Budgeting: Your Stress-Free December

Every December, agency leaders face the same questions:

“How will we afford the bonuses?”

“Can we still do the annual dinner?”

“Do we quietly cancel the incentive trip?”

This panic doesn’t happen because the agency is failing; it happens because the agency is operating on hope, not planning.

The Real Problem Is the Mindset

Many agencies wait for commissions to be collected before deciding if they can afford rewards. When the market slows or payouts are delayed, the numbers stop working. Bonuses become next year’s promise, dinners turn into potlucks, and trips are scrapped.

This isn’t a financial problem. It’s a management discipline problem.

Budgeting Is Preparation, Not Limitation

A proper annual budget doesn’t restrict you; it gives clarity and control. Set clear financial thresholds—and stick to them—so every reward is pre-funded:

- You know the number of deals needed to cover operations.

- A fixed surplus allocation flows to staff rewards automatically.

- Trip funds are ring-fenced from day one.

No stress, no guilt, no scrambling. When the team hits the target, the reward is automatic, not emotional.

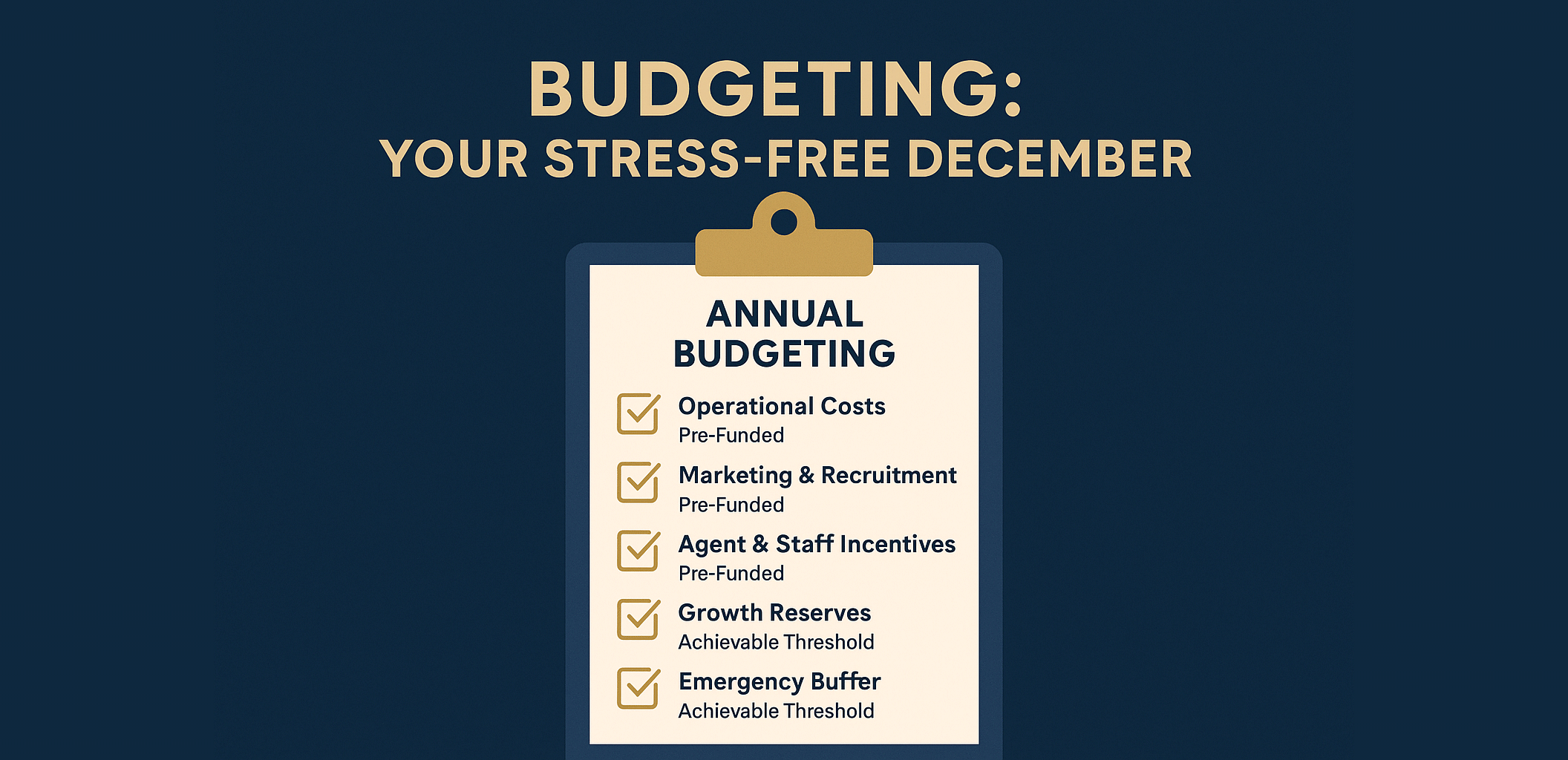

What Your Budget Must Include

Structure funds into at least five buckets:

- Operational Costs — Rent, systems, tools, admin.

- Marketing & Recruitment — Ads, events, onboarding.

- Agent & Staff Incentives — Bonuses, annual dinners, awards.

- Growth Reserves — Expansion, training, tech upgrades.

- Emergency Buffer — For delayed commissions or market shocks.

Know your average revenue per deal and the team’s historical close rate to model what’s possible and avoid the danger zone.

From Uncertainty to Control

Budgeting turns chaos into a roadmap. It tells you when to recruit, when to reward, and when to expand—and lets you communicate transparently:

“Once we collectively hit RM2 million in gross commission, the Bali trip is confirmed and paid for.”

That’s not a promise; that’s a plan. The target is common, funded, and credible—giving the boss peace of mind.

Running an agency without a budget is like driving with your eyes closed. Budgeting builds discipline, predictability, and trust. When rewards are planned, everyone wins—especially the boss.