How Money Laundering Works with Property Transactions

Property is one of the most popular tools for money laundering worldwide — and Malaysia is no exception.

Unlike cash-based businesses, real estate offers high value, stable appreciation, and a credible paper trail that can disguise dirty money as legitimate wealth. But how does it actually work? Let’s unpack the process step by step and understand how even honest agents can get caught in the middle if they’re not careful.

1. What Is Money Laundering?

Money laundering is the process of making illegal money look legal. Criminals earn funds from unlawful activities such as corruption, scams, drug trafficking, illegal gambling, or human trafficking, and then channel that money through legitimate-looking transactions — so the origin becomes hard to trace.

In Malaysia, this falls under the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA). It applies to all reporting institutions — including real estate agents, lawyers, and bankers.

If you handle client money or property transactions, you are part of the chain. That means you have legal obligations — not just moral ones.

2. Why Property Is a Favourite Laundering Tool

Property offers the perfect cover for illicit funds because:

- High Value: Large sums can be moved in a single transaction.

- Legal Documentation: Sale and Purchase Agreements (SPA) make dirty funds appear legitimate.

- Appreciation: Property can be resold later for “clean” profit.

- Physical Asset: Unlike crypto or cash, property is tangible and less volatile.

- Cross-Border Access: Foreign buyers can move money internationally under “investment” purposes.

In short, property is stable, scalable, and seemingly respectable — the perfect laundering vehicle.

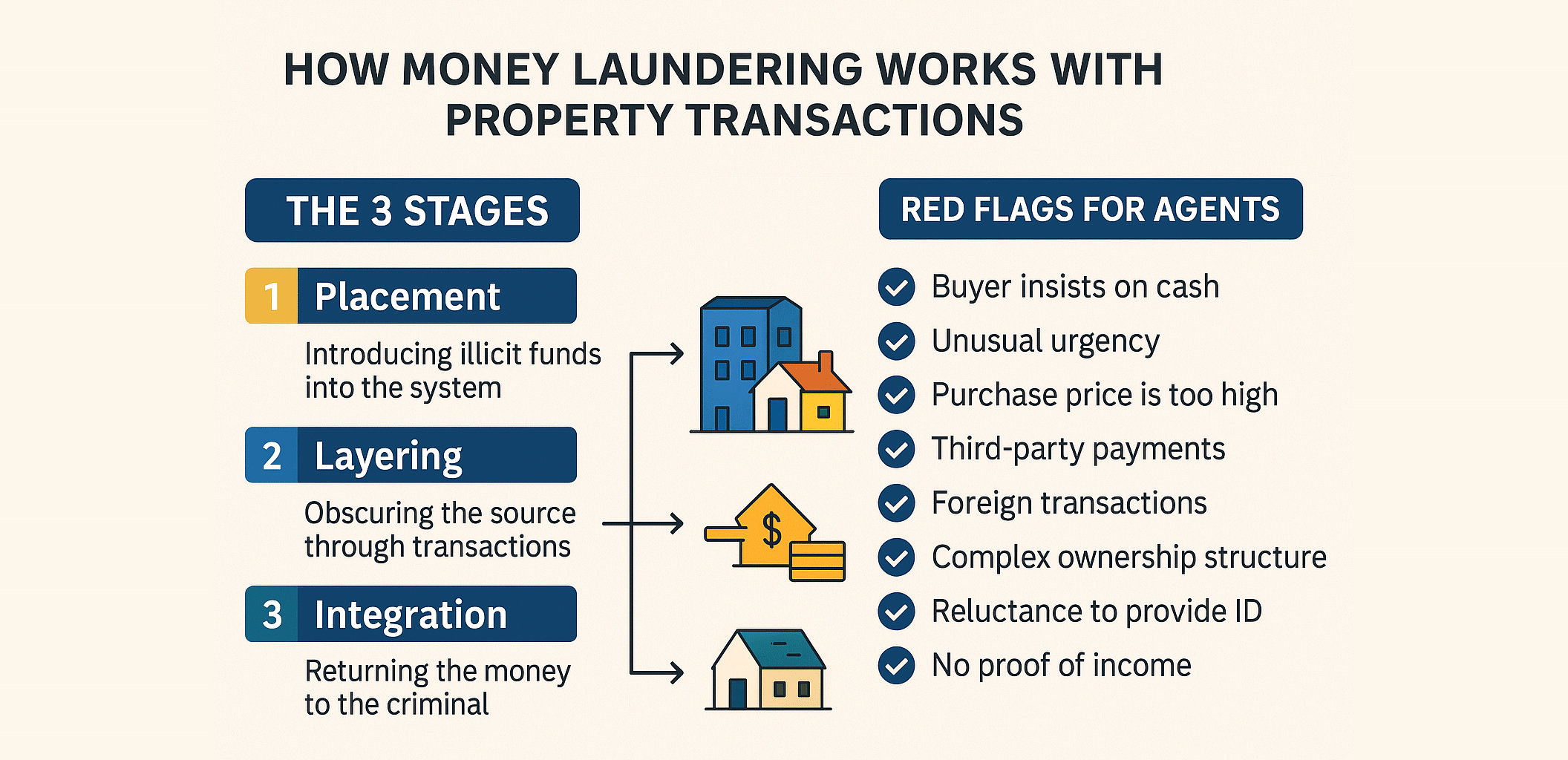

3. The 3 Stages of Laundering Through Property

Money laundering through real estate usually happens in three classic stages.

