Why Most Real Estate Agencies Don’t Pay a Basic Salary

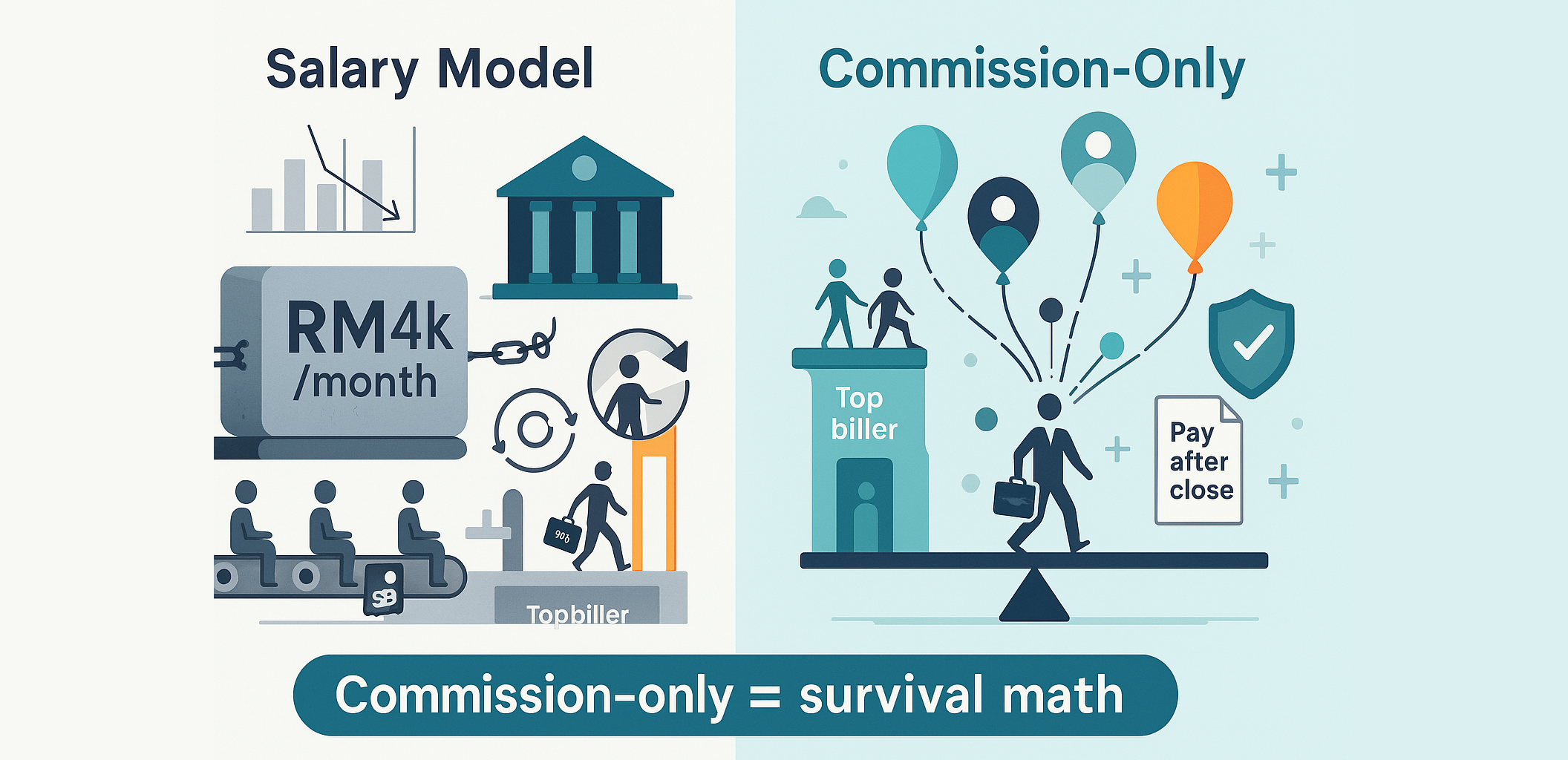

In agency land, commission-only isn’t a philosophy—it’s survival math. Paying fixed salaries to negotiators sounds supportive, but for most firms it breaks cash flow, dulls incentives, and traps the business in churn. Property sales are lumpy and low-volume; revenue doesn’t arrive on a neat monthly schedule, yet payroll does.

Run the numbers. Even a modest RM2,000 basic for 20 agents is RM40,000 a month before EPF, SOCSO, allowances, and benefits. Over a year that’s roughly RM480,000–RM550,000 in fixed cost that must be covered regardless of closings. Layer on portal packages, marketing, advances, admin headcount, and overrides, and the margin to subsidise salaries disappears. Quiet months burn the same cash as strong ones.

This is where the retention trap appears. High performers who start closing quickly realise they can earn far more at a commission-only shop and leave. Underperformers cling to the safety of a paycheck. The firm keeps recruiting and retraining while its best people become someone else’s top billers. Principals also worry about deal parking—salaried agents routing a large case elsewhere to maximise their personal net.

Where one-size plans stumble.

Company-wide plans offer clarity, compliance, and predictable margins. But when a performing team joins, a forced reset can cause fit issues and culture shock. Productivity pauses; churn risk rises. A wholesale option lets proven teams keep their playbook inside your licensed umbrella.

A commission-only structure flips both risk and incentives. The agency pays only after it gets paid, so cash flow matches results. Headcount becomes elastic: you can scale without committing to a heavy fixed-cost base. Negotiators chase leads, run viewings, and negotiate harder because the upside is theirs, while the house still earns on each close without carrying non-productive payroll between wins.

There are real exceptions. Corporate brokerage and institutional transactions often justify salaries because deals are complex, slow, and heavily coordinated; one fee from selling an office tower or securing a major lease can fund a team. And of course, inside sales, admin, marketing, and finance roles are salaried because they’re not REN roles and their output is operational rather than transactional.

The bottom line is simple. For most Malaysian agencies, a salary model invites cash-flow stress and adverse selection. Keep fixed pay for non-negotiator functions, consider recoverable draws and time-limited guarantees for ramp-up, and let negotiators live on the upside they create. You’ll protect cash, reduce churn, and attract better talent—because top billers migrate to where the upside is uncapped.