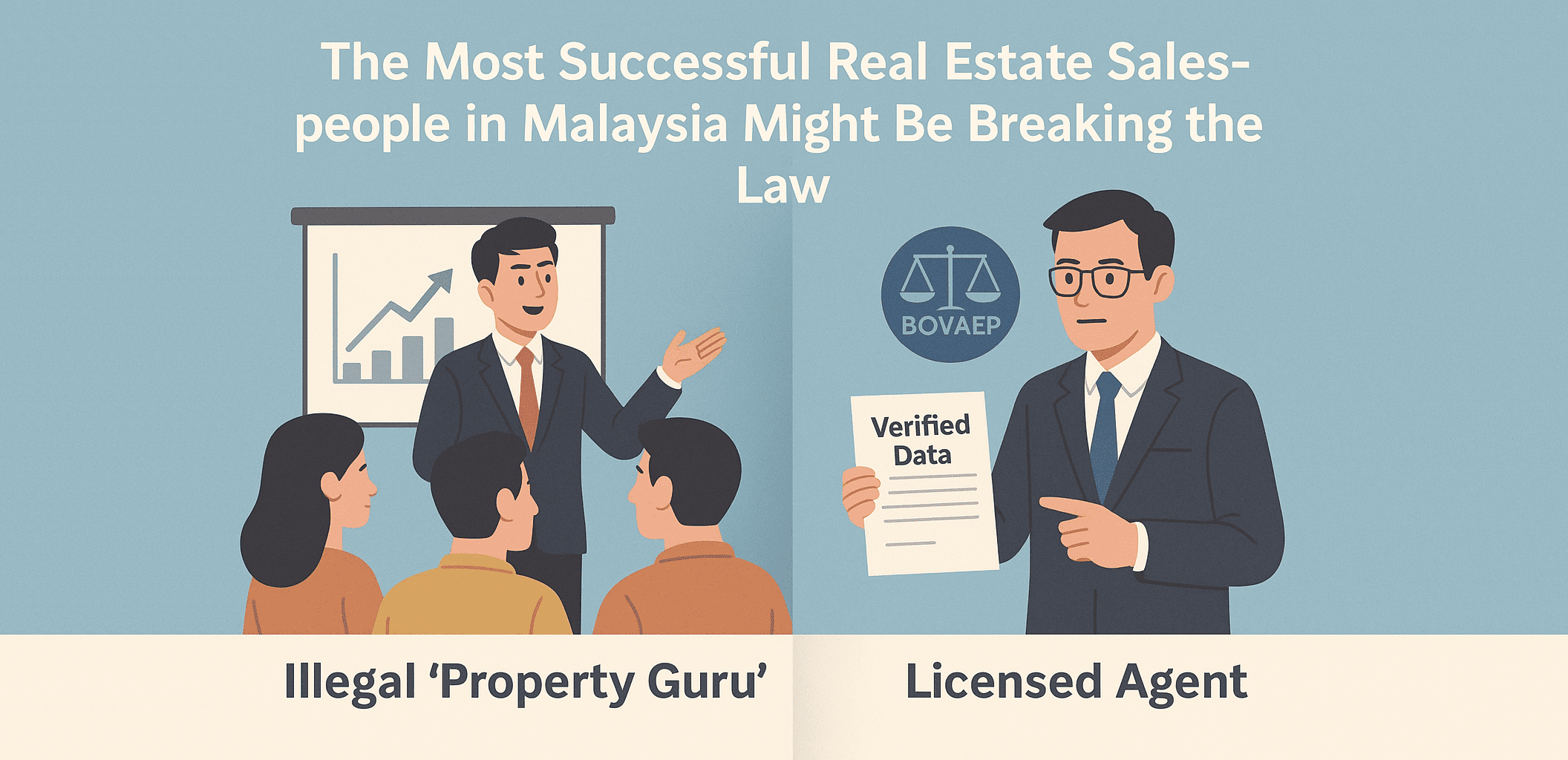

The Most Successful Real Estate Salespeople in Malaysia Might Be Breaking the Law

Why “Illegal Property Gurus” Are Outselling Licensed Agents — and What Must Change

In Malaysia’s property market, a strange paradox has emerged: some of the top “closers” aren’t even licensed.

While legitimate real estate negotiators (RENs) and estate agents are battling slow sales, many self-proclaimed “Property Gurus” — who operate without registration under the Board of Valuers, Appraisers, Estate Agents and Property Managers (BOVAEP) — appear to be thriving.

It’s not fair.

But it’s not random either.

The reason isn’t marketing. It's a strategy.

When strategy beats structure, even the unlicensed can win — at least for now.

