REN step.

- Do your constitutional docs and SHA lock in voting/control mechanics?

- Is your offer strong enough to win and retain scarce REA talent?

Bottom Line

Design ownership first, then scale headcount. Keep REA directors in clear majority per s.23(2) and align your REA bench with your REN growth plan so compliance never caps your expansion.