How Agencies Should Correctly Prepare CP58

The Definitive Malaysian Real Estate Guide (Updated for 2026)

CP58 is one of the most misunderstood documents in the real estate industry. Every year, agencies scramble to reconcile Payment Vouchers (PV), Credit Notes (CN), and Debit Notes (DN), often discovering too late that:

- CP58 totals don't match internal ledgers

- DN was used incorrectly

- CN was not tied to the correct PV

- Advances were treated as commission

- Marketing fees were confused with income

- Withholding tax (2%) was calculated incorrectly

- DN and CN were mixed together in the same document series

This guide fixes all of that. It is the cleanest, most audit-proof way to handle CP58 for commission-based agencies in Malaysia. If your agency follows this method, 99% of all CP58 problems disappear permanently.

SECTION 1 — The Golden Rule of CP58

There are only three financial documents that matter in a commission-paying business:

- Payment Voucher (PV)

- Credit Note (CN)

- Debit Note (DN)

Each one has a completely different purpose and must never be mixed up.

1.1 What Each Document Actually Does

| Document | Main Function | Which Account? | Impacts CP58? |

|---|---|---|---|

| PV (Payment Voucher) | Records commission paid or credited to agent | Commission Ledger | YES |

| CN (Credit Note) | Cancels/reduces commission previously in a PV | Commission Ledger | YES |

| DN (Debit Note) | Records agent borrowing or reimbursing money to agency | Agent Receivable (Balance Sheet) | NO |

The LHDN logic is simple:

CP58 reports incentives "paid or credited". That is only PV minus CN. DN is always ignored.

This leads to the unbreakable formula:

CP58 = Σ(PV) − Σ(CN)

(And never involves DN)

SECTION 2 — Why DN Causes 90% of Mistakes

Inside agencies, the term "DN" is used loosely. But in formal accounting, only ONE type of DN is valid.

The Two Types of DN (Industry Terminology)

| Industry Usage | Real Accounting Meaning | Status |

|---|---|---|

| DN used to adjust commission | INVALID (must be CN or PV) | Forbidden |

| DN used for money agent owes the agency | Correct Debit Note (Agent Receivable) | Allowed |

This confusion leads to:

- Wrong CP58 totals

- Auditors questioning DN sequences

- LHDN queries on why DN was used to change commission

- Double-counting or under-reporting of income

To eliminate this:

DN should only mean one thing: "The agent owes money to the company." Never to adjust commission.

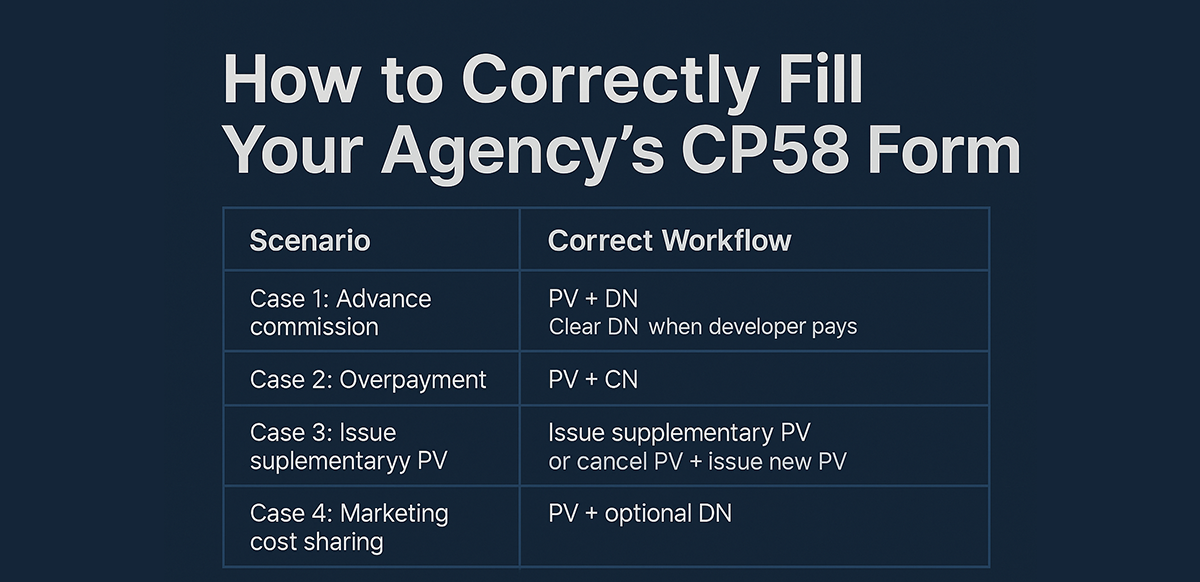

SECTION 3 — The Four Scenarios Every Agency Encounters

These are the four CP58-critical cases:

Advance commission

Overpayment

Underpayment

Marketing/shared-cost deduction

We will cover each in full detail.

CASE 1 — Advance Commission (Developer Has Not Paid Yet)

This is the most common messy scenario.

Scenario

| Item | Amount |

|---|---|

| Agent's commission entitlement | RM1,000 |

| Developer payment | Not yet received |

| Agency advances | RM1,000 |

Correct Workflow

| Document | Amount | Purpose |

|---|---|---|

| PV | RM1,000 | Records commission "paid/credited" (CP58 entry) |

| DN | RM1,000 | Records loan/advance the agent owes the agency |

CP58 = RM1,000

Taxable immediately.

