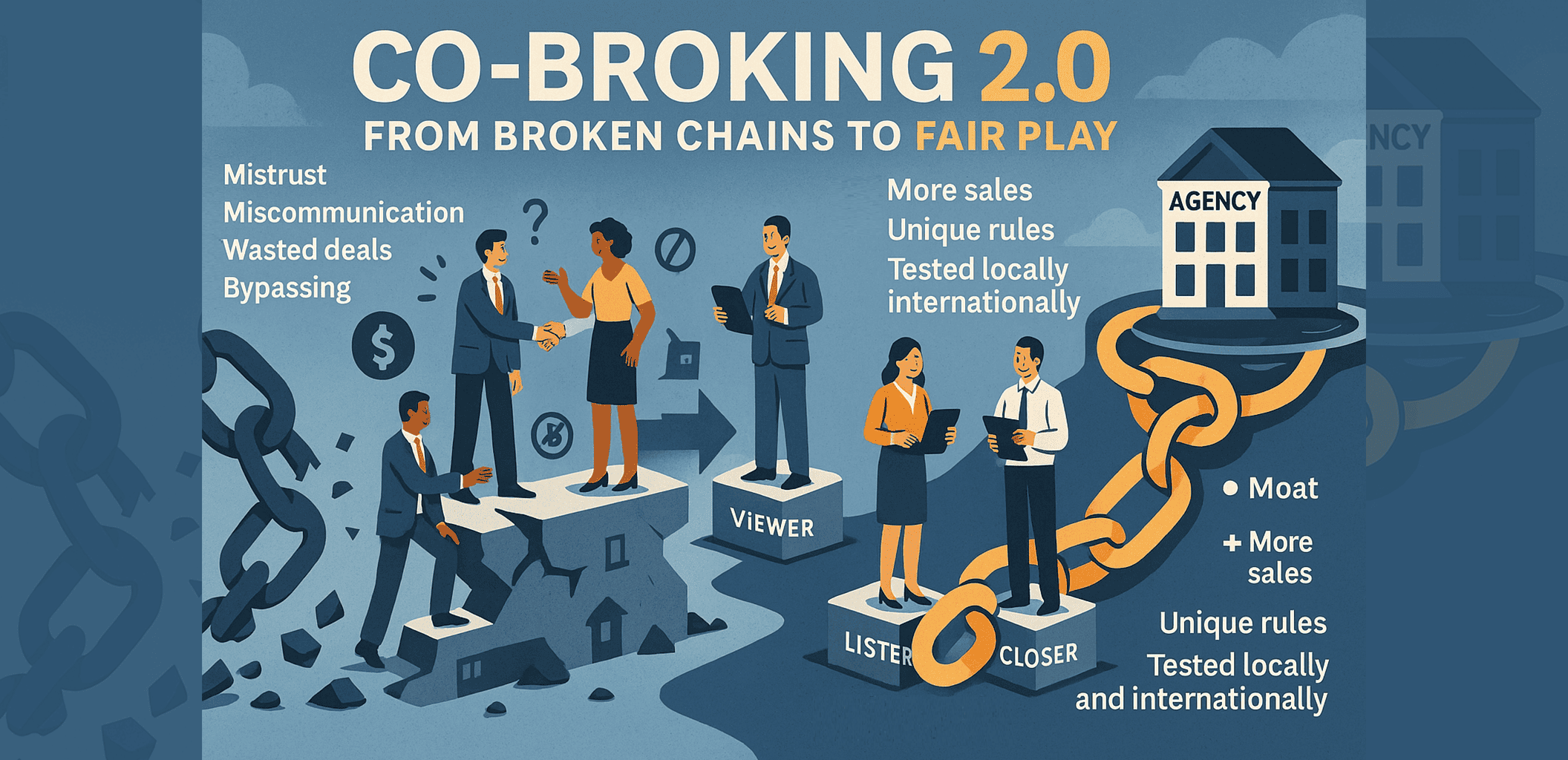

Co-Broking 2.0: From Broken Chains to Fair Play

In Malaysia’s property market, co-broking—professionally referred to as co-agency—isn’t just about two agents splitting a deal. It’s a survival tool, a recruitment strategy, and, for the unwary, a perfectly laid trap.

To an outsider, it looks simple: two agents, one commission. Insiders know the truth. Co-broking is a complex dance of trust, leverage, and hidden negotiations that can make or break careers.

Internal vs External Co-Broking

Internal Co-Broking: The Ecosystem Within

Internal collaboration isn’t one-size-fits-all. It takes several forms:

- Same-Branch Sharing – Two negotiators under the same team leader split a deal. Simple in theory, but often contentious in practice.

- Inter-Branch Cooperation – Agents from different branches of the same brand work together, but competition and overrides muddy the waters.

- Recruitment Co-Broking (The Real Model) – When bosses boast of “1,000 agents,” they’re describing alliances, not employees.

- The Agency provides brand, license, and compliance.

- The Agent/Leader runs as an independent unit, bringing sales and manpower.

It’s not employment—it’s co-broking of manpower and opportunity. These allied agents can leave anytime, taking their team and pipeline with them.

External Co-Broking: The Wild West

Beyond the agency walls, the risks multiply:

- Alliance Co-Broking – Structured collaborations with formal agreements.

- Stranger Co-Broking – The high-friction world of WhatsApp groups and portals.

- Non-Agent Co-Broking – Working with bankers, lawyers, or even owners. A legal grey area.

- Referral Co-Broking – A simple handover of a lead for a fixed fee.

