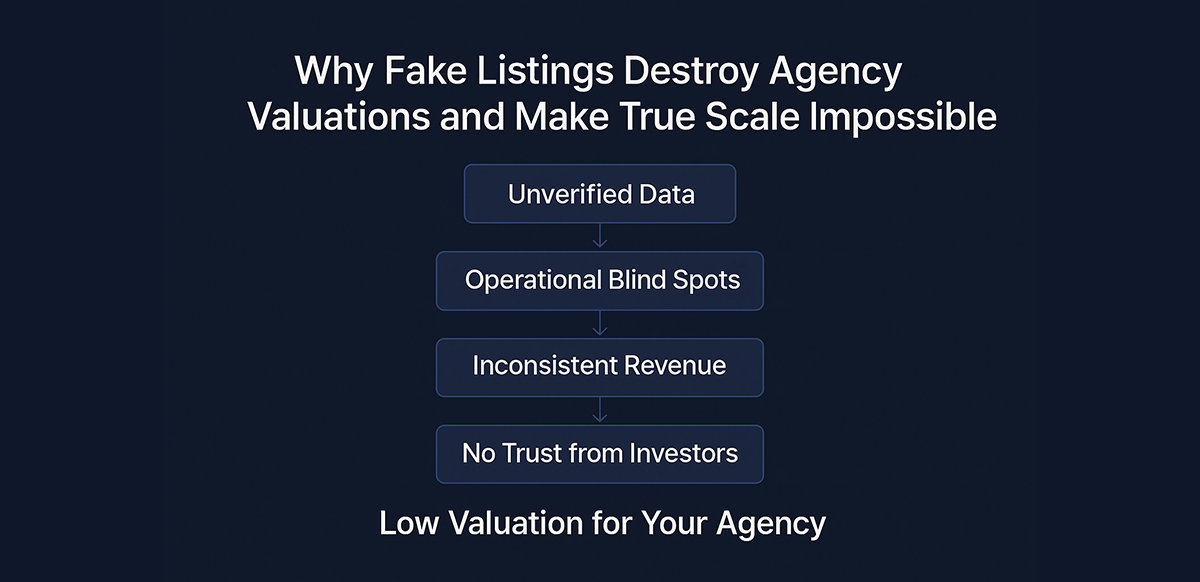

Why Fake Listings Destroy Agency Valuations and Make True Scale Impossible

ListingMine Academy | Agency Leadership & Structural Insight

Every agency leader dreams of scale:

more agents → more branches → more sublines → more revenue.

And some agencies today proudly claim 5,000, 8,000, even 10,000 agents. But here is the uncomfortable truth:

You can scale headcount on fake listings, but you cannot scale enterprise value.

A bloated organisation built on inaccurate, manipulative, or unverifiable data cannot be valued, cannot be audited, and cannot be trusted by capital markets.

This is the structural ceiling fake listings impose—and why the industry keeps producing large agencies without valuable companies.

1. The Illusion of Scale: Why “10,000 Agents” Doesn’t Mean 10,000 Worth Anything

The headcount is not scale. Valuation is scale.

A company becomes valuable when:

- revenue is predictable

- performance is measurable

- operations are auditable

- data is reliable

- systems reduce cost as size increases

Fake listings sabotage every one of these pillars. Agencies can accumulate 10,000 salespeople, but the underlying machinery remains:

- chaotic

- unmeasurable

- unverifiable

- impossible to forecast

Capital markets don’t reward big. They reward clean, predictable, scalable. Fake listings produce the opposite.

2. How Fake Listings Poison Financial Reporting and Destroy Valuation

A. Forecasting Becomes Fiction

When 60–80% of “activity” is based on fake or duplicate listings:

- pipelines appear bigger than reality

- opportunity conversion cannot be modelled

- revenue cycles cannot be predicted

No investor pays for imaginary pipelines.

B. Performance Tracking Becomes Meaningless

If agents generate leads through manipulation (bait pricing, fake units, phantom supply):

- performance metrics distort

- KPIs lose accuracy

- quality becomes invisible

- incompetence hides behind noise

Leadership cannot reward merit when the system rewards deception.