Stage 1: Placement

This is where criminals introduce illegal funds into the financial system.

How it looks in property:

- Buying property with cash or cashier’s cheques, often through multiple third-party accounts.

- Using proxies (family, nominees, shell companies) to purchase assets.

- Paying deposits or booking fees via non-banking channels or offshore transfers.

At this point, the goal is to enter the system — even if the ownership looks suspicious.

Stage 2: Layering

Now, they need to obscure the trail. They mix legitimate and illegitimate transactions so authorities can’t tell where the money came from.

How it looks in property:

- Rapid resale (“flipping”) between related parties.

- Overpaying or underpaying for property to move money between entities.

- Buying through complex company structures or trusts.

- Using foreign bank accounts or loan settlements to disguise origins.

Each layer adds confusion, making it harder for auditors or investigators to trace.

Stage 3: Integration

This is where the “cleaned” money re-enters the economy. By now, it looks legitimate — backed by property titles and legal documents.

How it looks in property:

- Selling the property later and declaring the profit as capital gain.

- Taking rental income as “legitimate” cash flow.

- Using refinancing to withdraw money via “loan proceeds.”

At this stage, the criminal can spend freely — on cars, shares, or luxury goods — all justified by “property profit.”

4. Common Red Flags for Agents and Lawyers

Not every suspicious deal is a crime, but patterns matter.

Here are red flags you should never ignore:

- The buyer insists on cash or pays through multiple accounts.

- Unusual urgency — “I don’t need to view, I just want to transfer.”

- Purchase price is way above or below market.

- Third-party payers fund the purchase.

- Foreign remittances with no supporting documentation.

- Complex ownership structures — companies or trusts with unclear roles.

- Reluctance to share identification or proof of income.

Under AMLA, suspicion alone is enough to trigger your duty. You don’t need proof — you need to report.

5. The Agent’s Legal Duty Under AMLA

As a reporting institution, a property agency must:

- Perform Customer Due Diligence (CDD): Verify clients’ identity, beneficial ownership, and fund source.

- Keep Records: Maintain documents for at least six years.

- Report Suspicious Transactions (STR): File to Bank Negara Malaysia (BNM) when red flags appear.

- Train Staff: Ensure negotiators understand AMLA responsibilities.

Failure to comply can lead to criminal penalties, even if you’re not involved in the laundering itself.

“I didn’t know” is not a defense under AMLA. If it’s suspicious, you must report. Silence equals liability.

6. Real-World Examples

- Case 1: A politically exposed person (PEP) buys ten condominiums under relatives’ names. Later, investigations reveal the funds came from public contracts.

- Case 2: A syndicate buys undervalued units, then “sells” them at inflated prices within their own network — booking the difference as clean income.

- Case 3: Scammers channel victims’ funds through quick property purchases, then flip them within months to withdraw the money.

These are not hypotheticals. They mirror real investigations carried out in Malaysia and neighbouring countries.

7. How ListingMine ERP Helps Agencies Stay Compliant

ListingMine ERP is not designed to “catch” suspicious transactions automatically — compliance always begins with human judgment. What ListingMine does is empower agencies to implement and enforce their own AMLA procedures through flexible digital tools.

Each agency can:

- Upload Custom Compliance Forms: Admins can upload their own Customer Due Diligence (CDD), Know-Your-Client (KYC), or Source-of-Funds declaration forms directly into the system.

- Assign Forms to Agents: Agents can fill in the uploaded forms within ListingMine whenever a new deal, buyer, or seller is onboarded.

- Auto-Store Completed Forms: Every submission is automatically saved and timestamped within the case record, ensuring traceability and easy retrieval.

- Centralise Documentation: All compliance documents — from CDD forms to signed acknowledgements — are stored securely in one place, ready for internal review or Bank Negara inspections.

By giving agencies full control over their own compliance templates, ListingMine acts as the digital filing system that ensures every form is filled, stored, and retrievable — reducing paperwork chaos and protecting the agency from audit risks.

8. The Bottom Line

Property transactions aren’t just about price and paperwork — they’re part of a national financial system. When bad actors exploit it, every honest agent, lawyer, and banker is put at risk.

Money laundering isn’t always obvious; it’s often hidden inside normal deals. That’s why your best defense is vigilance and systemisation.

- Always verify who you’re dealing with.

- Always ask where the money comes from.

- Always document every step.

- And when in doubt, report.

You’re not just selling homes. You’re safeguarding the integrity of the entire market.