The Dark Side of Co-Broking

Theory often breaks down under pressure. Common pitfalls include:

- The Bypass – A partner steals your buyer by cutting you out, especially without a signed co-broking letter.

- The Free Rider – One agent does 90% of the work while another pockets half the commission.

- The Address Trick – An agent co-brokes only to extract the property address, then approaches the owner directly.

- Fake Collaboration – Deals collapse, not because clients walked away, but because trust between agents evaporated mid-stream.

Myths vs Realities

- Myth 1: The split is always 50/50.

Reality: Splits are negotiable. Some agencies enforce 70/30. Overrides further dilute payouts. - Myth 2: Recruiting agents = controlling them.

Reality: Recruitment is alliance, not employment. You co-broke with them, you don’t control them. - Myth 3: Co-broking saves time.

Reality: Without trust and systems, coordination costs more time than it saves. - Myth 4: Co-broking means full transparency.

Reality: Buyer agents hide budgets; seller agents hide bottom prices. It’s a poker game of information. - Myth 5: A WhatsApp message is a co-broke agreement.

Reality: WhatsApp groups are graveyards of half-baked leads. Without systems, deals vanish into chat history.

What Really Happens Behind the Scenes

Behind every co-broking deal are invisible negotiations:

- Silent debates over commission splits between bosses.

- Verification calls to weed out fake listings.

- Turf battles over who controls client communication.

- Commission disputes that erupt months after closing.

Co-broking works, not because it’s smooth, but because determined agents push through friction to close.

When Co-Broking Becomes 3-Way or 4-Way

Not all co-broking is two-sided. Some stretch into A → B → C → D chains:

- A passes critical data to B.

- B relays to C.

- C finally passes to D, who attempts to close.

Problems pile up:

- Unfair Splits – Middlemen (B and C) often demand 25% each just for passing a number. A (the source) and D (the closer) carry most of the work but get squeezed.

- Data Distortion – Each handoff distorts information by at least 10%. By the time it reaches the buyer, details are inaccurate.

- Viewing Delays – Instant viewings are impossible. Arrangements drag across multiple layers.

- Low Success Rate – Unless buyers are extremely accommodating, most of these chains collapse before a viewing even happens.

This “broken telephone” model wastes opportunities and creates resentment.

Co-Broking 2.0: The Multi-Role Model

The 50/50 split is outdated. The future is Co-Broking 2.0—a role-based model that rewards contribution, not mere participation.

Where Co-Broking 2.0 Applies

- Internal – Solves same-branch vs inter-branch tension with role-based fairness.

- External – Turns risky 50/50 or multi-way splits into structured, transparent role agreements.

- Hybrid Alliances – Two or more agencies collaborate, each bringing teams. Instead of crude splits, roles are assigned: one handles lead gen, another site viewings, another closing, while platform fees are shared.

For Subsale Properties: Maximum Granularity

- Lister – Inputs and maintains the listing.

- Key Holder – Manages property access.

- Document Person – Collects and verifies authorization letters.

- Buyer Introducer – Refers the client.

- Viewer – Conducts the first showing.

- Closer – Negotiates and secures the deal.

- Loan Officer – Advises on financing and ensures approval.

Every contribution is recognized—even if an agent performs only one role.

For New Development Projects: The New Profit Model

- Lead Generator – Sources potential buyers.

- Appointment Setter/Caller – Qualifies leads and books gallery visits.

- Site Agent – Manages gallery tours and briefings.

- Closer – Handles booking and documentation.

- Company Platform Fee – A transparent share for compliance, branding, and infrastructure.

Why Co-Broking 2.0 Works

Critically, Co-Broking 2.0 solves all the problems above.

No more wasted deals lost to mistrust, miscommunication, or distorted information.

- Deals move faster and clients get a smoother experience.

- Companies can finally build a moat: a defensible collaboration system outsiders can’t copy.

- Each rule set is unique to the creator—a reflection of culture, leadership style, and priorities. No fixed templates; imagination drives the design, enforcement ensures compliance.

- Most importantly, this model has been tested and proven locally and internationally. Agencies adopting role-based collaboration consistently report:

- Higher closing rates.

- Stronger trust between agents.

- Longer-lasting partnerships.

Beyond sales, the strategy also improves recruitment and retention. New joiners see fair recognition across all roles, and seasoned agents stay longer when transparency replaces empty promises.

Where ListingMine ERP Comes In

To make Co-Broking 2.0 work, agencies need systems that can:

- Handle custom rules without months of coding.

- Deploy changes in minutes, not quarters.

- Let admins experiment with trial-and-error refinements at no cost.

This is where ListingMine ERP changes the game:

- Codeless Rule Setup – Define, test, and launch new structures instantly.

- Zero Customization Fees – No RM10k surprises. Adjust anytime, free.

- Very Agile – By the time other vendors deliver one update, ListingMine users have iterated 10 times.

- Culture Enforced – Each agency’s rules reflect its unique DNA, and the system ensures compliance automatically.

Final Word: From Broken Chains to Fair Play

The old world of co-broking was messy, unfair, and high-risk. Refusing to co-broke is worse—it shrinks your opportunity pool to almost nothing.

The winners are those adopting Co-Broking 2.0:

- Documenting everything clearly.

- Choosing partners strategically.

- Using systems that make fairness enforceable.

Co-broking is no longer about splitting commissions. It’s about building a network where everyone is paid for the value they create.

The 50/50 split is over. Co-Broking 2.0 is here.

Agencies that embrace it will grow faster, keep their people longer, and finally build the moat that competitors can’t cross.