ASEAN Integration: How Cross-Border Property Investment Will Shape the Agency of the Future

The next big property wave won’t come from new launches or domestic upgrades — it will come from borders disappearing.

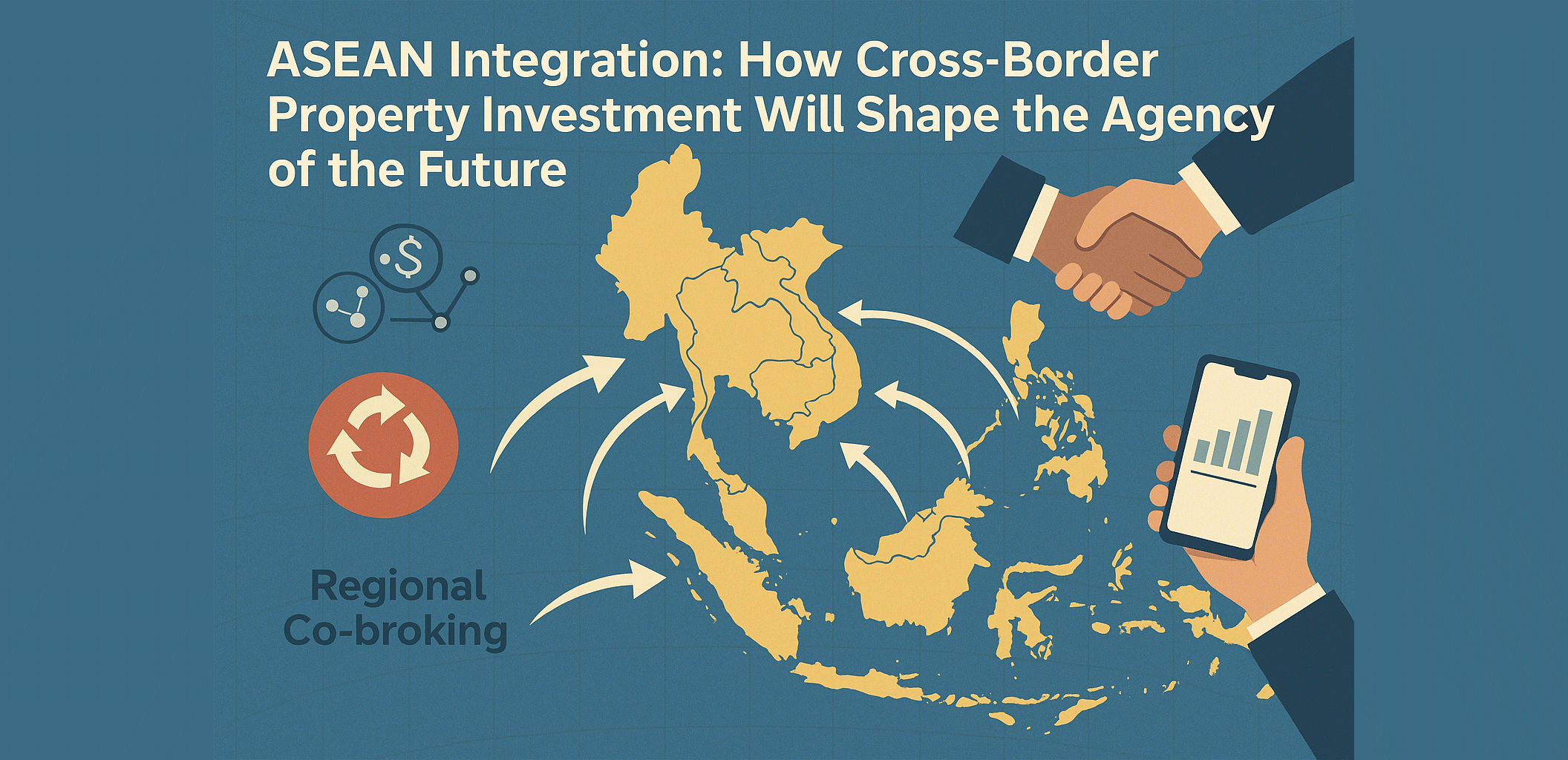

As ASEAN economies integrate through trade, infrastructure, and digital finance, property is becoming a regional asset class. Developers are going regional, buyers are going international, and agencies are quietly being forced to evolve from local sales teams into cross-border transaction networks.

This shift won’t just change what agents sell — it’ll redefine how agencies are structured, trained, and trusted.

