The Ethical Dilemma of Gentrification: Are We Part of the Problem?

ListingMine Academy | Urban Economics, Agency Ethics & Market Behaviour

Few words in property spark more conflict than Gentrification.

To an investor, it means progress: Starbucks, safety, paved roads, and rising capital appreciation.

To a long-term resident, it means displacement: The kopitiam becomes a café, rent doubles, and the community is pushed out.

For real estate practitioners, the question is uncomfortable:

Are we accelerating the displacement of the poor, or can we manage the transition responsibly?

This article explores that dilemma with nuance — grounded in Malaysian realities, not imported Western narratives.

1. What Gentrification Actually Is (Without the Emotion)

Stripped of politics, gentrification is economic displacement.

It is the process where higher-income households replace lower-income households due to rising property values and commercial upgrades.

It is driven by three forces:

- Capital Flow: Money moves to undervalued assets.

- Infrastructure: MRT lines and highways unlock new demand.

- Demographics: Young professionals seek “lifestyle” districts.

The Hard Truth:

Gentrification is not caused by agents. It is caused by supply and demand.

But agents sit at the control panel. We influence how quickly it happens — and who gets prioritised.

2. The Malaysian Context: The “Bangsar South” Effect

Every major district in KL follows the same four-stage cycle:

- 1. Discovery

Artists, students, and young workers move in for cheap rent (e.g., Old PJ, Sentul, Pudu). - 2. Commercialisation

Hipster cafés, boutique hotels, and creative spaces open (e.g., The Row, Chinatown, Pekeliling). - 3. Rebranding

Developers clean up the image to justify premium prices (e.g., Kampung Kerinchi → Bangsar South). - 4. Displacement

Flat dwellers sell out or get priced out. Luxury condos rise.

The question is not “Can we stop it?” (We can’t.) The real question is “How should we behave while it happens?”

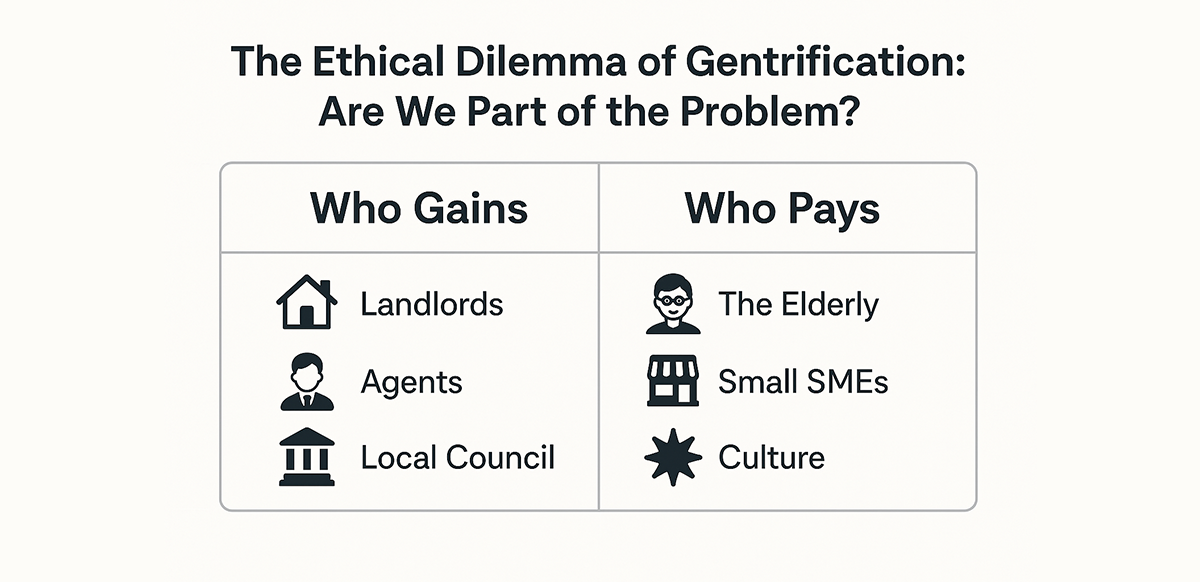

3. The Ethical Tension: Who Pays the Price?

When a neighbourhood “upgrades,” the winners are obvious:

- Landlords: Asset value ↑

- Agents: Commissions ↑

- Local Council: Assessment tax ↑

But the losers are often invisible until they’re gone:

- The Elderly: Who lose the support network they’ve relied on for 40 years.

