Commission Chaos: Why Copying Payout Percentages is a Fast Track to Collapse

It's a scene that repeats itself across the real estate industry. A few key team leaders leave, their followers bolt, and panic strikes the agency’s boardroom. In a desperate attempt to "retain talent," the managing director sacrifices the firm’s financial stability:

- "We'll match 98% commission!"

- "We'll offer higher overrides!"

- "We'll charge inactive agents a RM200 fee to offset costs!"

This feels like a decisive counterattack. In reality, it's often the most dangerous move—one that positions the agency for an inevitable collapse.

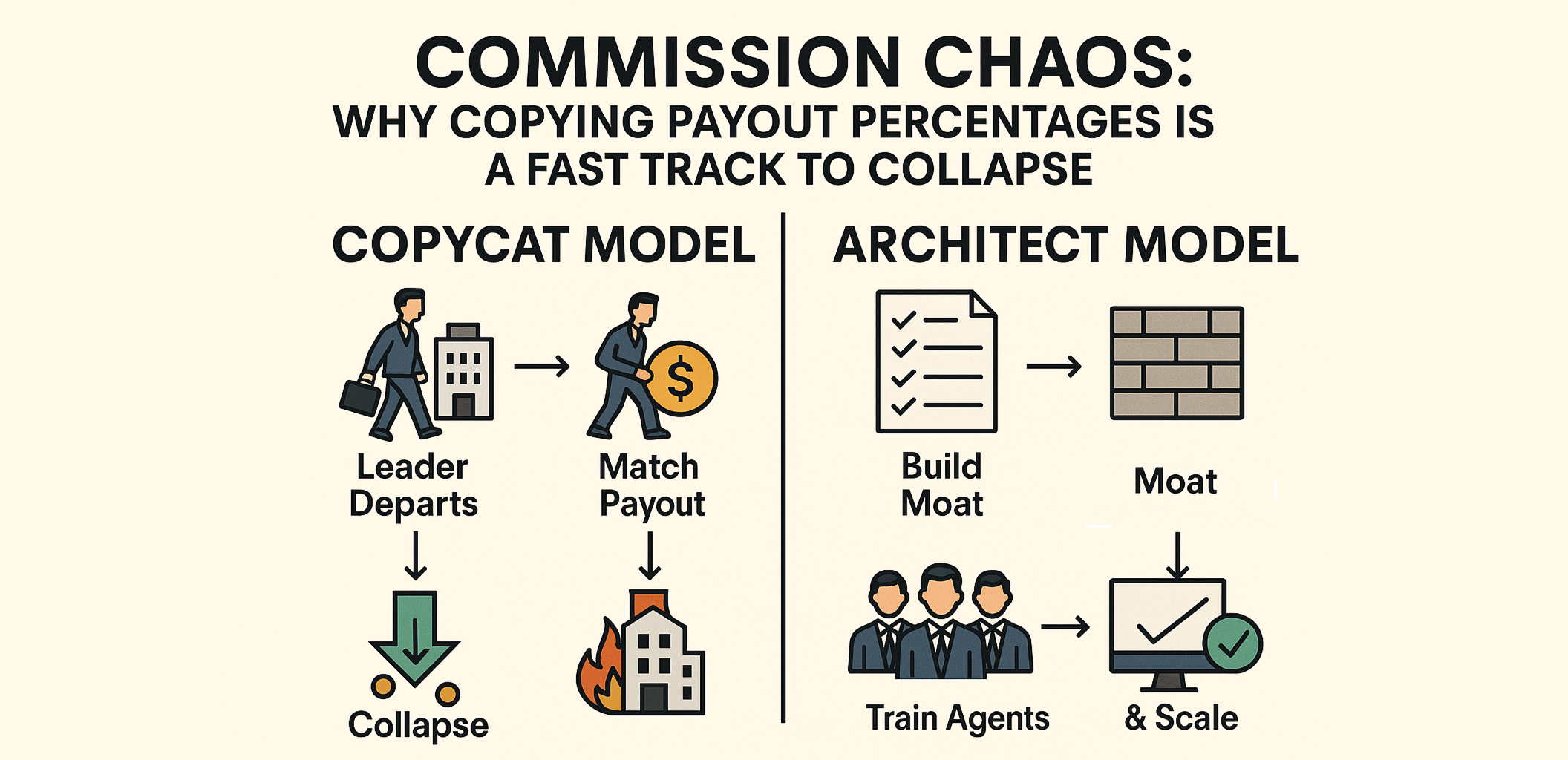

Copying Formulas Without the Moat

Many agency bosses were once star agents. They remember what successful firms offered (high payout) but not the structural reason why it was sustainable.

When a dominant competitor offers 98%, smaller agencies rush to copy it without asking the critical question: How are they still profitable?

The truth is, top agencies don't survive on payout; they survive on moats—structural advantages that cannot be easily copied:

- Exclusive Inventory: Direct developer backing and sole access to premium projects.

- Internal Networks: Proprietary co-broking systems that accelerate deal closures.

- Verified Systems: Centralized, shared platforms for verified listings and lead distribution.

If you match their payout without these moats, you're not executing a strategy—you're copying a formula without the necessary ingredients.

The Desperate RM200 Trap

To offset losses, many bosses introduce financial penalties: "If agents don’t close any deals, I’ll charge them RM200 per month."

This ignores human nature. When the payment deadline arrives, agents don't pay—they leave. Why would any agent pay penalties when dozens of other agencies offer similar commissions with zero fees? Your retention disappears because your offer has no real value behind it. This fee doesn't fix your cost problem; it exposes your business model problem.

High Payout Is an Expense, Not a Strategy

High commissions are not innovation; they are simply your largest expense. And an expense without a compensating structure becomes a liability.

A sustainable business model must clearly define:

- Your breakeven point per agent.

- Your monthly burn rate and cash reserves.

- Your margin for reinvestment (in training, tech, and systems).

If you skip this foundational groundwork, you have momentum without management—and that always ends in financial exhaustion.

Build Your Moat, Not Just Your Payout

Top agencies don't compete on "who pays the most." They compete on ecosystem value—verified stock, structured co-broking, transparent reporting, and measurable lead performance.

They can afford a slightly lower payout because their infrastructure helps agents close faster and cleaner. They've built a moat that can't be replicated simply by raising percentages.

If your only advantage is "high payout," your model is already obsolete. The next agency with deeper pockets can outbid you overnight—and your foundation crumbles instantly.

The Path Forward: From Gambler to Architect

Before adjusting your commission scheme, stop asking about percentages and start asking: "What high-value service do I provide that no one else can replicate easily?"

If you don't have a solid answer, your problem isn't the payout—it's the absence of a moat. Stop chasing. Start building.

- Audit your value: List every real tool, service, or advantage you offer beyond a desk.

- Develop a niche: Become the undisputed expert in one property segment or region.

- Invest in one system: Adopt a CRM or co-broking platform that truly helps agents close faster.

Commissions might attract, but systems retain. When the market tightens, it's not the percentage that keeps you alive—it's the unbreachable structure beneath it. Build that structure first.