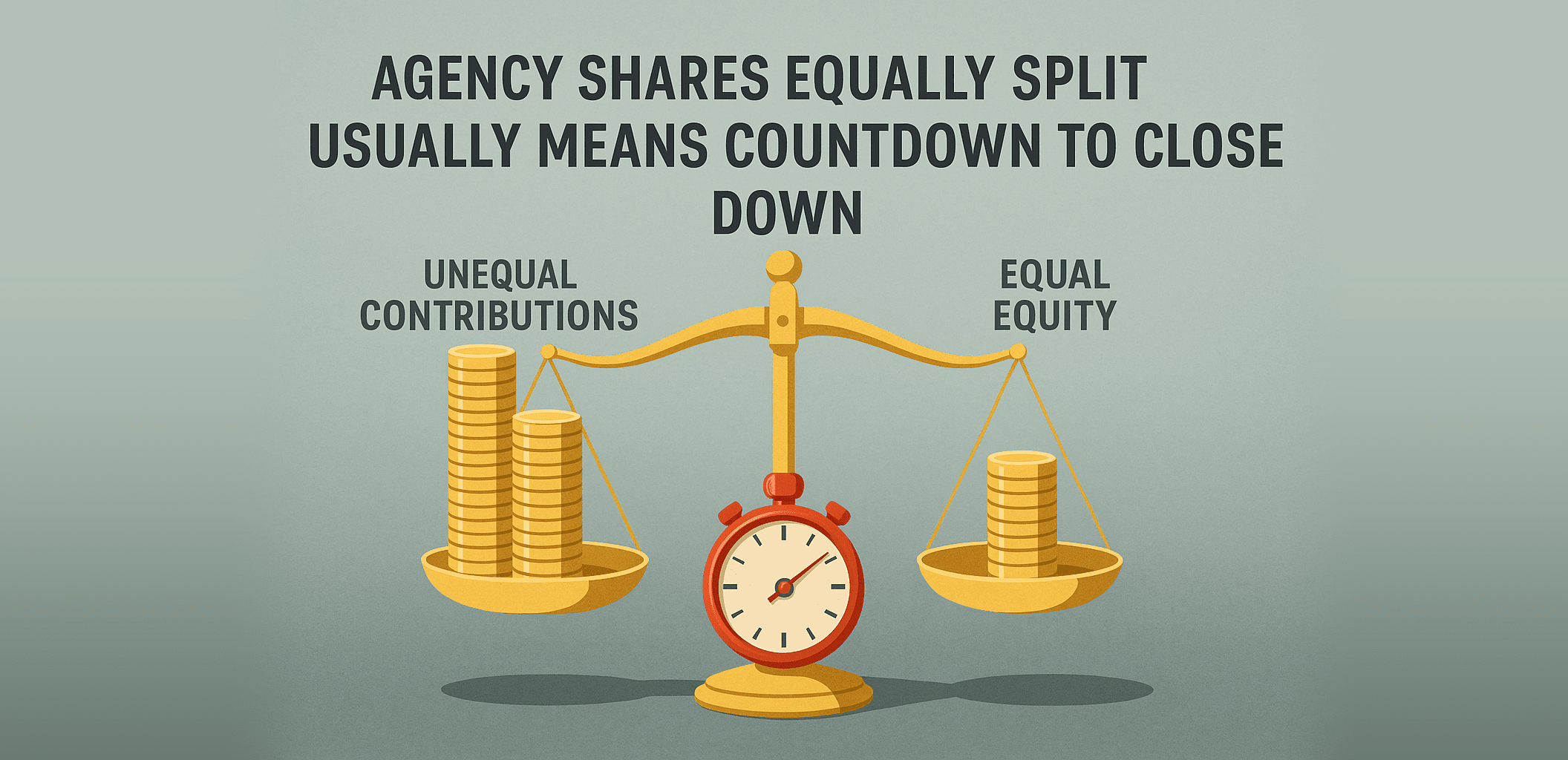

Agency Shares Equally Split Usually Means Countdown to Close Down

Many startups in real estate—and beyond—make the same mistake when forming a Sdn Bhd: they divide shares equally. Whether it’s 50–50, 33–33–33, or 25–25–25–25, it looks “fair” on paper but is often a countdown to collapse.

At first, it feels safe: no one has more power than the other, decisions are democratic, and everyone is a co-founder. But equal splits usually signal that the roles of directors and shareholders haven’t been defined clearly. Over time the imbalance of effort becomes obvious—one person works day and night while another contributes little. Resentment builds, conflicts grow, and eventually the business cracks—even when the company is doing well financially.

Why Equal Splits Fail

Equal shares ignore unequal contributions. In reality, founders wear different hats: an operator driving sales and execution; a funder carrying financial risk; an IT lead building the platform; a marketer creating visibility; a BD lead unlocking partnerships; HR and finance keeping the machine running. When everyone holds identical stakes regardless of role, misalignment is inevitable. The contributor feels exploited; the free-rider feels entitled. The result is deadlock, mistrust, and, too often, shutdown.

Weighted Shares Make More Sense

A durable approach is to assign shareholding based on roles and responsibilities. Agree upfront which roles carry what weight, and allocate accordingly. The funder may initially hold a larger stake to reflect capital at risk. Once that capital is recovered with a pre-agreed return, their stake can step down while the operator’s steps up, keeping the driving force motivated. As the company scales, the funder still wins from a larger pie even if their percentage trims.

Combine Weighted Shares with Vesting

A weighted structure is strongest when paired with vesting. Instead of issuing all shares on day one, have founder stakes vest over time (e.g., over four years with a cliff). This ensures people earn their ownership by staying and contributing, and it protects the company if someone leaves early. Vesting turns the cap table into a performance and commitment tool—not just a handshake.

How to Start the Conversation

The hardest part is raising it. Frame the discussion around long-term success, not distrust. Start by listing the real work the company needs over the next 12–24 months—operations, funding, product/IT, marketing, BD, HR, finance. Map who is actually delivering which outcomes, how much time or capital each will put in, and what risks they’re taking. Then align share weightage and a vesting schedule to that reality. The tone is simple: the structure should reflect contribution and keep everyone motivated as the business grows.

Plan Early, Avoid Unsolvable Problems Later

You can’t easily fix an unfair cap table ten years in — emotions, egos, and sunk costs make it messy. Design a fair structure before the first deal is closed. Think deeply about roles, weigh contributions realistically, agree on vesting and any step-down mechanics for capital recovery, and document a path for adjustments as the business evolves. Resist the temptation of “equal feels fair.” It rarely matches reality—and it often ends in arguments.

Conclusion

When setting up your agency, fairness isn’t equal numbers it’s aligned incentives. Clarify roles, assign weightage, add vesting, and keep a mechanism to adapt as the company scales. Do this early and you’ll avoid the root conflicts that quietly count down to a close-down—even inside otherwise successful businesses.