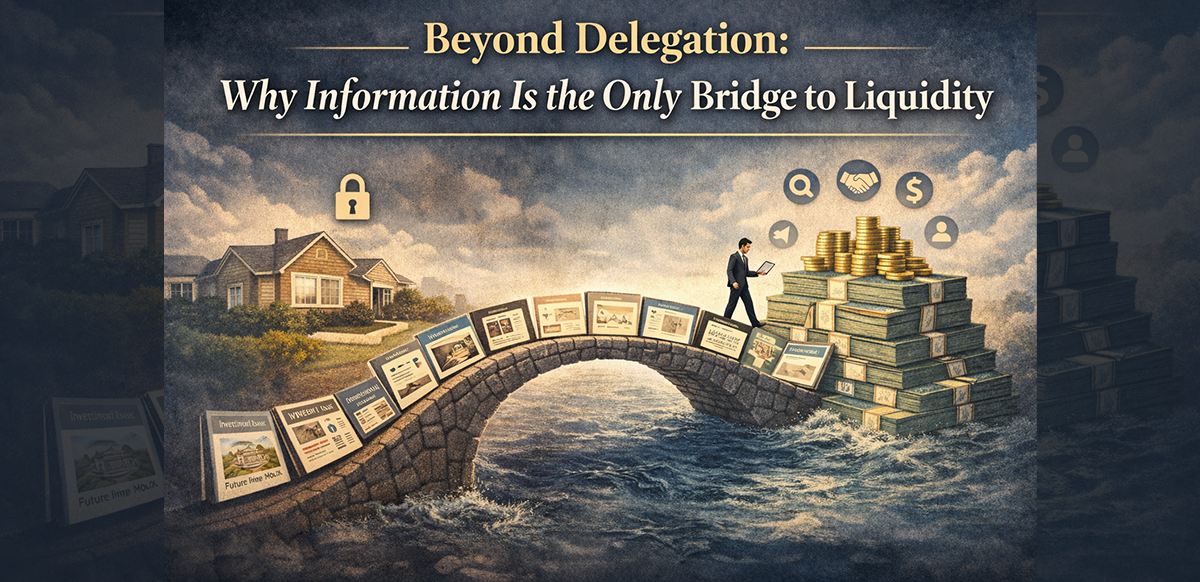

Beyond Delegation: Why Information Is the Only Bridge to Liquidity

Securing delegation from a seller is not a success. It is merely permission to begin.

Once a seller delegates the right to sell, the agent has obtained the product. But in real estate, possession of the product does not generate revenue. The hardest stage comes next: converting a static asset into a liquid transaction.

That conversion does not happen through the physical house. It happens through information.

1. Property vs. Representation: The Only Bridge That Moves

A physical house is immobile. It cannot be broadcast, duplicated, or moved through networks. Only its representation can.

What actually flows through portals, WhatsApp groups, internal ACNs, and private buyer networks is not the property itself—it is the product description:

- Photos and cinematic walkthroughs

- Floor plans and structural data

- Pricing logic and comparative context

- Investment framing and risk explanation

- Lifestyle positioning and future optionality

Without this informational twin, the asset is economically invisible. In a modern market, what is undocumented does not exist.

2. Information Is the Conversion Layer

If delegation gives you inventory, information converts inventory into liquidity. This is where the agent's real work begins.

You are not selling bricks and mortar. You are shaping how the market understands those bricks. The physical object does not change, but the outcome does, depending on the lens:

- Is it a yield instrument for an investor?

- Is it a scarcity asset for a collector?

- Is it a timing opportunity for a flipper?

- Is it a lifestyle upgrade for a family?

The difference lies entirely in how information is structured, emphasized, and sequenced. Information is the software; the property is merely the hardware it runs on.

3. Distribution Is Commodity; Information Is Alpha

Portals do not sell properties. Social media does not sell properties. Networks do not sell properties. They are pipes.

They transmit information, but what determines success is not reach—it is fidelity.

- A low-quality description broadcast to 100,000 people will still fail.

- A high-fidelity description shared with 10 aligned buyers can close cleanly.

This is why two agents can market the same unit with radically different results. One distributes noise; the other manufactures signals.

4. Information Manufacturing Is the Agent's Craft

Professional agents are not messengers. They are conversion engineers. Information manufacturing involves:

- Selection: Choosing which facts create gravity and which create confusion.

- Enhancement: Adding clarity, verification, and context that the market can trust.

- Translation: Converting seller intent ("I need to move") into buyer logic ("This is a motivated exit with asymmetric upside").

The market does not pay equally for identical bricks. It pays for clarity of value. That is why two identical units on the same floor can transact at different prices. One crossed the liquidity bridge cleanly; the other stalled.

The Complete Mental Model

A transaction is not a single act. It is a sequence of conversions:

- Delegation creates the product (Inventory).

- Information defines the product (Asset Logic).

- Media transmits the information (Distribution).

- Matching aligns buyer and seller delegations.

- Transaction converts information into money.

Agents who stop at delegation become listing collectors. Agents who master information manufacturing build leverage.

The profession is not selling houses. It is turning delegated assets into tradable, high-fidelity information that the market can understand, trust, and act upon. That is where liquidity comes from.