How to Know If Your Property Is Priced Too High

The Market Doesn't Reject Your Property—It Rejects Your Number. Silence is Feedback.

If your property listing gets high views but no calls, or viewings but zero offers, the problem is not exposure—it's pricing.

In real estate, silence is the clearest feedback you can receive. The market speaks perfectly: Too low means you're flooded with offers in a week; Too high means you get nothing but "still available?" texts. Every professional agent recognizes this pattern, but owners often miss it because emotional value clouds market logic.

The Emotional Premium Problem

Owners naturally overprice their property. They are factoring in:

How much they originally paid.

The cost of every renovation and furnishing.

The emotional effort and personal memories tied to the unit.

But the buyer does not pay for your memories or your hopes. They pay for alternatives. The true value of any property is never what it cost you—it's what the market can replace it with today.

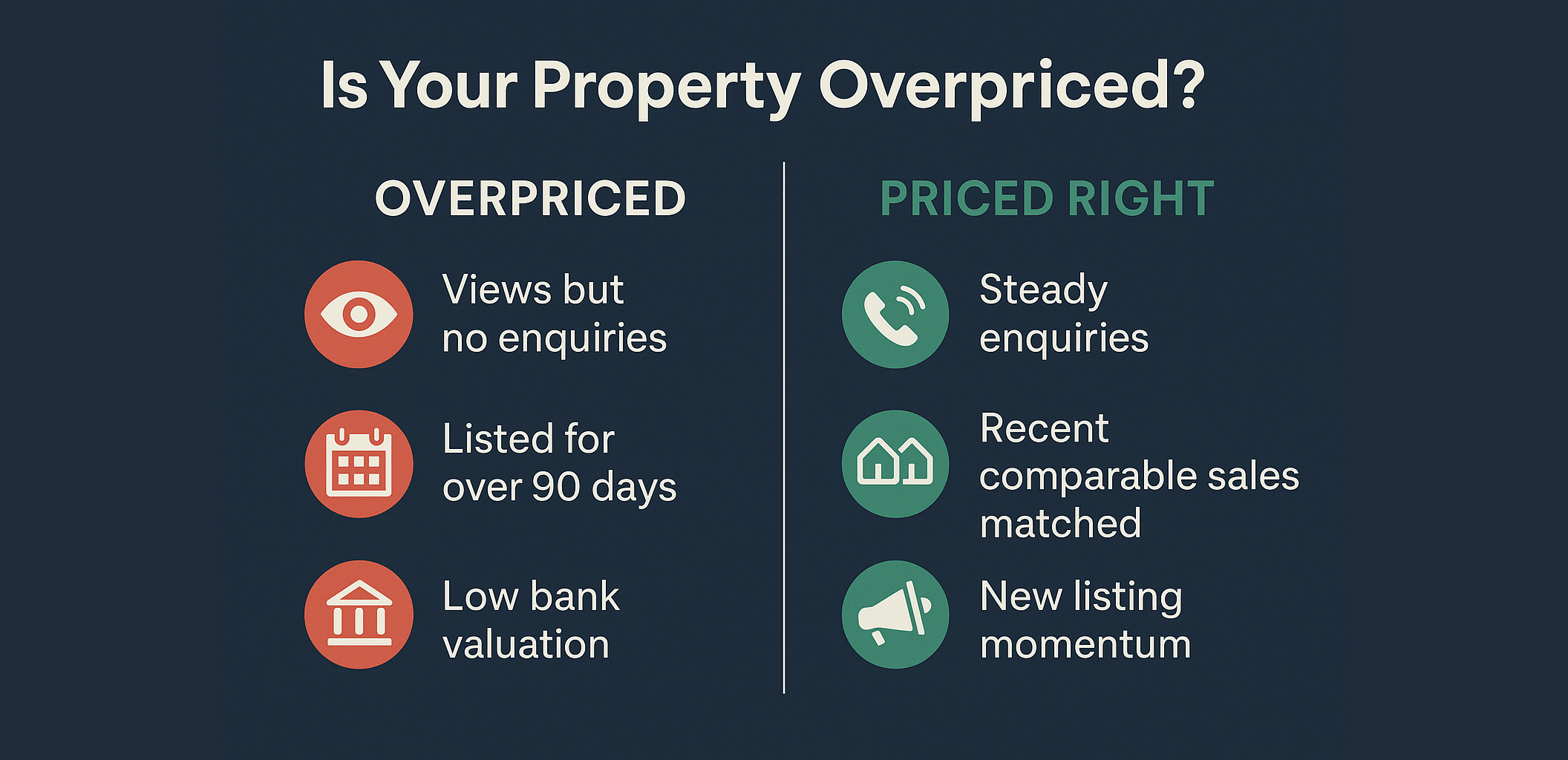

Five Red Flags That Your Property Is Overpriced

These are the immediate, measurable signs that your listing is failing:

1. High Views, Low EnquiriesThis is the first digital warning sign. If your ad impressions are high on portals like PropertyGuru or PropertySifu, but the clicks or WhatsApp messages are low, your photos are doing their job—but your price is filtering buyers out.

2. Every Agent You Call Says "No Problem"When every agent instantly agrees with your asking price, it's not validation—it's avoidance. They are only after the listing mandate. A truly professional agent should give you comparable data and honest advice, not compliments.

3. Comparing to Asking Prices, Not TransactionsThe real estate market runs on transactions, not wish lists. A property advertised at RM800k but sold at RM720k is a RM720k property. If you compare only to other agents' asking prices, you're chasing a market fantasy.

4. Listed for Over 90 Days Without an OfferIn the digital age, a listing is considered "stale" by the fourth week. Buyers assume, "If it was a good deal, someone would have taken it." Stale listings attract only deep bargain hunters or generate suspicion.

5. Bank Valuation Comes In LowerIf a buyer’s loan margin is reduced because the bank's valuer submits a lower figure, that is hard, objective proof your asking price is not supported by financial data. This is the market's final, non-negotiable rejection.

Why Overpricing Backfires Aggressively

When you overprice, you don't just delay the sale—you actively undermine it:

Lost Momentum: You waste the critical first 30 days when your listing is freshest and most visible.

Competitor Advantage: Your overpriced ad makes every similar unit listed by competitors look cheaper and better value.

Reduced Trust: Buyers subconsciously mark you as unrealistic, making future negotiations unnecessarily difficult.

Ultimately, time is the most expensive cost in real estate. Overpricing only guarantees your property stays unsold longer.

How to Recalibrate the Right Way

Recalibration requires swapping emotion for discipline.

Step 1: Start with Real DataUse professional tools (like ListingMine ERP or public data from NAPIC/Brickz) to check actual transacted prices within the last 6 to 12 months. Base your number on facts, not gossip.

Step 2: Study Competing InventoryIf five similar units are currently asking 10% less, buyers will call them first. Price your property to be the most attractive alternative among current listings.

Step 3: Test and Monitor EngagementUse your dashboard to track views vs. enquiries. If engagement drops sharply after week 2, reduce your price by 3-5% and observe the market's reaction. Use the system to guide your strategy.

Step 4: Anchor Price with ProofOnce you find the optimal price, justify it with data—valuation letters, rental yield tables, or a comparison report. When you anchor your price with proof, buyers feel secure, even if the price is at the top of the range.

The Takeaway

An overpriced property doesn't stay expensive—it just stays unsold. In today’s transparent market, every price is instantly compared, and every exaggeration is exposed by a click.

Data wins. Emotion loses.

If you want calls, offers, and a fast closing, price your property at where the market is going, not where your heart is stuck.