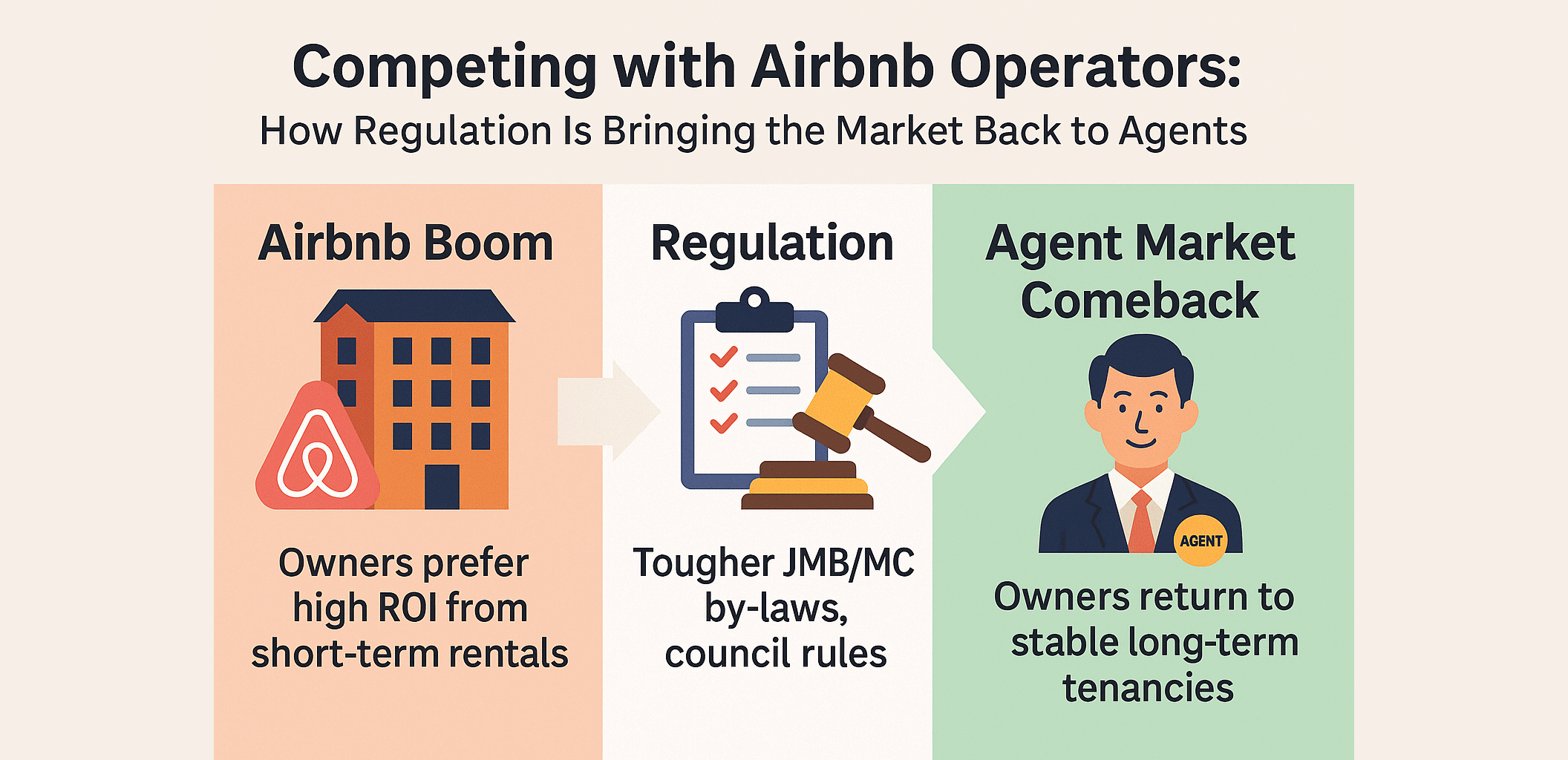

Competing with Airbnb Operators: How Regulation Is Bringing the Market Back to Agents

For several years, short-term rental platforms created a new kind of competition for property agents. In condos that permitted Airbnb operations, owners saw an opportunity to rent out units daily instead of annually — chasing higher yields and faster returns.

