Affordable Housing in Malaysia: Physical and Financial Schemes for the People

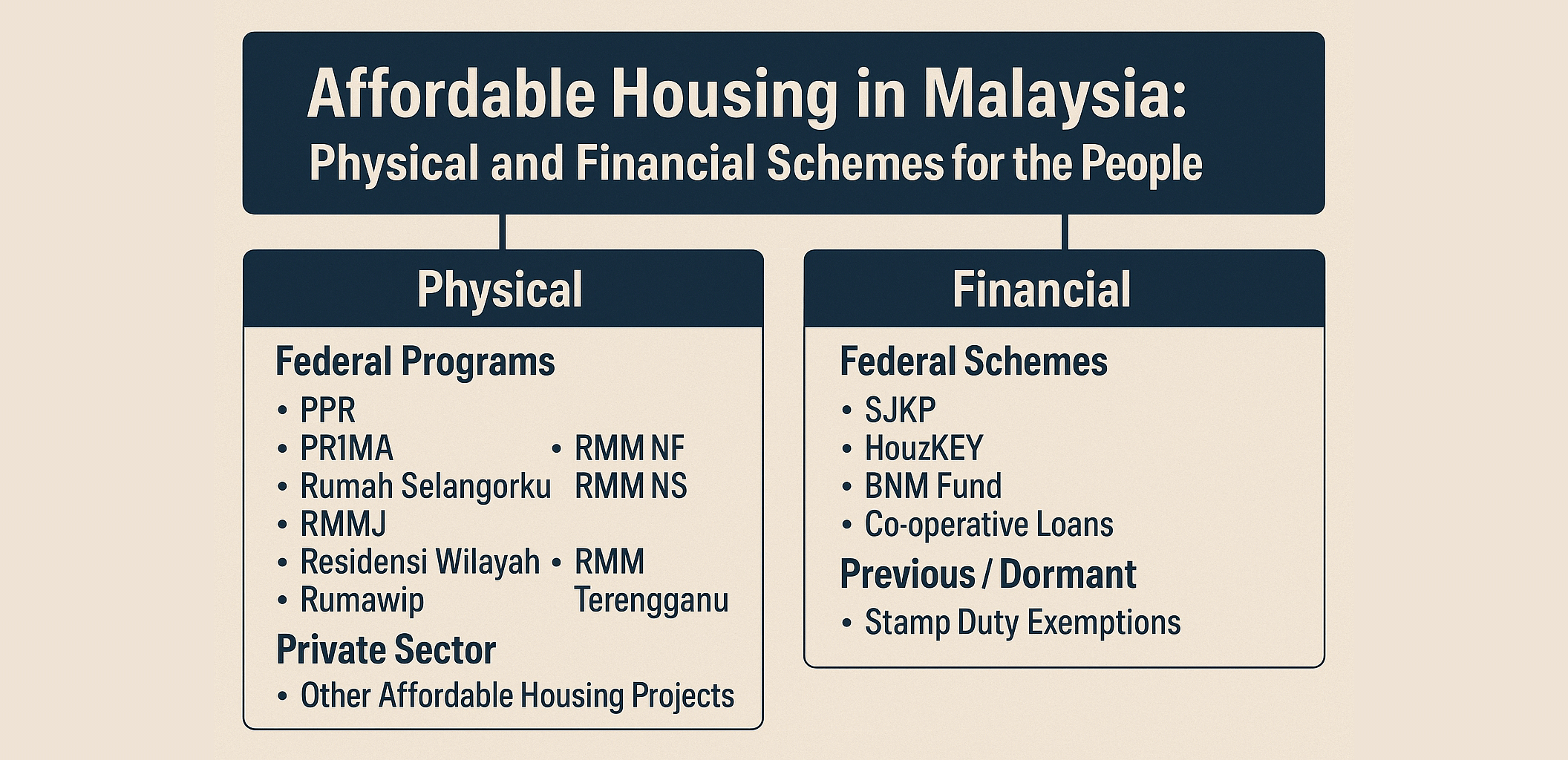

Home ownership has always been a national aspiration — yet for many Malaysians, it feels increasingly out of reach. Despite the government’s continuous efforts to make housing affordable, most Malaysians — including property agents — are still unaware of the full range of incentives available, simply because there are too many overlapping schemes managed by different agencies.

To bridge this gap, ListingMine Research has compiled a complete reference of Malaysia’s affordable housing initiatives — both physical housing programs that build and allocate homes, and financial schemes that help buyers secure financing.

This knowledge empowers agents to:

- Speak confidently about government-backed housing options when advising clients,

- Assist younger or first-time buyers in reducing their financial burden, and

- Identify sales opportunities in the affordable housing segment, where many incentivised units remain unsold despite active schemes.

By understanding these programs, agents not only elevate their professional credibility but also contribute to Malaysia’s broader housing vision — ensuring more citizens achieve sustainable home ownership.