C. Revenue Attribution Breaks

Fake listings inflate:

- call volume

- lead volume

- viewing volume

But none of this translates into deal velocity. The gap between activity and actual closed revenue widens—making EBITDA unpredictable.

D. No Audit Trail = No Institutional Money

Investors and acquirers need:

- verifiable inventory

- provable workflows

- traceable transactions

- clean, compliant data

Fake listings produce the exact opposite: a black box full of unverifiable behaviours. No one will pay a premium for a company whose core activity cannot be audited.

3. The Leadership Paradox: Fake Listings Force Bad Management Decisions

A leader must choose:

Short-Term Volume

→ tolerate fake listings

→ agents feel “productive”

→ inflated activity metrics

→ short-term morale boost

Long-Term Culture

→ enforce truth

→ short-term drop in listing count

→ real performance metrics emerge

→ long-term professionalisation

Most existing systems financially reward the former while punishing the latter. This is why good culture cannot survive in a fake-listing ecosystem.

4. Fake Listings Inflate Operational Cost Instead of Reducing It

Real scaling means:

- cost per agent ↓

- output per agent ↑

- margin ↑

Fake listings do the opposite:

- support tickets ↑

- consumer complaints ↑

- lead quality ↓

- marketing cost ↑

- management overhead ↑

This is the anti-economies scale trap. As the agency grows, the chaos grows faster.

5. The Pricing Distortion Loop Makes Branch Expansion Unprofitable

Fake listings damage pricing signals. When agents rely on fabricated comparables:

- pricing conversations become longer

- negotiation cycles expand

- deal conversion drops

- branches struggle to break even

A branch network built on distorted pricing cannot generate strong unit economics. Branches become cost centers, not profit engines.

6. The Capital Markets Challenge: Why Large Agencies Cannot Sell, Merge, or Raise

Here is the most brutal truth:

If a 10,000-agent agency attempted to raise capital or sell itself today, institutional investors would almost certainly walk away.

Why?

A. No Verifiable Inventory Layer

A company built on unverifiable listings cannot be valued.

B. No Reliable Performance Data

If metrics are inflated by manipulation, no due diligence team will trust forecasts.

C. No Predictable EBITDA

Unpredictable conversion → unpredictable revenue → low valuation multiples.

D. Regulatory & Reputational Risk

A business model implicitly tolerating misinformation is a contingent liability.

No serious investor wants to inherit a compliance bomb.

E. Scalable PropTech Cannot Be Layered On Top of Lies

Automation breaks. AI fails. ACN collapses. Capital wants companies that can scale with technology. Fake listings prevent technology from working.

The valuation test:

Challenge any 10,000-agent agency:

Get a real valuation and see whether capital is willing to pay above a 3× PE.

They won’t—because the fundamentals cannot support it.

7. The Technology Ceiling: Why Fake Listings Cap Your Agency's IQ

A scalable agency requires:

- accurate data

- automation

- predictable workflows

- cross-team collaboration

- performance transparency

Fake listings corrupt the first layer—data. When the foundation is false, the entire technology stack collapses.

In short:

Fake listings keep agencies stuck in manual mode forever.

You cannot build:

- ACN

- automated valuation

- smart routing

- role-based commissions

- transaction analytics

- agent performance engines

…on a foundation of lies.

The agency’s “IQ” remains low, regardless of agent count.

8. The Real Bottleneck: Fake Listings Block True Enterprise Scale

True scale is not:

- more agents

- more branches

- more WhatsApp groups

- more listings

True scale is:

- automation

- auditability

- predictable revenue cycles

- transparent pricing

- cross-team collaboration

- clean data

- institutional-grade governance

Fake listings destroy all seven.

Which is why many agencies grow bigger — but none grow more valuable.

Conclusion: The Choice Between a Large Crowd and a Valuable Company

Fake listings do more than harm reputation. They destroy scalability and valuation.

A company cannot:

- be valued

- be sold

- be acquired

- raise institutional capital

- automate

- modernise

- build a legacy

…if its operating system is built on misinformation.

If the industry wants to scale—to build enterprises worthy of institutional capital and lasting legacy—the data layer must be rebuilt first.

Verification is not an upgrade; it is the reset button.

The future belongs to leaders who choose truth over noise.

The choice is simple:

Preside over a large crowd… or build a valuable company.