The Hidden Traps in Rich Dad Poor Dad: What Malaysian Agents Often Misunderstand

It’s the unofficial bible for a generation of Malaysian property agents: Rich Dad Poor Dad. The book is everywhere — in agency training, motivational seminars, and team WhatsApp groups. It’s quoted like scripture: “The rich don’t work for money.” “Buy assets, not liabilities.” “Use other people’s money.”

But while its motivational power is undeniable, treating its simplified American advice as a literal blueprint for the Malaysian market can be a fast track to financial strain.

There’s no doubt Kiyosaki’s ideas spark ambition and confidence. Yet, without local context, they can lead to over-leverage, misplaced confidence, and poor financial planning — especially among agents who take inspiration as instruction.

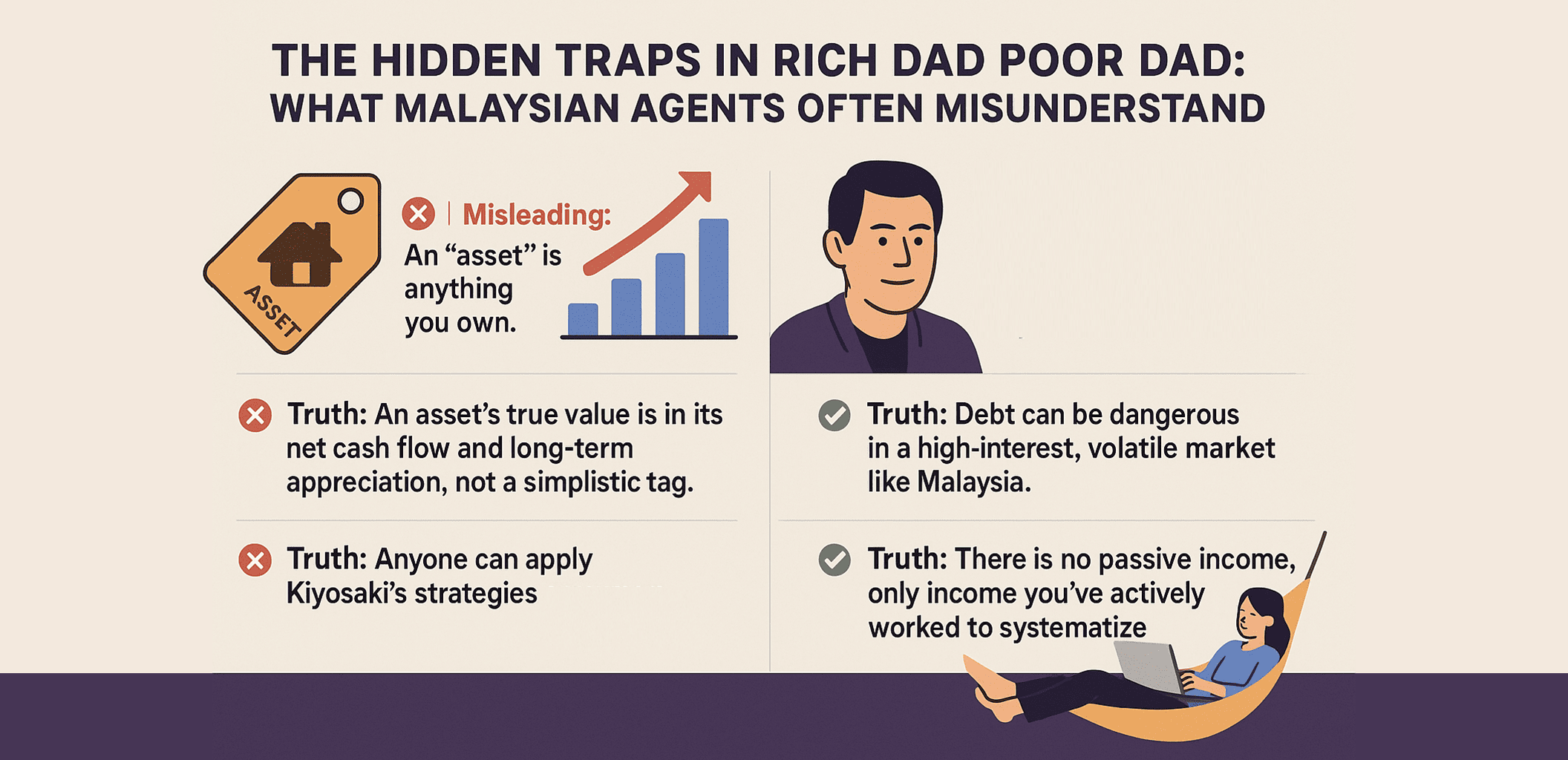

Let’s unpack the eight hidden traps Malaysian agents fall into when they take Rich Dad Poor Dad too literally.

