From Sales to Shareholders: What Every Agency Boss Must Understand Before Going Public

ListingMine Academy | Real Estate System Design

The road to listing doesn’t end when the bell rings.

It begins there.

Most agency founders dream of the IPO moment — the headline, the celebration, the validation that their company has finally “made it.”

But few understand what happens after that moment.

Once you enter the capital market, you stop answering only to clients and agents.

You now answer to capital.

And the capital speaks a different language.

1. The DNA Shift — From Growth to Governance

In a private company, speed is everything. You can pivot, test, fail, and rebuild in a week — and no one outside your office will ever know.

In a public company, everything slows down — not because you’re inefficient, but because you’re accountable. Every decision needs board approval, disclosure, audit, and justification. You can’t just chase growth; you must defend governance.

Your DNA changes overnight:

- From intuition to reporting

- From culture-driven to compliance-driven

- From experimenting to explaining

That doesn’t kill innovation — it forces justified innovation.

2. Capital’s Agenda — Different Clock, Different Metric

Agents and bosses live on monthly commission cycles. Capital lives on quarterly earnings calls. Your agency may be proud of long-term vision, but fund managers want short-term predictability. They expect:

- Quarterly profit growth — not just rising sales

- Clean, recurring margins — not volatile commissions

- 15–20 % net profit and 15 % ROE — or the market will price you as inefficient

As Warren Buffett reminds us:

“If your financial report can’t deliver at least 15 % ROE, you’re not creating value for both sides.”

Once capital enters, you’re judged not by enthusiasm or headcount — but by discipline.

3. The Hijack Risk — When Capital Starts Calling the Shots

Capital doesn’t issue commands. It votes with its legs. When your quarterly report disappoints, investors don’t argue — they sell.

That sell-down is their version of a performance review. It pressures management to take short-term actions: cut costs, trim staff, or chase vanity growth. Before long, you’re no longer building the company you founded — you’re maintaining the company the market expects.

This is how many once-innovative property platforms, local and abroad, lost their edge after listing. Their DNA shifted from problem-solving to price-defending.

4. The Honesty Gap — What Capital Really Respects

Most management teams oversell good news and under-explain problems. But in the capital market, honesty is a strategy.

When Warren Buffett releases Berkshire’s reports, he doesn’t hide bad quarters — he explains them. He treats shareholders as partners, not audiences. That’s why his reputation compounds faster than his returns.

Public-company leadership isn’t about always winning. It’s about communicating why you’re still worth believing in — even when you lose.

5. The Three Competencies Every Public-Ready Boss Must Build

- Operational Excellence — The business must run on rails, not personalities.

You can’t fix your ERP after you list. The system itself becomes your credibility. - Transparent Communication — Financials must tell the truth.

If you’re still running 50 % manual reporting, you’re not ready. Investors forgive weak numbers, not hidden ones. - Social Expectation Management — Beyond profit, the market expects culture, compliance, and contribution. If your quarterly statement triggers public backlash, your governance already failed.

6. The Private Advantage — and the RTO Reality

For many founders, the dream of listing hides a simple truth: Private freedom is often worth more than public valuation.

In practical terms, the 20 % annual growth and total control of a private company are often more valuable than a 3× P/E multiple and quarterly scrutiny from analysts. When you go public, your reward becomes predictable but capped; your freedom, measurable but limited.

Even if the law allowed agencies to list directly, most would still struggle to fetch strong multiples. Pure-agency businesses rarely trade above 3× earnings because profits are people-dependent, not system-dependent. You trade flexibility for compliance and agility for disclosure.

Some try to shortcut the process through a Reverse Takeover (RTO) — buying a dormant listed shell and injecting their operations. It can work, but the compliance load remains identical. RTO merely relocates your audit headaches to a bigger room. Without governance maturity and clean financial reporting, the same cracks just echo louder.

The takeaway: going public isn’t a reward for growth — it’s a test of structure. You must already operate like a listed company before attempting to become one.

7. Build Your Finance Brain First

Many agency bosses lack financial depth. They’ve mastered recruitment and sales but not valuation mechanics — and that blind spot quietly destroys their future worth.

