How a Modern Real Estate Agency Actually Builds Profit

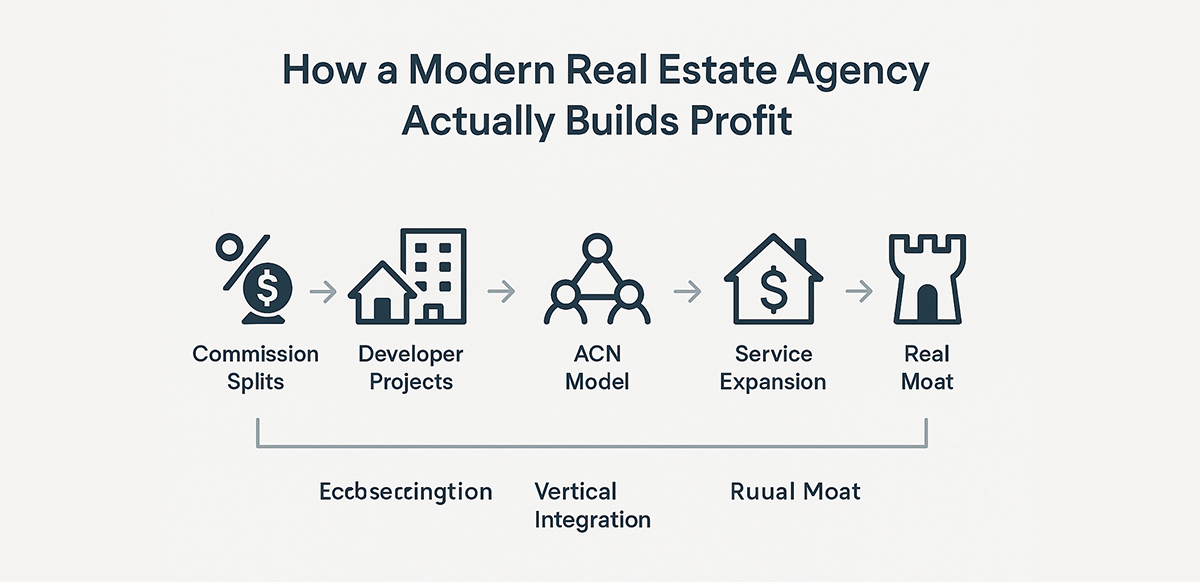

The old saying is that real estate agencies simply "take a cut" of the agent's commission. That's a huge understatement. Today's successful agencies don't just collect fees; they build profit like sophisticated investment houses, creating multiple, layered revenue streams.

To understand how a modern agency makes money, you need to look at its profit engines across six key dimensions.

1. The Foundation: Commission Splits & The "Profit Gap"

This is the core engine. Every sale's total commission is split among the agent, the team lead, and the brokerage. Most agencies use a tiered system (e.g., 60/40 for a new agent, 90/10 for a top producer) to drive agent performance.

The agency profits here in two ways:

- The Base Retention: The fixed percentage the company keeps (e.g., the 10% in a 90/10 split).

- The Profit Gap: The margin earned from the spread between an agent's current commission tier and the next highest tier available to them. The agency profits from an agent's growth journey by earning this differential until they hit the top split.

2. The High-Leverage Play: Developer Project Economics

The biggest profit accelerators come from securing exclusive rights to sell new development projects. This is about unlocking sophisticated financial models, not just high volume.

The Exclusive Appointment (Payout Control): The agency gains full control over the agent payout structure. If the total commission is 5%, the agency might pay co-broking agents 3%, retaining the remaining 2% as pure profit. Since they control all desirable inventory, the agency is not afraid of co-broking agents seeking stock from other agencies that might offer a slightly higher payout.

The Wholesale Model (Master Distribution): The agency acts as the master broker, keeping a strategic cut (e.g., 5%–15%) and letting other brokerages sell for the remainder. This converts a staffing limitation into a pure, risk-free distribution profit.

Commission Tier Accumulation (The Volume Bonus): Agencies strategically "accumulate" sales to hit developer volume targets faster, unlocking exponentially higher commission rates (e.g., jumping from 2% to 4%) on all units sold.

3. The ACN Model: Role-Based Value Creation

The Agent Cooperation Network (ACN) model allows a modern agency to profit by transforming its internal departments from cost centers into value-contributing roles that earn a percentage of the commission pool. This turns the company into an active deal participant, not just a middleman.

| Agency Role | Value Contributed | Commission Entitlement |

|---|---|---|

| Lead Generator | Running ads and delivering verified prospects. | 40% (Example) |

| Qualifier/Caller | Managing the call center, setting appointments. | 30% (Example) |

| Verifier/Admin | Document checking, compliance, and systems input. | 15% (Example) |

This structure rewards the value contributed by company resources, making revenue no longer solely dependent on the closing agent.

4. The Ecosystem Play: Horizontal Service Expansion

A sale is a one-time event; a client relationship is a revenue stream. Modern agencies monetize the entire property lifecycle by seamlessly integrating adjacent services.

This creates a recurring revenue source:

- Financial Services: Earning referral fees from mortgage lenders and commission shares from insurance partners.

- Property Management: Collecting monthly or annual fees for managing rental properties.

- Ancillary Services: Earning markups or referral fees from renovation, staging, and cleaning providers.

5. The Endgame: Vertical Integration & Equity

The most ambitious agencies move beyond collecting fees to owning parts of the value chain. This shifts their income from commission-based to equity-based.

- Project Marketing Partner: Moving from a simple sales agent to a joint-venture partner with the developer, sharing in the project's overall profit.

- Co-Development: Using market expertise to co-develop boutique projects and earn developer-level returns.

- Owning Subsidiaries: Creating or acquiring in-house mortgage, insurance, or legal service companies to capture 100% of those ancillary fees.

6. The Real Moat: Sustaining Profitability

While the five models above define how an agency profits, they are all ultimately easy to copy. Every competitor can eventually replicate a tiered split or a wholesale structure.

A truly sustainable agency profit model requires a Real Moat—an unfair, structural advantage that cannot be bought or easily copied:

- Developer Closeness: Being intimately close to the most active developers in town, guaranteeing first-right-of-refusal on exclusive projects. This pipeline security is a massive barrier to entry.

- International Affiliation & Global Lead Flow: Partnering with a global real estate brand or network that provides a steady stream of pre-qualified, high-intent buyer leads from overseas. This is essentially free customer acquisition that competing local agencies cannot access, creating a powerful and cost-effective advantage.

- Cultural & Trust Advantage (ACN): Building an ACN culture of trust and transparency where co-broking and internal cooperation are flawless. This reputation ensures that top-tier agents and outside brokerages choose to work with you, even if a competitor offers a slightly better split.

- Powerful Technology Backing (The Thought Leadership Moat): Possessing a proprietary, purpose-built platform that automates ACN roles, commission logic, and profit-gap calculations in real time. This system becomes the business’s operating core — impossible to replicate externally, ensuring total financial transparency and operational speed.

Only when the business model is secured by these high-trust relationships and competitive barriers can an agency's profitability truly be sustainable.

The Bottom Line

The modern real estate agency is a multi-faceted enterprise. The difference between survival and sustained dominance, however, is the Real Moat—the structural advantages like global lead flow, unbreakable developer relationships, and a culture of trust that prevent competition from eroding your profits.