1. Physical Affordable-Housing Schemes

These programs deliver or allocate actual homes — the “supply side” of Malaysia’s housing ecosystem.

1.1 Federal-Level Programs (Alphabetical Order)

| Scheme | Administering Body | Target Group | Core Features |

|---|---|---|---|

| DBKL Public Housing / E-Perumahan DBKL | Kuala Lumpur City Hall | Urban B40 | Rental flats and low-cost ownership units managed by DBKL. |

| PPAM (Perumahan Penjawat Awam Malaysia) formerly known as PPA1M (Perumahan Penjawat Awam 1 Malaysia) | Public Service Dept / LPPSA | Civil servants | Exclusive affordable projects for government employees, typically below market value. |

| PPR (Program Perumahan Rakyat) | Ministry of Housing & Local Government (KPKT) | B40 households | Low-cost flats or houses for rental or ownership (650–750 sq ft; RM 42 k – 100 k). |

| PR1MA (Perumahan Rakyat 1 Malaysia) | PR1MA Corporation Malaysia | M40 (RM 2,500 – 15,000 income) | Medium-cost apartments / terraces (RM 100 k – 400 k) for first-time buyers. |

| Rumah Idaman Rakyat / RMMN | SPNB / KPKT | B40 – M40 | Homes below RM 350 k, often co-developed with state authorities. |

| Rumah Mesra Rakyat (RMR) | Syarikat Perumahan Negara Berhad (SPNB) | B40 families with land | Helps families build 750 sq ft detached homes; subsidy up to RM 20 k. |

| SPNB Rumah Mesra Rakyat (Expanded Programme) | SPNB | Rural B40 | Prefabricated, energy-efficient designs to shorten build time and cut cost. |

1.2 State-Level Affordable-Housing Schemes (Alphabetical by State / FT)

| State / FT | Scheme | Portal / Authority | Highlights |

|---|---|---|---|

| Federal Territories (KL / Putrajaya / Labuan) | Residensi Wilayah (formerly RUMAWIP), Residensi Prihatin Madani | residensiwilayah.kwp.gov.my | Homes ≤ RM 300 k (min 650 sq ft) for FT residents. |

| Johor | RMMJ – Rumah Mampu Milik Johor | Sistem Perumahan Johor (PKPJ) | Type A–D (RM 42 k – 250 k); target ≈ 80 k units by 2029. |

| Kedah | Desa Sejahtera / PPR Kedah | State Housing Unit / KPKT | Rural Desa Sejahtera + federal PPR projects. |

| Kelantan | RMMK – Rumah Mampu Milik Kelantan | State Housing Corporation | Typical price ≤ RM 150 k; regional RMMK developments. |

| Melaka | RMM Melaka (Type A / B / C) | Lembaga Perumahan Melaka (LPM) | Demand-based state projects (landed & stratified). |

| Negeri Sembilan | RMM NS (Types A–C) | NS Housing Dept. | Type A ≤ RM 80 k; > 26 k units approved since 2018. |

| Pahang | Rumah Makmur / PR1MA Pahang / PKSR | ePerumahan Pahang (LPHP) | Rumah Makmur ≤ RM 100 k; PR1MA Pahang RM 100 k–250 k. |

| Penang | RMM / PMM Types A–C | LPNPP / PDC Penang | Type A ≤ RM 42 k, Type B ≤ RM 72 k, Type C ≤ RM 300 k. |

| Perak | Rumah Perakku / Perak Housing Policy 2.0 | PKNP Group / State Housing Division | Includes “Skim Rumah Ibu” (RM 98 k–238 k rural homes). |

| Perlis | Low / Medium-Cost Housing Projects | State Housing Dept. | Smaller allocations; FELDA–state joint ventures. |

| Sabah | Rumah Mesra SMJ (Sabah Maju Jaya) | LPPB Sabah | 40–50 units per constituency + newlywed quota. |

| Sarawak | HDC Affordable Homes + HDAS Deposit Aid | HDC Sarawak | Homes ≤ RM 300 k; RM 10 k deposit grant & SRAS rental aid. |

| Selangor | Rumah SelangorKu (RSKU) | LPHS / eHartanah | Type A–E (RM 42 k–250 k+); strict resale & income rules. |

| Terengganu | RMT / RMM Terengganu | ePerumahan Terengganu | Ongoing RMM rollout; earlier target 10 k units. |

2. Financial and Support Schemes

These address the demand side—helping Malaysians qualify for, finance, or eventually own homes.

