Stop Blaming Agents for Market Prices: The Illusion of “Agents Controlling the Market”

ListingMine Academy | Market Dynamics & Consumer Education

This article provides a strong, logical argument debunking one of the property market’s most persistent myths: that real estate agents somehow “control” prices.

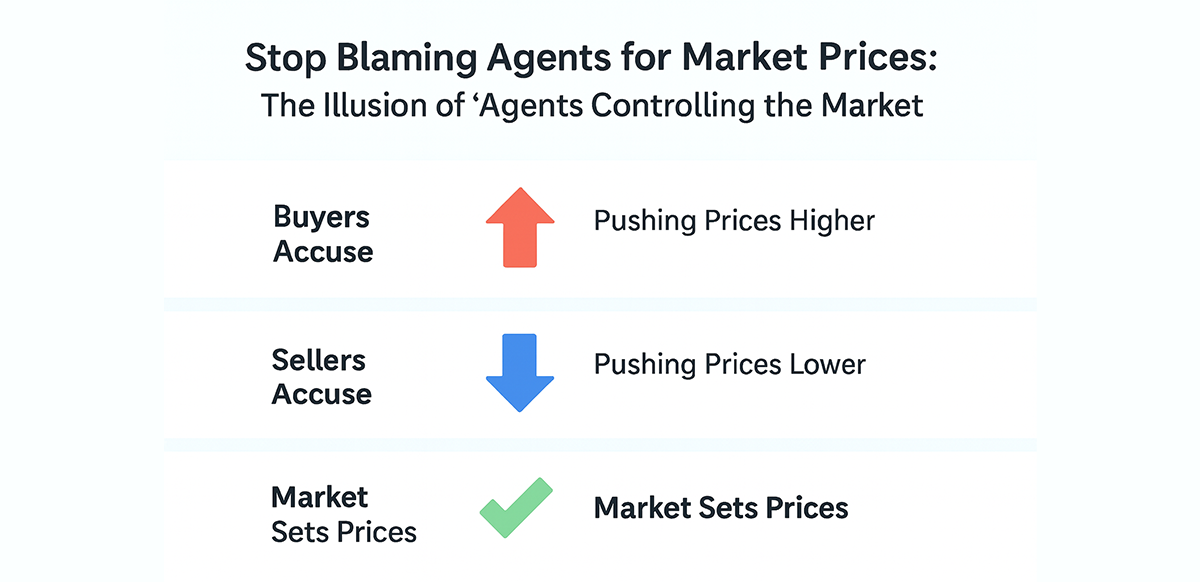

Across every market cycle, the narrative repeats itself: When the market goes up, buyers accuse agents of “pushing prices higher.” When the market goes down, sellers accuse agents of “pushing prices lower.”

Both sides imagine agents possess some hidden ability to influence market direction. This belief is not only inaccurate — it is economically impossible.

The reality is straightforward: Agents do not have the power to move the market. In fact, they prefer stable pricing, not volatility.

1. The Myth of Agent Price Control

The idea that agents can raise prices during a boom or depress them during a downturn may feel comforting, but it is entirely unrealistic.

If agents could truly influence national pricing trends:

- Ministries wouldn’t need economists.

- Banks wouldn’t need valuation departments.

In reality, agents are a tiny part of a massive ecosystem. Market prices are driven by fundamentals far beyond any agent’s control:

Economic Conditions: Interest rates, inflation, wage growth, bank lending policies.

Supply vs Demand: New project launches, stock overhang, demographic needs.

Global Shocks: Recessions, geopolitical instability.

Agents cannot control any of these forces.

2. What Agents Actually Want: Stability

Agents do not benefit from chaotic or rapidly changing prices. Agents earn from transactions, not from price jumps or price crashes.

When prices swing too quickly (up or down), agents suffer first:

- If prices rise too quickly: Buyers vanish, loan rejections spike, and negotiations freeze.

- If prices fall too quickly: Sellers reject offers, owners withdraw listings, and trust collapses.

Both extremes lead to one outcome: agents earn nothing because deals cannot close.

Agents survive on volume, consistency, and predictability. They want stable prices, realistic expectations, and healthy transaction flow—not the dramatic highs or lows people accuse them of engineering.

3. The Unrealistic Extremes from Buyers and Sellers

Many accusations toward agents come from disappointment, not facts. Before blaming the agent, consider the unrealistic expectations agents deal with daily:

- Unrealistic Buyers: Expecting “below-market” steals, wanting distressed prices for non-distressed properties.

- Unrealistic Sellers: Demanding 20–30% above actual transacted prices, valuing properties emotionally, or insisting bank valuations are “wrong.”

Agents stand between two extremes, trying to create a bridge that allows a deal to happen. When neither side wants to adjust, blaming the agent becomes the easiest escape.

4. Agents Are Messengers of Market Reality — Not the Creators of It

Agents simply communicate market feedback. They do not decide what buyers can afford or how much banks are willing to finance.

The truth: Buyers push prices up during demand spikes. Sellers push prices down during supply gluts. Agents simply operate in the middle, trying to keep the market functioning.

5. The Real Value of an Agent: Execution in an Imperfect Market

If agents don’t control prices, what are they for?

Their value lies not in manipulating the market, but in mastering its complexity. The fee isn't for setting the price. It's for guaranteeing the process.

A professional agent provides:

- Market Navigation: Interpreting data and trends to guide clients through the noise.

- Transaction Engineering: Managing the labyrinth of paperwork, legalities, and bank processes to get an unstable deal across the finish line.

- Negotiation Bridge-Building: Finding the fragile common ground between unrealistic buyers and emotional sellers that makes a transaction possible.

- Risk Mitigation: Identifying pitfalls in titles, defects, or financing that can cost a client far more than the commission.

Conclusion: Price Reality Is a Market Function, Not an Agent Function

The market is shaped by thousands of decisions made by policymakers, banks, developers, consumers, and investors. An agent is one small gear in a complex engine.

The truth is simple: The market sets the price. Agents do not.

Their role is far more critical: they are the operators of the market's machinery. They don't control the economic weather, but they are the expert captains who navigate their clients safely through it.

So, judge an agent on their professionalism, their knowledge, and their ability to execute—not on the market's direction, which they are powerless to change.