Why Team Leaders Should Value Lower ACN Passive Income More Than Traditional Overriding

ListingMine Academy | Leadership Economics & Long-Term Income Stability

Team Leaders often look at ACN’s Redistribution model and immediately react:

“Why should I accept lower passive income than the 20% I used to get?”

This is not a small objection. It is a high-stakes question because agency growth is entirely dependent on Team Leader recruitment. If TLs stop recruiting out of fear that ACN gives “lower overrides,” the agency’s growth pipeline collapses.

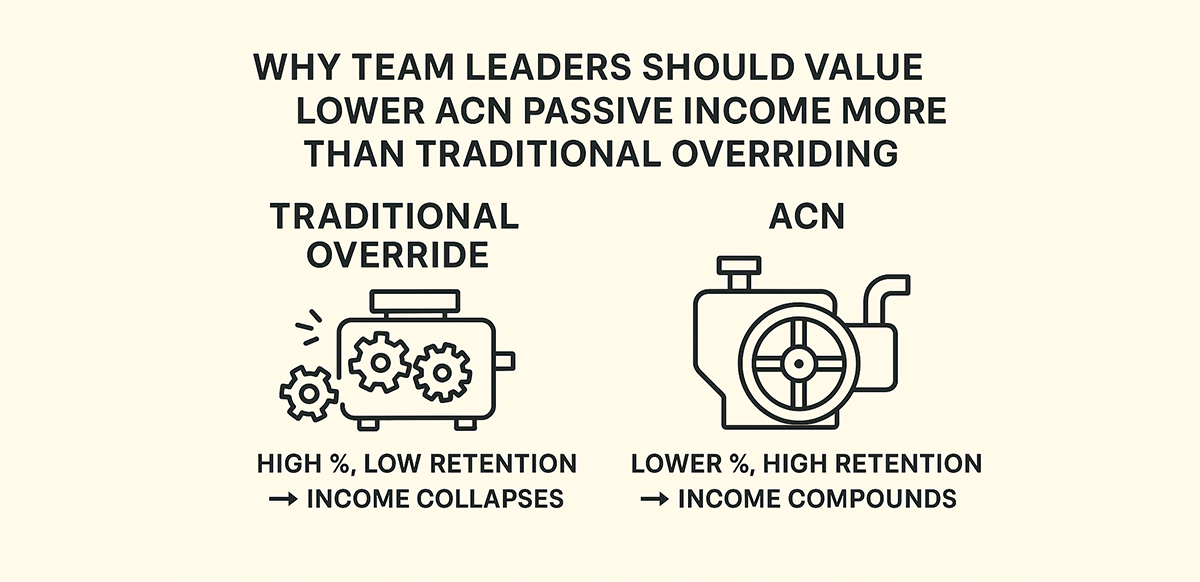

But the comparison itself is flawed. Traditional overriding gives you a higher percentage, but ACN gives you a longer lifespan for that income. The reality is simple: A smaller share of income that lasts is worth far more than a bigger share that disappears.

1. Traditional Override Is High Only on Paper — Not in Real Life

Traditional TL income looks attractive:

- 20% override

- big upside

- strong emotional appeal

But all of this collapses under real-world conditions:

- downlines resign frequently

- top performers almost always leave

- loyalty collapses once agents become independent

Traditional override is not passive income. It is churn-dependent income. You are earning 20% from people who stay 12–18 months at best. The percentage is high, but the lifespan is short — making it far less valuable than it appears.

2. ACN Redistribution Is Lower — But It Is Permanent and System-Enforced

ACN Redistribution typically gives you 15–20% of the role portion, not the full commission. But this income has qualities the old model cannot match:

- system-protected and audit-backed

- not tied to moods, loyalty, or personal influence

- retention rates are significantly higher

- agents rely on the platform’s infrastructure, not the TL’s personality

- the platform becomes the “home base” they cannot replicate elsewhere

ACN does not make your income bigger — it makes your income permanent. Lower percentage × high retention = stronger long-term income.

3. Traditional Override Has a Massive Hidden Cost: Churn

Every TL knows the cycle:

- recruit

- train

- motivate

- babysit

- agents leave

- rebuild

- repeat

This is the recruiting treadmill. Traditional override looks high only because TLs never calculate the hidden costs:

- lost time

- lost training effort

- collapsing momentum

- unpredictable income

- constant emotional fatigue

20% override on a revolving-door team is inferior to 15% override on a team that stays.

If you want to break even under the old model, you must recruit nonstop. That is not passive income — that is survival.

4. Traditional Override Isn’t Actually Passive — It Is Emotional Labour

TLs rarely say this publicly, but privately, almost all admit: “Every day feels like babysitting.”

Traditional leadership is:

- emotional

- relationship-based

- unstable

- exhausting

It is a managerial job disguising itself as passive income.

In the ACN model:

- TLs are repositioned into Governance Roles

- override entitlement is tied to system compliance

- leadership becomes structural, not emotional

- the system handles lead flow, attribution, and enforcement

- TLs maintain the system, not people’s feelings

This is what real passive income looks like:

rule-based

predictable

auditable

not dependent on charisma or mood

5. The Most Important Insight:

Passive Income Is Not About Percentage — It Is About Duration

This is the key principle TLs must understand: Traditional override is high but short-lived. ACN override is lower but long-lived. A leader should always prefer:

- 15% for 10 years over

- 20% for 12–18 months

Because:

percentage is irrelevant

duration determines wealth

retention is the engine of long-term compounding

ACN stabilizes the income base instead of resetting it

Traditional override gives you “shock income.” ACN gives you “compound income.”

Conclusion: Why Team Leaders Must Revalue Passive Income

| Feature | Traditional Override | ACN Redistribution |

|---|---|---|

| Payout Value | High percentage | Lower percentage |

| Team Stability | Downline disappears | Downline stays longer |

| Income Type | Volatile, churn-based | Stable, compounding |

| Leadership Role | Emotional babysitting | Governance + Compliance |

| Long-Term Value | Declines over time | Increases over time |

Traditional override appeals to ego: “I get 20% because they belong to me.”

ACN appeals to logic: “I get a smaller share, but agents stay longer, my entitlement is system-protected, and my income becomes permanent.”

For any leader who wants real passive income, the choice is obvious.