The 3% RPGT Trap: Why Many Sellers Lose Money Before Their Property Sale Even Completes

And Why Zero-Deposit and Mark-Up SPA Deals Are Financially Dangerous

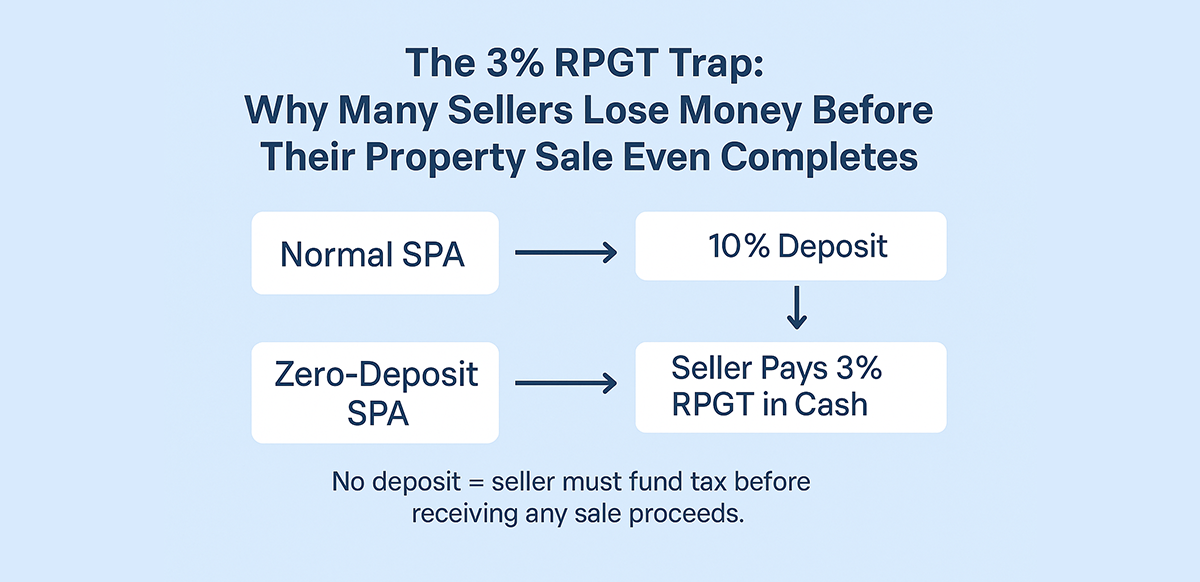

Most sellers assume that once they have signed the Sale & Purchase Agreement (SPA), they will soon receive money from the buyer, and only then will any tax or fees be deducted.

In reality, Malaysia’s Real Property Gains Tax (RPGT) system requires 3% of the SPA price to be paid to LHDN upfront, before the seller receives the full sale proceeds. This becomes a serious problem when agents structure deals with zero deposit or markup SPAs.

1. Why 3% RPGT Is Normally Not a Problem in a Standard SPA

In a normal subsale, the SPA includes:

- 10% downpayment from buyer

- 3% retained for RPGT

- Balance 7% goes to seller (minus agent fees and lawyer costs)

Example: RM500,000 property

| Item | Amount |

|---|---|

| 10% deposit paid to seller | RM50,000 |

| 3% RPGT retention (deducted from that 10%) | RM15,000 |

| Agent fee (usually 3%) | RM15,000 |

| Remaining to seller (before loan disbursement) | RM20,000 |

In this structure, the seller can use the 10% to pay RPGT and agent fees without using personal cash.

2. The Cashflow Problem When the SPA Has 0% Deposit

Many deals today are structured as “zero-downpayment” or “full loan to cover 10%.” In this case:

- Buyer pays 0% upon SPA signing

- RPGT 3% is still required

- Agent commission (usually 3%) is still due

Meaning the seller must now fund:

| Expense | Amount |

|---|---|

| RPGT retention | 3% of SPA price |

| Agent fee | 3% of SPA price |

| Total | 6% of SPA price payable before receiving money |

On a RM500,000 sale, that is RM30,000 the seller must pay out of pocket — during a period where they may not have any liquidity.

This is why many sellers panic after SPA signing, not before.

3. Why This Problem Is Even Worse in “Markup SPA” Arrangements

Some agents or buyers propose artificially increasing the SPA price (for example RM450,000 real price, RM500,000 SPA price) so the buyer can obtain a higher loan.

But this creates three serious consequences:

- RPGT is calculated on the inflated SPA price, not the real selling price

- Seller must pay more tax on money they never actually received

- The act itself is legally considered loan fraud — misrepresentation to the bank

Example:

| Actual Deal | SPA Marked Up To | RPGT Calculated On | Seller Pays Extra Tax On |

|---|---|---|---|

| RM450,000 | RM500,000 | RM500,000 (not RM450,000) | RM50,000 that never existed |

This is how some sellers end up owing LHDN more than their actual profit.

4. Legal Reminder: Mark-Up SPA Is Not Just “Risky” — It Is Illegal

Under Malaysian banking and anti-fraud laws:

- A false SPA price submitted to the bank = misrepresentation

- If the agent participates or advises it = abetting fraud

- If dispute occurs later, the SPA will not protect the agent or buyer

Agents who participate in mark-up SPAs risk:

- Civil liability (lawsuits)

- Being blacklisted by banks and lawyers

- Disciplinary action under the Estate Agency Act

- Criminal consequences if investigated under AMLA or fraud statutes

A professional agent must never facilitate or suggest a mark-up SPA.

5. Why This Also Affects the Agent’s Own Interests

Agents often think: “This helps close the deal, so it benefits me.”

In reality, the opposite is true:

| Issue | How It Hurts the Agent |

|---|---|

| Seller has no deposit | Agent commission cannot be paid from SPA 10% |

| Seller under financial stress | Agent blamed when RPGT bill appears |

| Mark-up SPA detected by lawyer/bank | Deal collapses, agent earns nothing |

| Seller cannot pay upfront tax | SPA delayed, disbursement delayed, commission delayed |

| Fraud investigation triggered | Agent becomes a named party or witness |

A deal that looks “fast and easy” often ends up being slow, risky, and unpaid.

6. Professional Agent Standards (What Should Happen)

A competent agent must:

- Explain 3% RPGT retention before SPA signing

- Avoid zero-deposit deals unless seller has enough cash buffer

- Refuse all markup-SPA arrangements

- Work only with lawyers who follow proper RPGT handling under Section 21B

- Confirm seller’s tax position (first disposal, exemption eligibility, etc.)

- Protect the seller’s cashflow, not just “push closing”

An agent’s real value is not in bringing a buyer — it is in preventing the seller from financially damaging themselves.

Final Message

The Malaysian system assumes a seller receives 10% upon SPA signing, and therefore has no difficulty paying 3% RPGT and agent fees.

The moment that 10% is waived — whether due to zero-deposit or markup SPA — both the seller and the agent are exposed to financial and legal risk.

A good agent closes a sale.

A great agent ensures the seller is never blindsided by tax, cashflow or legal consequences.