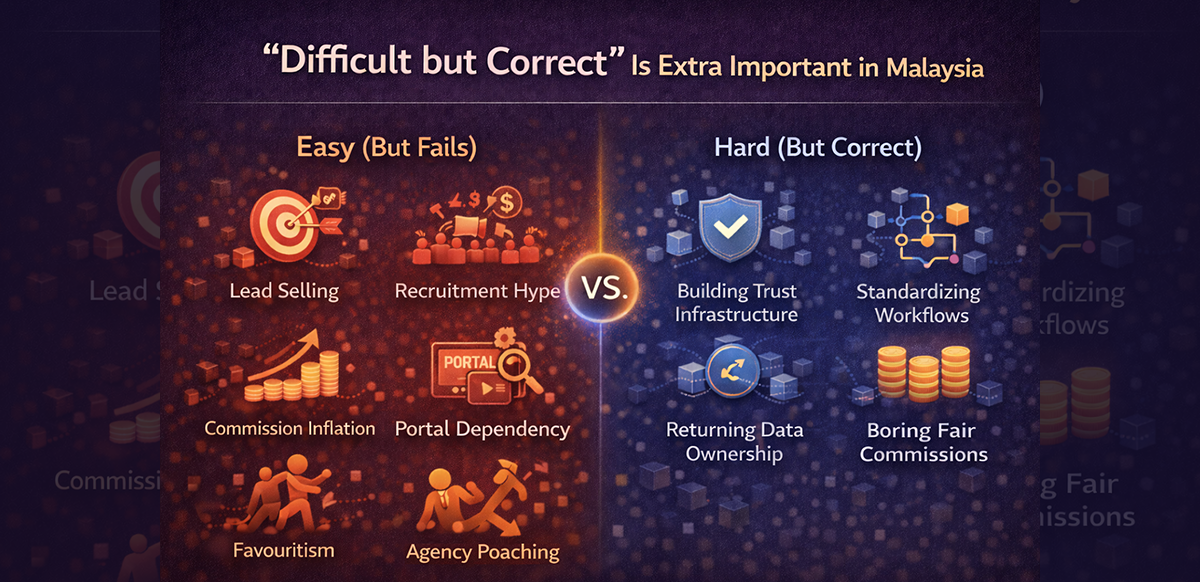

"Difficult but Correct" Is Extra Important in Malaysia

Why Shortcuts Die Fast — and Structures Quietly Win

There is a final universal lesson that every mature industry eventually learns: Easy strategies die quickly. Hard strategies compound quietly.

In Malaysia, this lesson is not philosophical—it is practical. Malaysia is a small, relationship-dense, and reputation-driven market. It is structurally unforgiving to shortcuts. Anything artificial collapses faster here than in large, anonymous economies.

The "Easy" Path: A Recipe for Structural Fragility

Let's be precise about what feels "easy" in the short term, but creates terminal debt for a Malaysian agency.

Lead Selling (The Commoditization Trap): Buying leads feels efficient, but it destroys trust and commoditizes agents. In Malaysia, transactional behavior is punished; reputation is the only currency that lasts.

Recruitment Hype (The Credibility Burn): Mass recruitment inflates headcounts but lowers standards and increases churn. In a finite talent pool, hype burns credibility faster than it builds scale. People remember who over-promised.

Commission Inflation (The Mercenary Cycle): High splits feel like a loyalty tool. They are actually a destabilizer. They attract mercenaries and create internal resentment. In a thin-margin market, inflated commissions almost always lead to clawbacks and conflict.

Portal Dependency (The Outsourced Future): Relying on portals for demand feels safe. In reality, it eliminates differentiation and erodes pricing power. When the algorithm changes, the business dies.

Agency Poaching (The Toxic Import): Poaching looks like growth, but it imports unresolved problems and triggers retaliation. In Malaysia's tight-knit ecosystem, poaching poisons the well.

The "Hard but Correct" Path: Engineering Durability

The strategies that actually work in Malaysia are boring, slow, and structural. This is exactly why they win—they are too difficult for the average competitor to replicate.

1. Building Trust Infrastructure

Trust cannot be marketed; it must be engineered. This means moving away from "feelings" and toward systems:

- Verifiable Listings: Ending the era of ghost ads.

- Auditable Commissions: Removing "principals' discretion" from the payout.

- Documented Contribution: Proving value through data, not charisma.

2. Standardizing the Mess

Property transactions are messy. Ignoring the mess does not make it disappear. Standardizing deal stages and role responsibilities does not remove flexibility—it removes the ambiguity that leads to 90% of Malaysian industry disputes.

3. Returning Data Ownership

This is emotionally difficult for principals who view data as control. But data hostage-taking destroys long-term loyalty and encourages "shadow systems" (personal WhatsApp silos). Clarity on what belongs to the agent versus the system is how you stabilize an ecosystem. Fear does not scale.

4. Predictable Commission Logic

The more "boring" the commission logic, the healthier the agency. Malaysia does not need creative or complex structures; it needs predictable ones that allow agents to focus on work rather than negotiating with their own company.

5. Systems That Outgrow Individuals

Strong systems allow agents to specialize, lead, and even leave without destroying the platform. Ironically, when a system respects an agent's growth and autonomy, they are far more likely to stay.

Why Malaysia Rewards the "Hard Path"

Shortcuts fail in Malaysia because memory persists. Politics shift, market cycles turn, and egos clash—but the structure remains.

Anything built on hype, dependency, or fear eventually collapses under its own contradictions. What survives are structures that absorb shocks, outlast individuals, and remain fair when stressed.

Final Thought

Easy strategies feel good in the moment. Hard strategies feel lonely at the start.

In Malaysia, the future does not belong to the loudest, the fastest, or the most hyped. It belongs to the systems that are difficult, boring, fair, and correct. Malaysia rewards the builders of infrastructure who realize that in a small market, durability is the ultimate competitive advantage.