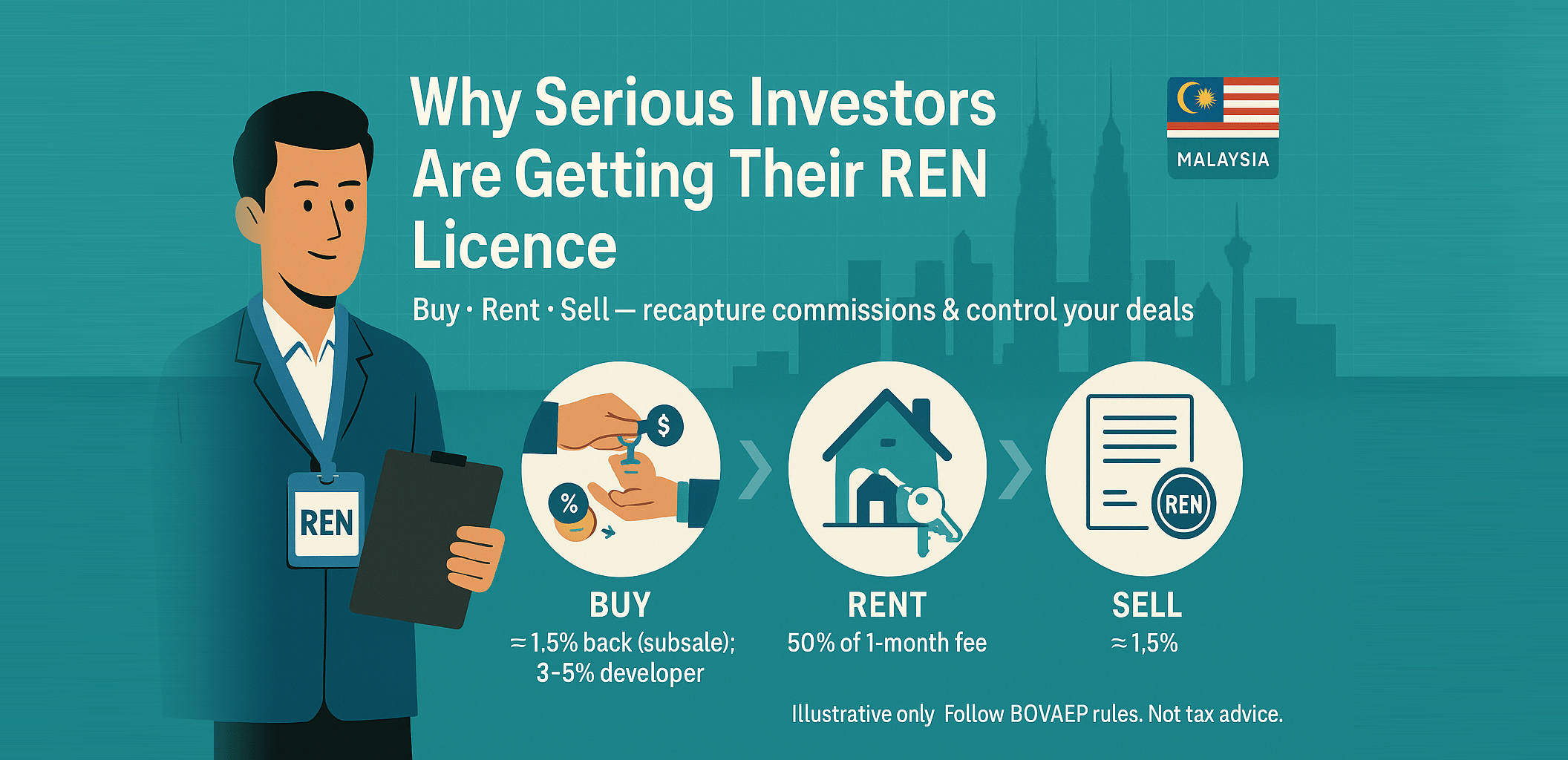

Why Serious Investors Are Getting Their REN Licence

What if you could knock 1.5% off your next purchase price—or get paid every time you rent out your own unit?

For most investors, the strategy is simple: buy low, sell high, and keep cash flow positive. The savviest investors add one powerful lever: they become the Real Estate Negotiator (REN) and sit at the professional-fee table for their own deals.

Below is a practical, numbers-first guide to how this strategy can supercharge returns—plus how ListingMine turns the workflow into a lasting advantage.

