The Paper Ceiling: The Real Difference Between Selling Houses & Owning a Career

In the corporate world, a degree is the key that unlocks the door. In real estate, the door is wide open—but what lies beyond it depends entirely on what you bring through.

Walk into any sales gallery in Malaysia and you'll witness the industry's great paradox: A 22-year-old school leaver closing deals from a cafe, driving a Mercedes. A 30-year-old MBA graduate grinding through paperwork, driving a Proton.

It creates a seductive, dangerous myth: "In sales, education is irrelevant. Only hunger matters."

But that is only half the story. While the commission slip doesn't ask for your certificate, your career ceiling absolutely does.

Here's the real, unvarnished breakdown of when paper matters—and when it doesn't.

Part 1: The Soft Skills Advantage — Why Graduates Start Ahead in Premium Play

Language as Leverage

Malaysia's upper-tier market—expats, MNCs, international investors, corporate clients—operates in English. Degree holders who've spent years writing reports, presenting, and debating don't just speak better English; they think in structured arguments. This isn't about vocabulary. It's about professional credibility in high-stakes negotiations where a poorly worded clause can cost thousands.

Research as a Reflex

The untrained agent relies on hearsay, brochures, and their leader's word. The graduate is conditioned to:

- Source data before speaking.

- Analyze trends, not just repeat them.

- Compare yields with Excel, not guesswork.

- Interpret bank reports, not just read them.

This creates trust that transcends personality—it becomes technical authority.

Tech as a Native Language

Formatting proposals, designing decks, managing CRM data—these aren't "skills" to graduates; they are subconscious competencies. In the modern era, tech literacy isn't an advantage; it is the baseline for scalability.

Verdict: In premium and corporate segments, degree holders begin with an unfair cognitive advantage—not because they're smarter, but because they're already systematic.

Part 2: The Hard Ceiling — When Paper Becomes Power

This is where the conversation turns from earnings to ownership.

The REA Pathway (Registered Estate Agent — "E License")

Non-degree agents = REN. They can sell, but they cannot:

- Own an agency.

- Become a principal.

- Hold a license.

- Legally override other agents.

Property-degree holders can sit for the TPC and become REAs—the only pathway to true ownership in real estate. This isn't a marginal benefit. It's the difference between driving the bus and owning the fleet.

The RV Pathway (Registered Valuer — "V License")

Only a Registered Valuer can sign:

- Bank valuation reports.

- Court submissions.

- Corporate asset appraisals.

- REIT portfolio assessments.

A superstar salesperson can move a RM100 million asset. A Valuer legally certifies its worth. One trades properties. The other trades authority.

Verdict: If your ambition includes ownership, licensing, or valuation, a degree isn't optional—it's the law.

Part 3: The Corporate Ladder — The Invisible Paper Filter

Many agents eventually seek stability, fixed income, or corporate roles in developers, banks, or funds. Here, the "paper ceiling" becomes tangible.

Corporate & Government Gatekeeping Positions like:

- Asset Manager

- Investment Analyst

- Development Strategist

- Government roles (JPPH, LPPEH, councils)

These roles automatically filter non-degree holders before a human ever sees the resume. Your closing record may be impeccable, but the system sees no credential, no interview.

Verdict: Sales experience opens conversations. A degree opens doors that are otherwise locked.

Part 4: The Counter-Reality — Why Hunger Still Wins on the Street

In the trenches of residential sales and leasing:

- Hunger beats education.

- Resilience beats grammar.

- Consistency beats theory.

- Street-smart beats book-smart.

A degree cannot teach:

- How to handle 50 rejections before lunch.

- How to build rapport in 90 seconds at a door.

- How to negotiate when the seller is emotional.

- How to prospect when you have zero runway.

Many of Malaysia's top producers never finished college—because they had no Plan B. Their survival instinct became their ultimate education.

Part 5: The Ultimate Truth — You're Not Choosing a Path, You're Choosing a Game

Game 1: The Performance Game (No Degree Needed)

Objective: Maximize commission.

Players: Closers, hustlers, individual contributors.

Winning: Top producer boards, luxury cars, immediate cash flow.

Ceiling: Your own energy, time, and market cycles.

Game 2: The Ownership Game (Degree Required)

Objective: Build equity and authority.

Players: Agency owners, licensed professionals, corporate leaders.

Winning: Business valuation, recurring revenue, industry influence.

Floor: Legal qualification, systemic advantage, long-term equity.

The Final Choice: Not Better or Worse—But Different Futures

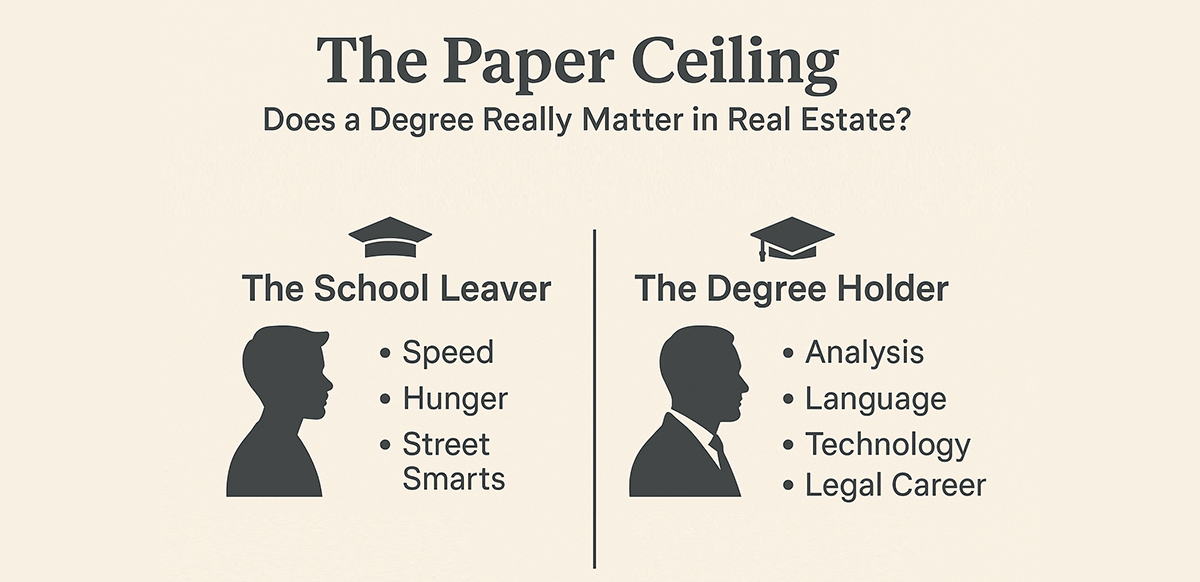

The School Leaver's Arsenal: Hunger, street intelligence, relatability, and armor-plated resilience. This builds top closers.

The Graduate's Toolkit: Language, research, credentials, and systems. This builds industry architects.

So—does a degree matter in real estate? The real question is: What are you trying to build?

A lucrative income? Then your results are your only diploma.

A lasting legacy? Then your credentials are your foundation.

Because in the end, you can either sell properties—or you can shape the industry that sells them. One requires grit. The other requires paper and grit.

Choose your game accordingly. The market rewards both—but never equally.