DN does NOT affect CP58.

Why this is correct

- The agent received money, so it is taxable now.

- The agency loaned money, so DN is required.

- The DN represents an interest-free loan, not commission.

- When the developer pays later, no new commission arises.

When the Developer Pays (Year 2 or Year 3)

This is the part most agencies get wrong. Let's break it into two clean steps.

Step 1 — Recognise Developer Payment (Accrual Method)

| Debit | Credit |

|---|---|

| Cash RM1,000 | Developer Payable / Commission Accrual RM1,000 |

This recognises that the developer has now paid what was originally owed.

Step 2 — Settle the Agent's Loan (DN)

| Debit | Credit |

|---|---|

| Commission Expense / Settlement of Advance RM1,000 | Agent Receivable RM1,000 |

Important clarifications:

- This step does not pay any additional cash to the agent

- The DN is simply marked as settled

- CP58 remains unchanged

- The settlement of DN has no withholding tax implications

- The DN was a loan, not income

CASE 2 — Overpayment

Scenario

| Item | Amount |

|---|---|

| True entitlement | RM1,000 |

| PV issued by admin accidentally | RM1,100 |

| Overpayment | RM100 |

Correct Workflow

| Document | Amount | Purpose |

|---|---|---|

| CN | RM100 | Reduces the overstated PV |

| (Optional) DN | RM100 | If the agent must return the excess |

CP58 = RM1,100 − RM100 = RM1,000

Why DN is optional

If the agent already returned RM100 physically, no DN is needed.

CASE 3 — Underpayment

Scenario

| Item | Amount |

|---|---|

| True entitlement | RM1,000 |

| PV issued | RM900 |

| Shortfall | RM100 |

There are two correct methods.

Method A — Supplementary PV

| Document | Amount |

|---|---|

| Original PV | RM900 |

| Additional PV | RM100 |

CP58 = RM900 + RM100 = RM1,000

Method B — Cancel and Reissue

| Document | Amount |

|---|---|

| CN | RM900 (cancels wrong PV) |

| New PV | RM1,000 |

CP58 = RM1,000

❌ Forbidden Method: DN RM100

A DN cannot increase income. It never enters the commission ledger.

CASE 4 — Marketing Cost Sharing

Scenario

| Item | Amount |

|---|---|

| Commission entitlement | RM1,000 |

| Agent agrees to share marketing | RM100 |

| Net cash paid | RM900 |

There are two possible treatments, but only one is safe for withholding tax compliance.

Method A (Recommended for WHT Section 107D Compliance)

| Document | Amount | Purpose |

|---|---|---|

| PV | RM1,000 | Gross income (safe for WHT) |

| DN | RM100 | Agent reimburses the agency |

CP58 = RM1,000

WHT = 2% on RM1,000 (if applicable)

Why this method is safest

Under Section 107D:

WHT applies to gross incentives, not net

LHDN expects agencies to report the full commission

Agents can later claim RM100 as a business expense in their own Borang B

Method B — Using CN (Only If Entitlement Truly Reduced)

| Document | Amount |

|---|---|

| PV | RM900 |

This is only correct if:

- The agent's true commission entitlement was contractually RM900

- Not a cost-sharing deduction

- Not a reimbursement situation

SECTION 5 — Withholding Tax (Section 107D)

| Rule | Description | Applies to |

|---|---|---|

| Resident individuals only | ||

| Threshold | > RM100,000 incentive from same payer in prior YA | |

| Rate | 2% | |

| Based on | Gross payment = PV − CN | |

| DN affects WHT? | NO | |

| Remittance | Monthly via e-CP107D | |

| Agent must have | Tax Identification Number (TIN) |

SECTION 6 — E-Invoicing

Malaysia announced a simplified rollout:

- Companies above RM1 million annual revenue must issue e-Invoices

- Full adoption for all companies expected by 2025–2026

E-Invoice Requirements for PV/CN/DN

| Item | Requirement |

|---|---|

| UUID | Mandatory for PV, CN, DN |

| CN must link to | The specific PV UUID |

| DN must link to | The receivable UUID |

| B2C over RM10,000 | Requires e-Invoice starting 2026 |

Important clarification

E-Invoice does not change CP58 rules. Its main purpose is to ensure:

- Document traceability

- Prevention of deletion/alteration

- CN and DN cannot be used incorrectly

- Real-time cross-verification

SECTION 7 — Summary Table for All Scenarios

| Case | PV | CN | DN | CP58 Result |

|---|---|---|---|---|

| 1 — Advance | 1,000 | – | 1,000 | 1,000 |

| 2 — Overpayment | 1,100 | 100 | (optional 100) | 1,000 |

| 3A — Underpayment | 900 + 100 | – | – | 1,000 |

| 3B — Cancel + Reissue | 1,000 | 900 | – | 1,000 |

| 4A — Marketing Cost (Safe) | 1,000 | – | 100 | 1,000 |

| 4B — True Reduced Entitlement | 900 | – | – | 900 |

SECTION 8 — Three Laws Every Agency Must Follow

| Law | Meaning |

|---|---|

| Law 1 | PV and CN are the only documents that affect CP58. |

| Law 2 | DN is a loan/debt and must never change commission. |

| Law 3 | CP58 = PV − CN. Always. No exceptions. |