Stop Paying Commissions. Start Earning Them.

Imagine recapturing fees you would normally pay to others. As a licensed REN representing yourself (with the proper firm attachment and disclosures), you can.

1) Earn when you buy

- Subsale (secondary market): Represent yourself as the buyer’s agent and co-broke with the listing firm. Your co-broke share (commonly about 1.5%) effectively lowers your net purchase price.

- New launch projects: Developer professional fees are often 3%–5%. As a REN booked in through your firm, you may earn that fee on your own purchase — subject to developer policy (some developers restrict self-purchases).

2) Earn when you rent

- Landlord agency fee is typically one month’s rent (residential). If you co-broke the letting, your side usually receives 50% of that fee. On a RM2,500/month unit, that is ~RM1,250 back to you.

3) Earn when you sell

- When you exit, co-broke with the buyer’s agent. Earning a share of the sale fee (again, commonly ~1.5%) directly offsets selling costs and boosts your final profit.

The Icing on the Cake: Tax & Credibility

- Potential Real Property Gains Tax (RPGT) benefits: In Malaysia, allowable incidental costs for RPGT typically include professional fees and commissions tied to acquisition and disposal (e.g., estate agency, legal, valuation, advertising). Always confirm details with your tax adviser or LHDN.

- Trust that converts: You are buying with your own money. Family and friends tend to trust that more than a pitch from someone who does not buy. When they buy or rent through you, additional professional fees further reduce your effective costs.

Let’s Talk Numbers: A RM500k → RM1M Journey (Illustrative)

| Action | Illustrative Fee Earned |

|---|---|

| Buy at RM500,000 (subsale) | ~RM7,500 (≈1.5% co-broke) |

| Rent at RM2,500/month | ~RM1,250 (50% of one month’s rent) |

| Sell at RM1,000,000 | ~RM15,000 (≈1.5% co-broke) |

| Total potential fees earned | ~RM23,750 |

This is a simplified example. Terms vary by firm, project, and negotiation—but the directional impact is clear.

Is This Path Right for You? A Reality Check

Becoming a REN is not a passive “hack”; it is a regulated profession.

✅ Consider becoming a REN if you:

- Plan to build a larger, active portfolio.

- Enjoy sourcing, viewings, negotiations, and paperwork.

- Are committed to ethical practice, full disclosure, and compliance.

❌ Remain a private investor if you:

- Have a small or purely passive portfolio.

- Prefer to outsource all frontline agent work.

- Do not want licensing, continuing education, or client-service obligations.

How to Get Started & Stay Organised

- Choose a sponsoring firm that fits your market focus (subsale area, projects, rentals).

- Attend the Negotiator Certification Course (NCC) and register with BOVAEP (the Board of Valuers, Appraisers, Estate Agents and Property Managers).

- Receive your REN Tag and firm authorisation before practising.

- Operate ethically: declare your interest in writing when representing yourself/related parties; follow PDPA/AML procedures, firm SOPs, and proper co-broke agreements, booking forms, receipts, invoicing, and audit records.

Turn Your Workflow Into an Edge With ListingMine

Whether you become a REN or stay a private investor, ListingMine gives you a clean operating system for your property business.

- Portfolio manager: Track sale/let status, tenancy expiries, asking prices, market notes, photos, documents, and a private buy-list (areas, budgets, yields).

- One-link brief to agents: Share a single link with sizes, photos, tenancy terms, and instructions so agents can act fast.

- Organised co-broking: Create a private Group with 3–5 trusted agents; update once and everyone sees the latest. Control visibility and access.

- Optional free exposure: Publish selected units to PropertySifu and ListingSifu so Google can index them for organic reach.

- Free for property investors: Use ListingMine privately at no cost; if you later become a REN, enable professional tools as needed.

The Bottom Line

For active investors, a REN licence can compound gains: earn fees on the way in, during tenancy, and on the way out—while building market expertise and control. Paired with ListingMine to organise every step, you move from an investment hobby to a serious, compounding property business.

Ready to stress-test this path? Speak with a registered real estate firm, and set up your portfolio in ListingMine to see where the numbers lead.

Disclaimer

This article is for information only and is not legal, tax, or financial advice. Rules and practices change. Please consult LHDN/your tax adviser and a registered real estate firm (BOVAEPP-regulated) for guidance on your specific circumstances.