How a Well-Built System Makes Your Agency More Valuable to a Buyer

When investors or larger agencies evaluate a potential acquisition, they aren’t buying your listings, leads, or even brand name. They’re buying continuity — the ability of your agency to keep generating revenue and profit even when people change.

A well-built system is the foundation of that continuity. It’s what makes an agency sustainable, scalable, and investable — not because it runs faster, but because it runs without depending on any single person, even the founder.

1. Investors Don’t Buy Leads — They Buy Predictability

Market conditions change. Leads rise and fall. What investors value most is a system that sustains performance through market cycles.

They look for evidence that your business keeps earning consistently even when ads slow down or top producers leave. They want to see a machine — not a collection of personalities.

A system builds that machine. It standardises every process, from client acquisition to payout, so performance remains stable regardless of who’s in charge. That predictability is what buyers pay for.

2. A System Protects Profitability and Enables Scale

Revenue means little without control. Investors pay for agencies that can grow without growing their cost base.

A strong system automates repetitive tasks, encodes best practices into workflow, and reduces management firefighting. As volume increases, costs stay proportionate.

That’s how you prove scalability — more output, same structure. Sustainable efficiency always commands a valuation premium.

3. True Value Lies in Systems That Outlive the Founder

Every acquirer asks the same question:

“If the founder walks away for six months, will this business still function?”

If the answer is no, valuation drops instantly.

A mature system — blending software, processes, and governance — proves the business can survive leadership changes. That’s when your agency shifts from founder-led hustle to institutional platform.

That transition is what investors mean by a moat: an advantage that keeps your business strong even when ownership changes.

4. The Moat: What Others Can’t Easily Copy

A moat isn’t just technology; it’s the combination of system and uniqueness that others can’t replicate quickly.