Some spend ten years building the wrong thing: chasing headcount instead of assets investors value. When due diligence arrives, the books show high revenue but no transferable equity, no audited systems, and no defensible margins.

Before you approach capital, fix your foundation:

- Appoint a CFO who truly understands agency economics.

Not just accounting — but deferred commissions, cost recovery, and profit attribution across projects. - Learn how investors value businesses.

They pay for predictability, not personality. Study profit quality, recurring revenue, and risk discounting. - Rebuild your P&L around investor logic.

Marketing, data, and technology aren’t expenses — they’re capitalizable assets when structured properly.

The right financial brain doesn’t just prepare you for listing. It tells you whether you should list at all.

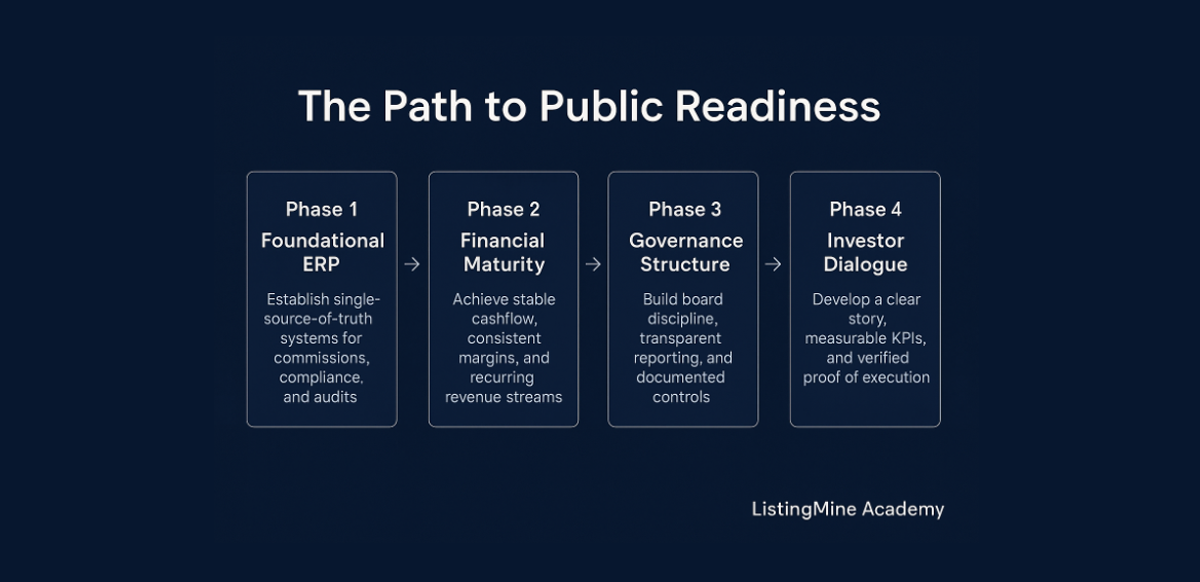

8. The Path to Public Readiness

When you can demonstrate all four, the market stops seeing you as a risk — and starts valuing you as infrastructure.

9. The Real Question

Going public isn’t about “getting listed.” It’s about who you’re willing to answer to — agents, clients, or capital.

If your systems are strong, your reporting is clean, and your culture is disciplined, capital will trust you. If not, capital will teach you — sometimes brutally.

10. Final Thought

The capital market is not your enemy — it’s your mirror. It doesn’t change you; it reveals you. And the only way to face that mirror confidently is to build a company that can already stand without makeup.

So before you talk to investors, build your rails. Before you dream of listing, pass your own audit. Then, when the market finally looks your way — you’ll already look like a public company that just hasn’t listed yet.

What Comes Next

If you’re an agency boss preparing for the next growth stage, or a team leader who wants to understand how real businesses scale beyond commission — read the full library at ListingMine Academy.

Every article is original writing by the founder — combining operational experience, system design, and capital-market insight tailored for Malaysia’s real-estate industry.

Learn how agencies evolve from sales teams into investment-grade enterprises. It’s not a theory. It’s the playbook the next generation of property firms will follow.