2.1 Active Nationwide Schemes (Alphabetical)

| Scheme | Type | Key Features |

|---|---|---|

| BNM Fund for Affordable Homes | Concessionary loan | 3.5 % fixed-rate financing for homes ≤ RM 300 k and income ≤ RM 4,360. |

| BSN MyHome / MyFirstHome | Bank loan | Up to 110 % financing for first-time buyers (income ≤ RM 10 k). |

| Cagamas Mortgage Guarantee Programme (MGP) | Portfolio guarantee | Enables banks to offer higher LTV loans with reduced risk. |

| Co-operative Loans & Credit Societies | Micro-finance | Civil-service co-ops provide low-interest loans for housing deposits. |

| EPF Account 2 Withdrawal | Savings utilisation | Withdraw EPF savings for down payment or loan reduction. |

| LPPSA | Public-sector loan | Low-interest financing for civil servants to buy / build / refinance. |

| Maybank HouzKEY / Maybank 2Own | Rent-to-Own | 100 % financing, no down payment, no instalments during construction. |

| PR1MA RTO | Rent-to-Own | Rent first, convert to ownership later with part of rent credited. |

| SJKP & SJKP MADANI | Loan guarantee | 110 – 120 % financing covering deposit & fees for self-employed buyers. |

| Stamp Duty Exemptions | Fiscal incentive | Periodic waivers for first-time buyers of homes below RM 500 k. |

2.2 Historical / Dormant but Likely to Return (Alphabetical)

| Scheme | Status | Summary |

|---|---|---|

| Legacy RTO Pilots | Absorbed into HouzKEY / PR1MA RTO | Early bank + developer rent-to-own trials (2015–2017). |

| MyDeposit | Discontinued (2016 – 2019) | Government-matched 10 % (≤ RM 30 k) deposit assistance for first-home buyers. |

| MyHome | Dormant (2014 – 2018) | RM 30 k developer-side subsidy to reduce selling price for buyers. |

| Skim Perumahan Belia (SPB) | Paused (2015 – 2020) | BSN scheme offering RM 200 monthly subsidy for 24 months to young buyers. |

| Skim Rumah Pertamaku (SRP) | Replaced by SJKP (2011 – 2023) | 110 % loan scheme for income ≤ RM 10 k; paved way for SJKP. |

| State Microloan Programmes | Variable by state | Soft loans for local affordable projects; may re-emerge with future funding. |

3. Physical vs Financial: Two Sides of the Same Coin

| Focus | Objective | Examples |

|---|---|---|

| Physical (Supply-Side) | Build and allocate affordable units directly. | PPR, PR1MA, Rumah SelangorKu, RMMJ, Residensi Wilayah, RMR, RMT, SMJ Homes. |

| Financial (Demand-Side) | Help buyers qualify for and finance homes. | SJKP, BNM Fund, HouzKEY, LPPSA, MyDeposit (legacy). |

4. The Role of the Private Sector

Banks and developers now play an increasingly strategic role. Initiatives such as Maybank HouzKEY, Hong Leong’s Housing Guarantee Scheme, and developer-backed RTOs bridge gaps for buyers without large savings or traditional payslips.

Developers collaborate with state agencies under RMM quotas to produce mixed-market projects, while SPNB’s Rumah Mesra Rakyat empowers rural owners to build on inherited land — sustaining ownership across generations.

For agents, this sector represents a hidden reservoir of unsold stock — projects that are fully incentivised but underpromoted. Agents who understand these programs can connect eligible buyers to the right schemes and capture opportunities others overlook.

5. Malaysia’s Long-Term Vision: From Ownership to Livability

Malaysia’s housing direction has evolved from a pure quantity-based approach (“build more units”) toward a livability-based framework (“build communities people can sustain”).

This shift aligns with the country’s long-term policy frameworks:

- Malaysia Madani – promoting equitable housing access and social well-being.

- Shared Prosperity Vision 2030 (SPV 2030) – closing the affordability gap between urban and rural households.

- National Housing Policy 2023–2030 – driving sustainable, green, and digitally managed housing ecosystems.

The underlying philosophy: affordable housing is not just about price—it’s about dignity, stability, and sustainability.

6. Key Takeaways

- Physical schemes provide the supply; financial schemes make ownership achievable.

- Different states, different rules — always check the correct portal for eligibility.

- SJKP and HouzKEY symbolise Malaysia’s modern approach to inclusive housing finance.

- Discontinued schemes like MyDeposit and SRP may reappear under new names or enhanced versions.

- Agents who understand these programs can differentiate themselves by advising clients holistically — not just selling property, but selling access to ownership.

Conclusion

Affordable housing in Malaysia is more than a policy—it’s a partnership between government, banks, developers, and the public. From PR1MA to RMMJ, and from SJKP to HouzKEY, Malaysians today have multiple entry points into the housing ladder.

For agents, awareness is power. By mastering these schemes, you not only serve your clients better but also discover new transaction channels in an overlooked segment where supply still exceeds demand.

ListingMine Research continues to consolidate these programs for the benefit of agents and the public — ensuring that the path to home ownership in Malaysia becomes not just affordable, but achievable.