1. The ASEAN Property Integration Is Already Underway

ASEAN’s free-movement frameworks — like the ASEAN Comprehensive Investment Agreement (ACIA) and Mutual Recognition Arrangements (MRAs) — are paving the way for simpler capital flows and cross-border ownership.

Meanwhile, lifestyle and tax dynamics are driving regional mobility:

- Singaporean and Hong Kong buyers are eyeing Malaysian landed and industrial assets.

- Thai and Vietnamese investors are diversifying into Cambodia and Laos.

- Malaysian retirees are exploring the Philippines, Indonesia, and Thailand for lifestyle properties.

The idea that “foreign buyers are just Chinese” is outdated — ASEAN is building its own intra-regional investment ecosystem.

2. The Rise of the “Transnational Agent”

Tomorrow’s successful agent won’t be limited by national borders. They’ll be what we call Transnational Agents — fluent in cross-border financing, foreign ownership regulations, tax regimes, and residency programs.

For example:

- A Malaysian agent collaborating with a Singaporean counterpart on Johor landed properties.

- A Thai agent marketing Bali villas through ASEAN referral networks.

- A Filipino broker representing Malaysian developers targeting Manila’s upper-middle class.

Instead of competing, regional agents will co-broke across borders — mirroring how capital, buyers, and developers already do.

3. ASEAN Infrastructure: Redrawing the Map of Demand

Infrastructure integration is the silent driver behind property globalization.

Projects like:

- High-Speed Rail (KL–Singapore)

- Trans-Borneo Highway

- East-West Economic Corridor (Da Nang–Savannakhet–Bangkok)

- Batam–Bintan–Johor–Singapore Triangle

These corridors create property gravity zones where demand clusters around logistics, digital commerce, and hybrid living.

For example:

- Johor and Batam will serve as “Greater Singapore suburbs.”

- Penang’s tech hub will attract Thai and Vietnamese professionals.

- Danang and Dawei will link industrial and residential migration patterns.

The future ASEAN agent must be able to read corridors like markets — understanding that infrastructure equals investment flow.

4. The Role of Fintech and Blockchain

Property has always been constrained by legal friction — borders, ownership rules, and slow banking systems. Now, fintech and tokenization are rewriting that playbook.

Cross-border platforms like Wise, Instarem, and digital escrow wallets enable faster capital movement. Meanwhile, blockchain-led initiatives (like tokenized REITs and digital fractional ownership) allow investors in Bangkok to co-own Malaysian retail lots or serviced apartments with traceable returns.

The ASEAN property market is digitizing, and agents who can operate across both financial and regulatory boundaries will lead this transformation.

5. Developers Are Expanding Regionally — and They Need Regional Partners

Large Malaysian developers (like EcoWorld, Mah Sing, Sime Darby) and Singaporean groups (like CapitaLand, UOL, GuocoLand) are expanding across Southeast Asia.

That means they don’t just need local agents — they need regional distribution partners who can coordinate:

- Local compliance and marketing licensing.

- Dual-currency financing presentations.

- Co-branded regional roadshows.

This will blur the line between agency, distributor, and investment advisor — creating multi-market “super-agencies.”

6. What the Future Agency Looks Like

The agency of the next decade won’t be a single office in one city — it’ll be a cloud network of regionally integrated professionals, with:

- Multi-country Licensing and Co-broking Agreements

- Shared CRM and Commission Infrastructure (like ListingMine ERP)

- Automated Forex Conversion and Escrow

- Cross-border Marketing Localization (Language, Tax, Visa Info)

- Client Portfolios Measured in ASEAN Exposure, not National Volume

The agent of the future won’t ask, “Which project do I sell?” They’ll ask, “Which market needs me next?”

7. Strategic Implications for Malaysian Agencies

Malaysia sits at the center of ASEAN — geographically, linguistically, and financially. It has:

- Low property acquisition costs compared to Singapore and Thailand.

- English-speaking agents who can bridge North and South ASEAN.

- Maturing digital infrastructure (ListingMine, PropertyGuru, PropertySifu).

That makes Malaysian agencies natural gateways for cross-border collaboration. Agencies that master compliance (BOVAEP + PDPA + AMLA) while integrating ASEAN-wide referral systems can become regional command centers for investment flow.

8. Conclusion: From Agents to Regional Asset Managers

The next generation of real estate professionals won’t just manage listings — they’ll manage regional investment flows. They’ll understand not just what’s for sale, but where the capital is moving next — from Kuala Lumpur to Bangkok, Manila, and Hanoi.

ASEAN integration won’t erase national agencies — it will upgrade them into cross-border ecosystems. And the future of property in Southeast Asia will belong to those who build trust across borders, not just sales within them.