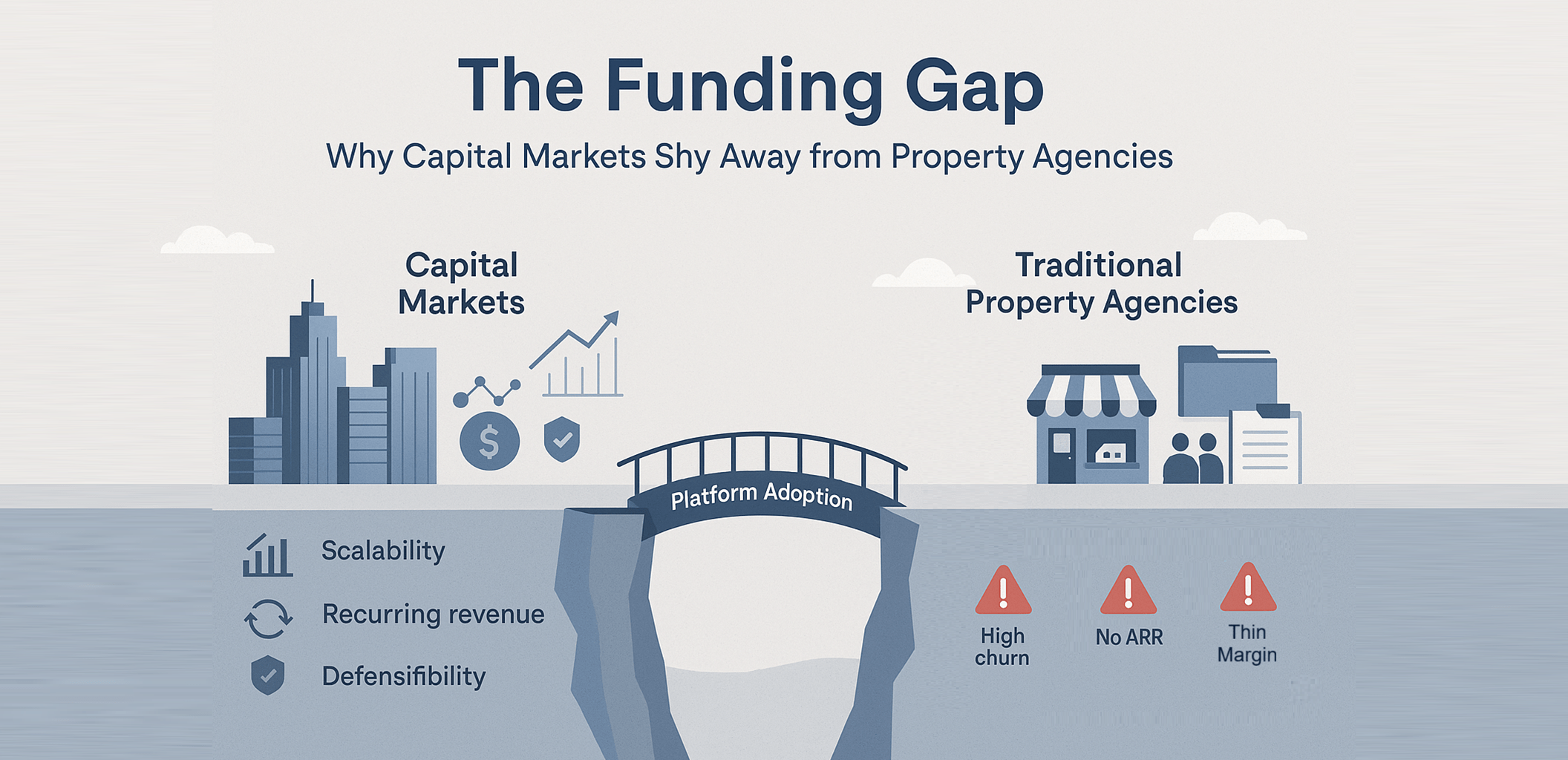

The Funding Gap: Why Capital Markets Shy Away from Property Agencies

For ambitious agency leaders, the struggle is clear: you operate in a massive market, yet the capital needed to dominate it flows everywhere but to you. Venture capital fuels tech platforms, private equity buys into scalable models, but traditional property agencies are left behind.

This isn’t an accident. It’s a fundamental mismatch between the old agency model and what modern investors demand.

The Investor's Diagnosis: A Business Model with Built-In Red Flags

Sophisticated investors don't just see revenue; they see structure, scalability, and risk. Unfortunately, the traditional agency scores poorly on all three:

The Scalability Ceiling: Growth is tied directly to headcount. More agents mean more revenue, but also exponentially more management complexity, all on notoriously thin margins. It’s a linear grind, not the high-margin, exponential curve investors fund.

Revenue Volatility: The pure transaction model means revenue is feast or famine. Investors prize predictable, recurring revenue streams—the kind enjoyed by SaaS companies or subscription services—not income that resets to zero every month.

The Agent Churn Problem: A value proposition built on "the best split" attracts free agents, not loyal partners. This mercenary culture creates a fragile operation with no durable competitive advantage. When your moat is your payout, you’re always one point away from losing.

Knowing the Solution Isn't the Same as Building It

The blueprint for an investable business is no secret. The success of platforms like Beike proves the model: standardize data, orchestrate cooperation, and create network effects.

You know the playbook. You know you need to:

- Generate recurring revenue through integrated services.

- Build a defensible moat with data and technology, not just splits.

- Create a scalable system that improves margins with growth.

The critical insight for most leaders is this: the barrier isn't vision; it's execution. Building a true platform requires a multi-million-dollar tech investment, years of software development, and expertise in data science—all while trying to run your core business. This “build-it-yourself” path is a costly distraction with a high risk of failure, a lesson many have learned the hard way.

The New Path to Funding: Platform Adoption, Not Platform Construction

The goal isn't to become a tech company. The goal is to leverage one to transform your economics.

You become investable by adopting a platform that allows you to demonstrate:

- Recurring Revenue: effortlessly offering ancillary services like property management or mortgage referrals that generate stable income.

- Data Intelligence: utilizing a centralized platform to gain market insights that make your operations smarter and your brand more valuable.

- Scalable Operations: using technology to automate tasks and increase agent productivity, breaking the link between revenue growth and overhead.

This is how you build a story that makes investors lean in.

Closing the Gap: The Power of the Alliance

For forward-thinking agencies, the most strategic move is to join forces with a platform that has already solved these technological challenges. This allows you to bypass the years of cost and risk associated with building your own.

By aligning with a centralised platform, you do more than just get a set of tools. You adopt a new operating model. You gain the narrative of a tech-enabled business, the metrics of a scalable enterprise, and the collective strength of a network.

You transform your agency from a standalone risk into a node in a powerful, fundable ecosystem. This is how you finally close the funding gap—not by building a moat alone, but by joining a new continent.

At ListingMine, we've built that platform for Malaysia. We provide the technology, the ecosystem, and the operational playbook to transform your agency’s economics and narrative. We enable you to demonstrate the recurring revenue, data intelligence, and scalable operations that attract capital.

You gain the advantages of a platform—without the cost and risk of building one.