Singapore vs Malaysia: What Agent Density Reveals About Two Very Different Property Markets

At first glance, both Singapore and Malaysia appear to have thriving real estate industries — busy developers, active agents, and competitive marketplaces.

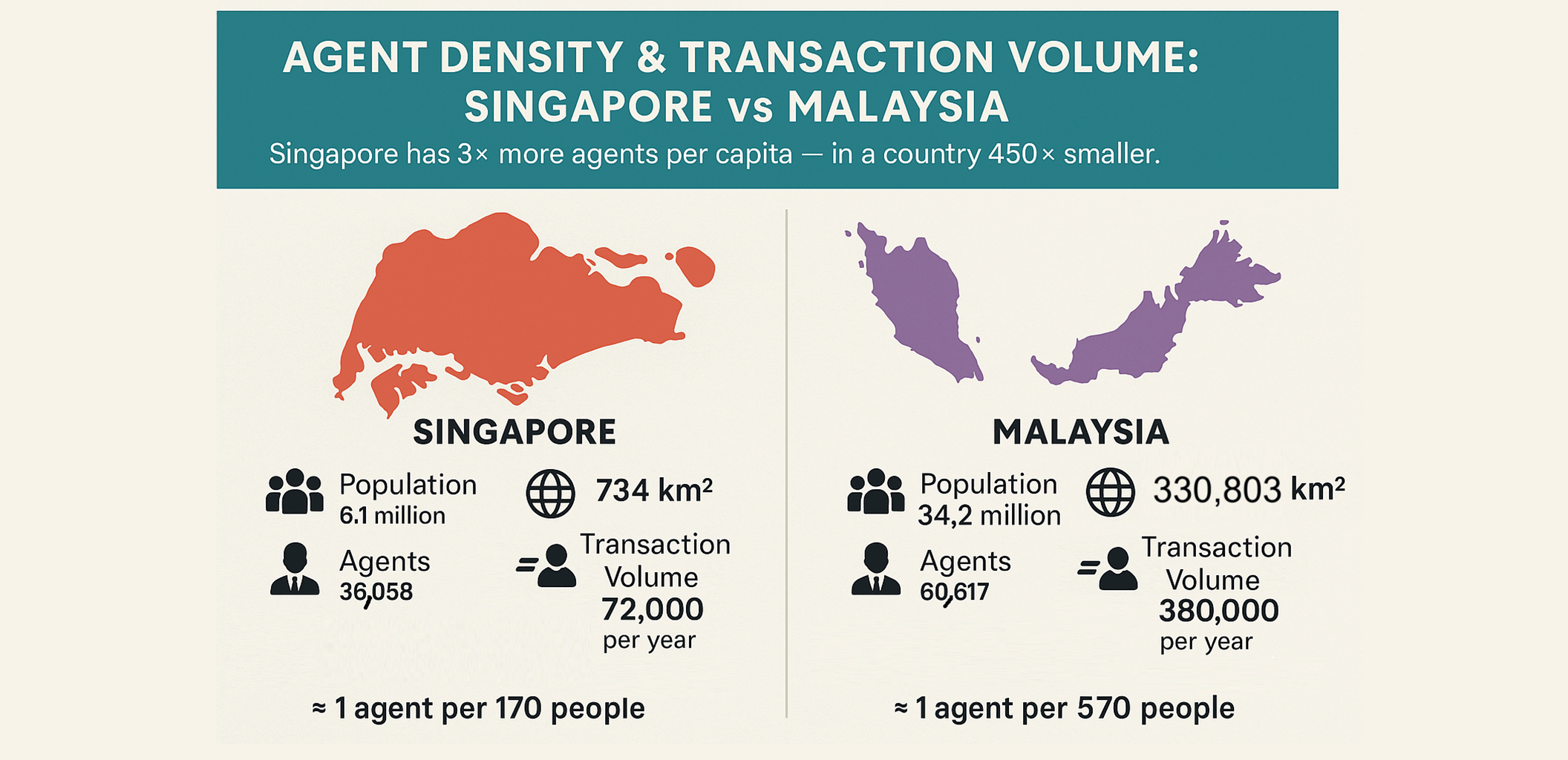

But beneath the surface lies a striking, almost unbelievable contrast: Singapore’s agent density is over three times higher than Malaysia’s, even though Malaysia is 450 times larger in land area.

This isn’t just a numerical difference; it’s a reflection of two countries that have built their property ecosystems on fundamentally different scales — one driven by hyper-competition, the other by the challenge of vast coverage.