1. Agents Sell Projects. Gurus Sell Outcomes.

When a developer launches a project, here’s how most agents respond:

- Negotiate commission

- Agree on fees

- Begin selling through Facebook ads, roadshows, and generic campaigns

The focus is on exposure, not execution.

Buyers, however, don’t want exposure. They want a plan that works.

By contrast, some “gurus” start from the end game:

- “Can this project achieve positive cash flow after tenancy?”

- “Can we buy at least 30% below market value?”

- “Can we secure bulk discounts through collective bargaining?”

Only when those boxes are ticked do they move.

They’re not selling units — they’re selling profitability.

2. Gurus Don’t Wait for Buyers. They Create Them.

Most agents chase leads.

Gurus build communities — often positioning themselves as educators or “deal curators.”

They gather committed investors first, then launch one project at a time.

These buyers pay commitment fees (later contra-ed into the purchase price), signaling seriousness to developers and accelerating sales.

No cold calls. No “anyone interested?” posts.

Every launch is a pre-sold mission, not a blind campaign.

3. Agents Take What’s Offered. Gurus Negotiate the Terms.

Licensed agents usually accept whatever pricing and incentives a developer sets.

Gurus dictate terms, leveraging their buyer pool:

“We’ll bring 50 confirmed purchasers — but only at 30% below market value.”

Developers listen. Buyers benefit.

That negotiation creates value — something many ordinary project agents never attempt.

4. Gurus Think in Track Records. Agents Think in Closings.

For many agents, the sale ends at SPA signing.

For gurus, it begins there.

They track rental performance, showcase real post-VP results, and publish case studies.

Buyers see proof, not promises — and they come back for more.

Agents, meanwhile, often lose credibility when cashback or rebate schemes backfire, leaving clients with negative cash flow and no repeat business.

5. The Market Rewards Value — Not Titles

Buyers don’t care about license numbers; they care about results.

When one group sells hope and another sells verified profit, the wallet follows the latter.

It’s an uncomfortable truth: Illegal operators thrive because licensed ones rarely lead.

⚠️ 6. But a Serious Warning: Most “Gurus” Are Breaking the Law — and Many Are Dangerous

Let’s be clear. These individuals are not licensed estate agents or RENs.

Under Malaysia’s Valuers, Appraisers, Estate Agents and Property Managers Act 1981 (Act 242), anyone who:

- Acts as an estate agent without registration, or

- Receives commissions or brokerage fees without being licensed

…is committing an offence.

Only a small minority of these gurus genuinely create value — negotiating true below-market opportunities and realistic investment plans. Many of their investors do end up with positive cash flow and repeat success.

But the majority? They’re pretenders — persuasive marketers who:

- Overpromise returns,

- Promote over-leveraged “no money down” schemes,

- Cherry-pick data, and

- Abandon students once the course ends.

The result is a trail of failed investments — and auction properties now flooding the market, many owned by those who bought through such programs.

And here’s the real danger:

If you buy through an unlicensed person, you have no legal recourse.

Should the deal collapse, deposit vanish, or promises go unmet, BOVAEP cannot protect you. There’s no tribunal, no complaint channel, and often, no accountability.

So, buyers — beware.

Always verify your agent’s REN or REA number.

If they can’t show it, walk away — no matter how good the deal sounds.

7. What Licensed Agents Must Learn — And Elevate

The solution isn’t imitation — it’s integration.

Licensed agents can — and should — borrow the best strategies from the good gurus while operating within the law.

- a. Start With Value, Not Visibility

Stop leading with ads. Lead with math. Demonstrate cash flow, rental potential, and holding cost. - b. Build Buyer Communities

Nurture investor circles. Use tools like ListingMine Groups to distribute deals, gather data, and coordinate collective buys. - c. Negotiate Like a Fund, Not a Freelancer

Developers respect volume. Present organized demand, not individual hope. - d. Track Results Post-VP

Show what happened after handover. Document ROI. Build a verifiable portfolio.

Combine strategic intelligence with legal compliance, and you’ll outlast every guru in the long run.

8. The Real Reform Malaysia Needs

Regulators must act.

The compliance gap allows unlicensed operators to profit unchecked.

But enforcement alone isn’t enough. The value gap — between what buyers want and what licensed agents offer — is equally damaging.

Until licensed professionals match or exceed the market value proposition, the shadow industry will thrive.

Final Word

Illegal “Property Gurus” dominate because they engineer value before marketing.

Agents struggle because they market before engineering value.

Buyers must stay cautious.

Agents must evolve.

And regulators must close both the legal and value gaps.

Because in the end, results build trust,

but only legality protects it.