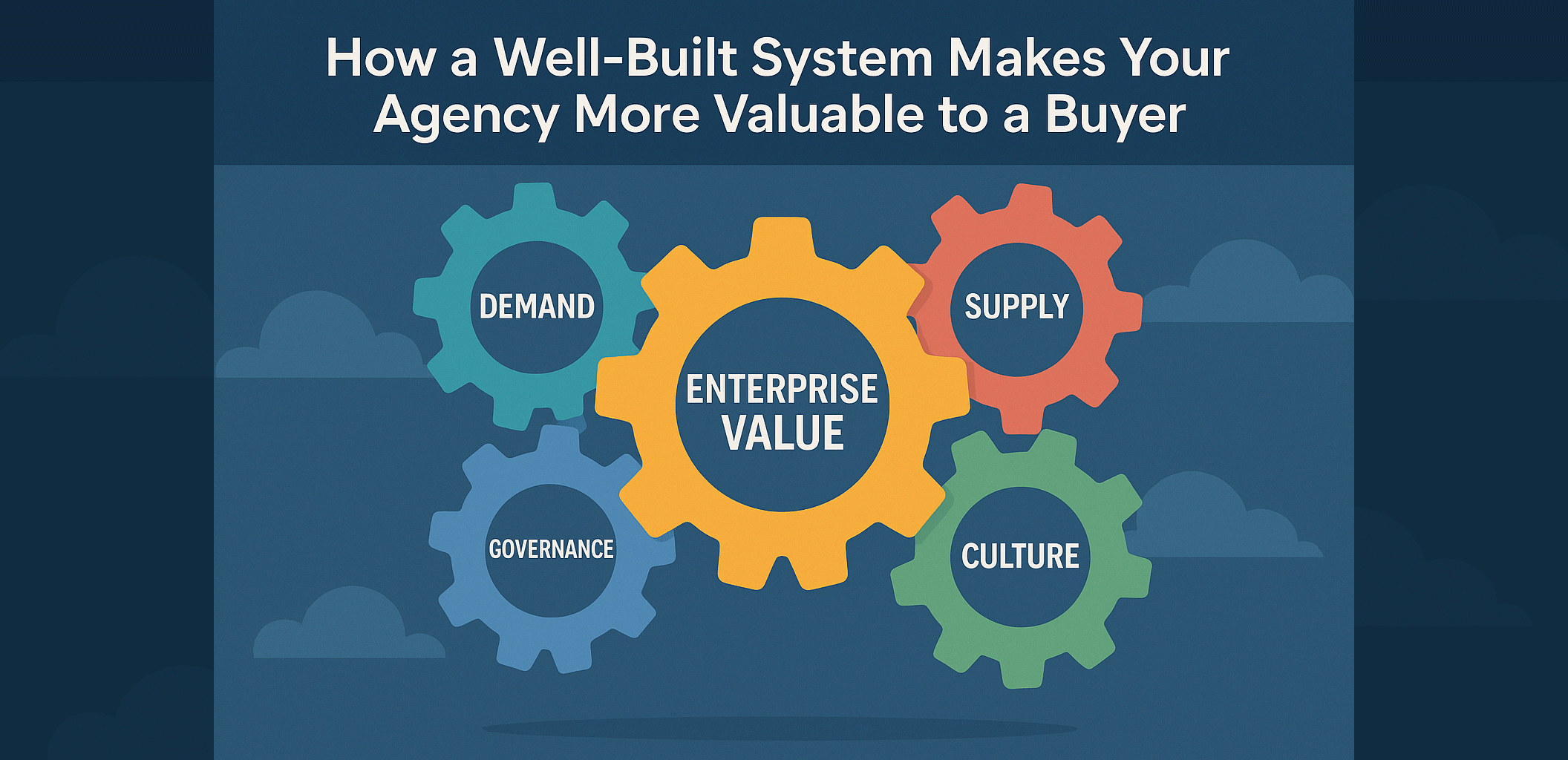

In real-estate agencies, four types consistently create defensibility and valuation upside — ranked by impact:

- Demand Moat (Buyer Flow & Brand Trust)

The most powerful moat today. A brand or content ecosystem that attracts buyers organically, without paid ads. When buyers instinctively start their search with your brand, you own the demand side.

That’s how top property portals achieved billion-ringgit valuations — their systems monetise attention, not inventory. - Supply Moat (Exclusive, High-Demand Inventory)

Control over supply is still a critical edge — but it must be the right supply. If you hold exclusive rights to easy-to-sell projects or high-demand listings, agents will come to you — even with lower commission splits — simply because they want access.

Exclusive stock with strong absorption gives your agency leverage, bargaining power, and brand magnetism. When other agents need your projects to close deals, you control the pace of the market. That’s not just inventory — that’s power. - Governance Moat (ACN-Style Cooperation System)

A structure that standardises cooperation, commission splits, and verified inventory across agents and brands. It embeds trust and discipline into workflow — cooperation becomes systematic, not voluntary. Hard to replicate because it depends on network credibility and consistent enforcement. - Local Integration Moat (Cultural & Regulatory Fit)

A system tailored to local law, language, and agent behaviour becomes native to its market. Foreign entrants can copy features but not cultural nuance, compliance familiarity, or local partnerships. This is what anchors regional dominance once scale is achieved.

Each moat strengthens the others. Demand drives value, supply anchors it, governance scales it, and local integration protects it.

5. Systems That Embed Discipline Are Worth More Than Raw Revenue

Many agencies show profit; few show control. A system with built-in discipline — audit logs, rule-based approvals, automated compliance — signals governance.

It tells investors your growth won’t collapse under chaos. It proves your performance is process-driven, not personality-driven.

Governance converts profit into enterprise value. That’s why disciplined systems always price higher than aggressive ones.

6. A System Becomes the Buyer’s Shortcut to Expansion

For an acquirer, expanding into a new market is costly and uncertain. But if your system already functions efficiently — blending local workflows, compliance, verified supply, and active demand channels — you’ve built the shortcut they’re willing to buy.

They’re not just acquiring your team. They’re buying your operating blueprint — your proven way of doing business. That blueprint becomes their engine for regional replication.

Final Thought

A buyer can copy your logo or replicate your ads, but they can’t copy your system — the living combination of technology, demand, supply, governance, and culture that keeps your business running even after you’re gone.

That’s what investors call enterprise value. It’s the moat that protects your agency’s worth and multiplies your exit price.

When your agency runs on a well-built system, you’re not selling people — you’re selling permanence.