Agents, meanwhile, found themselves sidelined. The logic was simple: why settle for RM2,000 a month in long-term rent when nightly guests could bring in RM300 per night?

But markets evolve. And lately, regulation and building management enforcement have begun to level the playing field again — reopening the door for traditional agents to re-enter these once-lost markets.

1. The Shift That Started It All

When Airbnb first gained traction, it reshaped how investors thought about property income. A fully furnished condo in a prime area could, in theory, generate two to three times more monthly revenue through short stays compared to a fixed tenancy.

Many early adopters jumped in — either self-managing their listings or engaging “Airbnb operators” who handled everything from cleaning to check-ins for a management fee (usually 20–30%).

As more success stories spread, new projects even began advertising themselves as “Airbnb-friendly” developments to attract buyers.

2. The Impact on Agents

The rise of short-term rentals quickly narrowed the inventory pool for agents. Owners who once relied on agents for year-long leases began exploring daily rentals instead.

For agents, this meant:

- Fewer listings available — as owners held back units for Airbnb.

- Reduced repeat income — since Airbnb operators manage directly with owners.

- Weaker client relationships — because owners no longer needed tenancy renewals every 12–24 months.

The result: some agents were effectively pushed out of entire buildings, losing a market segment they once dominated.

3. The Reality Behind the Airbnb Numbers

While the gross returns of Airbnb look attractive on paper, many owners soon learned the math wasn’t so simple.

Short-term rentals came with:

- High operational costs — cleaning, utilities, platform fees, repairs.

- Seasonal demand — strong during holidays, weak during off-months.

- High wear-and-tear — frequent turnover meant faster depreciation.

More importantly, competition among Airbnb hosts exploded. In some city centres, the number of listings grew faster than the number of guests.

What was once a gold mine became a race to the bottom — nightly rates dropped, and occupancy fell.

4. The Turning Point: Regulation and Building Management Pushback

Then came the regulatory clampdown.

- JMBs and MCs in many condominiums began passing by-laws to restrict or ban short-term stays, citing security, nuisance, and insurance risks.

- Local councils introduced or enforced licensing requirements, particularly in tourist zones.

- Fire safety, insurance, and zoning compliance became mandatory for commercial-style usage.

For many operators, compliance became too costly or complicated. Some were even fined or warned by building management.

In short: the low-barrier Airbnb game got harder overnight.

5. The Market Comes Back to Agents

As short-term rentals lose their simplicity, many owners are quietly returning to the stability of long-term tenancies.

They realise that:

- Consistent rent beats volatile occupancy.

- Less wear-and-tear means lower maintenance.

- No platform commissions or licensing stress.

And this is where agents come back in.

Owners who previously relied on Airbnb operators now need professional agents again — to find qualified tenants, draft tenancy agreements, and manage renewals.

The same condos that once shut out agents are slowly re-opening opportunities for long-term leasing.

6. How Agents Can Compete — and Win

Instead of viewing Airbnb operators as the enemy, agents can position themselves differently:

- Sell peace of mind, not hype. Emphasise stable cash flow, zero licensing headaches, and predictable tenancy.

- Show comparative ROI. Present actual net returns after Airbnb expenses vs. long-term tenancies. Often the difference is smaller than owners assume.

- Leverage compliance knowledge. Educate owners on what JMB rules or local councils now require — agents who sound informed earn trust fast.

- Offer management options. Some owners still want convenience. Bundle leasing with light management (rent collection, inspection, renewals).

Professionalism now beats speculation.

7. The Bottom Line

Airbnb operators changed the game — but not permanently. Regulation, enforcement, and oversupply have brought balance back.

For property agents, this is a second chance. The short-term rental rush showed owners the pain of volatility; now, they crave stability again.

Those who adapt — by being informed, service-oriented, and compliance-savvy — will find that the very buildings they lost are coming back to them.