1. The Oversimplified “Asset vs Liability” Rule

“An asset puts money in your pocket. A liability takes money out.”

It’s catchy — but dangerously simplistic.

A property that generates rent may still be a poor investment once loan interest, maintenance, and taxes are factored in. Meanwhile, a non-rented home in a high-growth area might quietly build real wealth through capital appreciation.

Why this matters for agents:

Many agents justify impulsive purchases — thinking “as long as it pays rent, it’s an asset.” But without analyzing yield, vacancy risk, or debt cost, they’re gambling, not investing.

Truth: An asset’s true value lies in its net cash flow and long-term appreciation, not a simplistic tag.

2. Glorifying Leverage Without Risk Management

Kiyosaki’s mantra of “Other People’s Money (OPM)” sounds powerful — and it can be, when used wisely. But many agents take it as permission to borrow aggressively, chasing quick wins in volatile markets.

In Malaysia’s reality:

- Floating-rate loans can double monthly payments when rates rise.

- Condos often face oversupply and rental competition.

- CCRIS reports limit future borrowing capacity.

Truth: Leverage multiplies everything — profit and pain. Always stress-test your cash flow before signing that loan offer.

3. Mocking Employment as “The Rat Race”

The book glorifies quitting your job and mocks employees as trapped in the rat race. That’s inspiring — but incomplete.

Many successful investors began with stable income, used EPF savings, and built wealth gradually. In Malaysia, financial institutions and home financing structures often favor salaried stability.

Why this matters for agents:

Some resign too early, thinking freedom equals quitting. Without capital buffers, their newfound “freedom” quickly becomes financial stress.

Truth: Wealth isn’t about rejecting employment — it’s about using stability to fund scalability.

4. The Myth of “Easy Passive Income”

Kiyosaki romanticizes “money working for you.” But truly passive income is an endgame, not a starting point.

Every so-called passive income stream — rental, business, dividend — requires:

- Capital to invest,

- Time to build, and

- Systems to maintain.

Why this matters for agents:

Believing income can be passive too soon leads to complacency. They stop prospecting, overextend, or rely on one fragile stream.

Truth: There is no passive income — only income you’ve actively worked to systematize.

5. The “Rich Dad” That Doesn’t Exist

Kiyosaki’s “rich dad” remains unnamed, unaudited, and unverifiable. It’s a parable — not a person.

That’s fine for motivation, but dangerous as a financial blueprint. Agents quoting “Rich Dad” advice often skip actual accounting, taxation, and valuation literacy — the real foundations of sustainable wealth.

Truth: Treat Rich Dad Poor Dad as storytelling, not strategy.

6. Confidence Without Competence

The book’s tone breeds boldness — but without the technical literacy to back it up.

True wealth-building requires understanding:

- National Land Code and Tenancy laws

- ROI, IRR, and gearing ratios

- Tax rules, strata titles, and financing limits

Truth: Mindset motivates, but skillset multiplies.

7. Ignoring Local Realities (US ≠ Malaysia)

Kiyosaki’s strategies are built for an American financial landscape that simply doesn’t exist in Malaysia. Applying them here is like using a US road map to navigate Kuala Lumpur – the basic principles of navigation apply, but the routes, rules, and roadblocks are completely different.

Examples:

- Mortgage interest is tax-deductible in the US — not here.

- The US has 1031 exchanges and C-corp arbitrage — Malaysia doesn’t.

- American property cycles move differently due to population growth, not speculative demand.

Truth: The principles may inspire, but the execution must localize.

8. The False Binary: Employee vs Investor

Kiyosaki frames it as a choice:

Work for money or Make money work for you.

In reality, Malaysia’s most successful professionals are hybrids — salaried leaders, self-employed specialists, or agency owners with multiple income layers.

Truth: You don’t have to quit to win — you have to compound intelligently.

Final Thoughts: Read It, But Don’t Worship It

Rich Dad Poor Dad is a mindset book, not a manual.

It’s a spark, not a system.

For Malaysian property agents, it’s valuable as inspiration, not instruction. Let it expand your perspective — but let local knowledge, legal compliance, and disciplined execution shape your reality.

Because true wealth isn't just about thinking like a rich person. It’s about building wisely within the reality of your market, your laws, and your financial timeline.