- Small SMEs: The mechanic or tailor who cannot pay RM15 psf rental.

- The Culture: The "vibe" that made the area attractive is erased, replaced by sterile chains.

The Agent’s Dilemma

If you aggressively force every landlord to chase the “highest possible rent,” you accelerate the destruction of the very community that makes the area valuable.

4. Are Agents the Problem?

Not intentionally. But functionally — often, yes.

Agents accelerate displacement when they:

- Speculate Aggressively: Encouraging quick flipping creates artificial inflation.

- Use Predatory Tactics: Targeting vulnerable residents to secure under-market deals.

Example: Canvassing an old neighbourhood with flyers screaming "Sell Your Old House for CASH Now Before Market Crashes." This preys on fear and accelerates community fragmentation.

- Ignore Sustainability: Advising landlords to hike rent by 50% “because the market says so,” even when it forces out a stable long-term tenant.

A commission-driven agent behaves like a mercenary. A career-driven agent behaves like a community guardian.

5. How to Be Part of the Solution (Practical Framework)

We cannot stop economic gravity. But we can be an ethical buffer.

Here is how responsible agents operate in transitioning neighbourhoods:

A. The “Stability Premium” Advisory

Bad Agent Advice:

“Kick out the family paying RM1,500. I can get students at RM2,200.”

Ethical Agent Advice:

“This family has paid on time for five years. A 40% hike will force them out. Let’s look at the Risk-Adjusted Return:

A reliable RM1,500 tenant has a higher Net Present Value (NPV) than a RM2,200 tenant who brings a 50% risk of vacancy and RM5,000 in repair costs. Stability pays better than volatility.”

Result: You protect the tenant AND the landlord’s long-term risk profile.

B. Prioritise Owner-Occupiers Over Speculators

When selling in gentrifying areas (Sentul, Pudu, Kampung Baru):

- Owner-occupiers stay, spend locally, and build the neighbourhood.

- Speculators create "Ghost Condos" — hollow, lifeless districts with zero community.

C. Respect History in Marketing

Don’t market a heritage area by trying to erase its past.

Instead of: “Demolish this old shack and build a bungalow.”

Say: “Restore this heritage gem and own a piece of KL history.”

This attracts buyers who value culture, not just yield.

6. The ACN Advantage: Structure Creates Ethics

In the traditional “every man for himself” agency model, agents oversell and squeeze deals because their survival is at stake.

In an ACN (Agency Co-Operation Network) structure:

- Listing Specialists have the time to educate sellers properly.

- Buyer Specialists filter for genuine demand.

- Transaction Specialists ensure compliance.

When desperation is removed, ethics become possible.

7. The Business Case for Ethical Gentrification

Why should agents care? Why not just make the money?

Because neighbourhoods that become soulless investment districts eventually CRASH.

When the culture disappears, units sit empty, local SMEs die, and zero owner-occupiers remain... the entire area becomes a dormitory, not a destination.

Long-term value is supported by character, history, and community. Preserve these — and prices rise sustainably, not artificially.

Final Word: We Are the Interpreters of Change

Gentrification is a force of nature. We cannot stop the tide.

But we stand at the shore deciding how the waves hit the community.

We can choose to be:

- Extractors (who take money and leave behind a broken neighbourhood),

- OR

- Stewards (who help an area evolve without erasing its soul).

The ethical agent understands a simple truth:

Community is the ultimate asset class.

Destroy the community, and eventually, the property value follows.

From Principle to Practice

Understanding the "why" is the first step. The next is mastering the "how."

For a practical tool, we have prepared the “Landlord Advisory Script: The Stability Pitch”—a proven negotiation framework to convince landlords that a stable, lower rent is a smarter financial decision than a high-risk hike.