The Shocking Numbers Behind the Contrast

| Metric | Singapore | Malaysia |

|---|---|---|

| Agents (Total) | 36,058 (CEA-registered) | 60,617 (REA + REN, BOVAEP) |

| Population (2025 est.) | 6.11 million | 34.2 million |

| Land Area | 734 km² | 330,803 km² |

| Agent Density (per 1,000 people) | ≈ 5.9 | ≈ 1.77 |

| Annual Transactions (est.) | ≈ 72,000 | ≈ 380,000 |

| Theoretical Transactions per Agent | ≈ 2.0 | ≈ 6.3 |

The Transactions Paradox

Despite having three times fewer agents per capita, Malaysia records five times more property transactions each year — roughly 380,000 vs. 72,000.

On paper, a Malaysian agent should have access to three times the deal opportunities.

But the reality of conversion is where the two markets diverge.

1. Competition vs. Coverage: The Geographic Divide

Singapore — Efficiency through Hyper-Specialization

Singapore’s high density forces intense competition within a small, urban geography.

Agents focus on micro-specialization: resale HDB, a single condo district, or luxury new launches. This environment drives professionalism and mandates technology adoption — CRM systems, data-driven pricing, digital viewing tools, and automated marketing are standard practice.

Malaysia — The Coverage Dilemma

Malaysia’s low agent density spread across a vast landmass creates a fragmented market.

Urban centres like Kuala Lumpur and Johor Bahru are crowded, while smaller towns remain underserved. An agent’s biggest challenge isn’t competition — it’s reach.

To succeed, Malaysian agents must find efficient ways to cover ground, access verified inventory, and collaborate across borders.

2. Productivity vs. Profitability: The Conversion Gap

The theoretical productivity numbers tell half the story.

While Malaysia’s agents appear to handle 6.3 transactions a year on paper (vs. Singapore’s 2.0), true efficiency is much lower.

- Singapore: Smaller market, but a high conversion rate — deals proceed smoothly thanks to strong buyer financing and predictable regulations.

- Malaysia: More listings, but higher fallout — financing rejections, unmotivated subsale buyers, slow documentation, and longer completion times.

In practice, both markets end up with similar active-to-inactive ratios, but for very different reasons:

Singapore — oversupply of agents.

Malaysia — systemic inefficiency.

3. Regulation and Maturity: Consistent vs. Varied Enforcement

Singapore’s CEA

The Council for Estate Agencies (CEA) enforces uniform registration, ethics, and advertising standards across all 36,000+ agents — within a city-state smaller than Selangor.

This centralized structure sustains professionalism and ensures every agent competes under the same regulatory umbrella.

Malaysia’s BOVAEP

The Board of Valuers, Appraisers, Estate Agents and Property Managers (BOVAEP) oversees over 60,000 agents nationwide.

Its challenge is scale.

While major cities show strong compliance, smaller markets vary widely in enforcement and education, creating uneven professionalism.

This inconsistency highlights why training, standardization, and digital verification will define the next phase of Malaysia’s evolution.

4. Caveat: Illegal Agents and Data Distortion

It’s important to note that Malaysia’s agent count may not reflect the true number of active market participants.

The presence of unregistered or illegal agents — individuals operating without REN tags or under expired authorizations — can significantly distort market perception.

While Singapore’s CEA regime leaves little room for unlicensed practice, Malaysia’s vast geography and uneven enforcement make illegal activity harder to track.

Thus, Malaysia’s real market density could be far higher in practice — though much of it exists outside official regulation.

This also means transaction data and per-agent productivity figures are indicative, not absolute.

The Big Takeaway: Density Shapes Opportunity

| Density Type | Market Behaviour | Strategic Focus |

|---|---|---|

| High Density (Singapore) | Agents differentiate by skill, brand, or niche. | Competition and specialization. |

| Low Density (Malaysia) | Agents differentiate by collaboration, systemization, and reach. | Innovation and network leverage. |

This is why system-based collaboration — not just recruitment — is the next frontier for Malaysia.

Tools that multiply reach, automate coordination, and verify listings can close the efficiency gap without multiplying headcount.

The Bottom Line

Singapore’s maturity stems from structure and specialization.

Malaysia’s potential lies in scale and systemization.

This comparison makes one truth clear:

Productivity doesn’t come from having more agents — it comes from having better systems.

The future of Malaysia’s property market will not be decided by how many new agents join, but by how the existing ones are empowered to operate with the efficiency, transparency, and connectivity of their Singaporean counterparts.

Sources (compiled)

- Council for Estate Agencies (CEA, Singapore) – Key Industry Statistics 2025

- Department of Statistics Malaysia (DOSM) – Current Population Estimates 2025

- BOVAEP / Planning Malaysia Journal (2024) – Registered REN & REA Data

- NAPIC (National Property Information Centre) – Property Market Report 2024

- Various industry and public data sources accessed via official reports and research compilations.

Disclaimer

All data above are compiled from public web sources and are estimates for comparative and educational purposes only.

Figures may change or vary based on reporting period, data collection method, or market revision.

Please consult official publications or qualified property analysts before relying on any information presented here.

This post does not constitute financial, legal, or investment advice.