Is a Seasoned Agent an Asset or a Liability? The Value Exchange Test

Many real-estate agency leaders make a critical mistake: they assume an agent’s tenure automatically equals value. They believe a seasoned agent is inherently a company asset.

That’s a costly assumption.

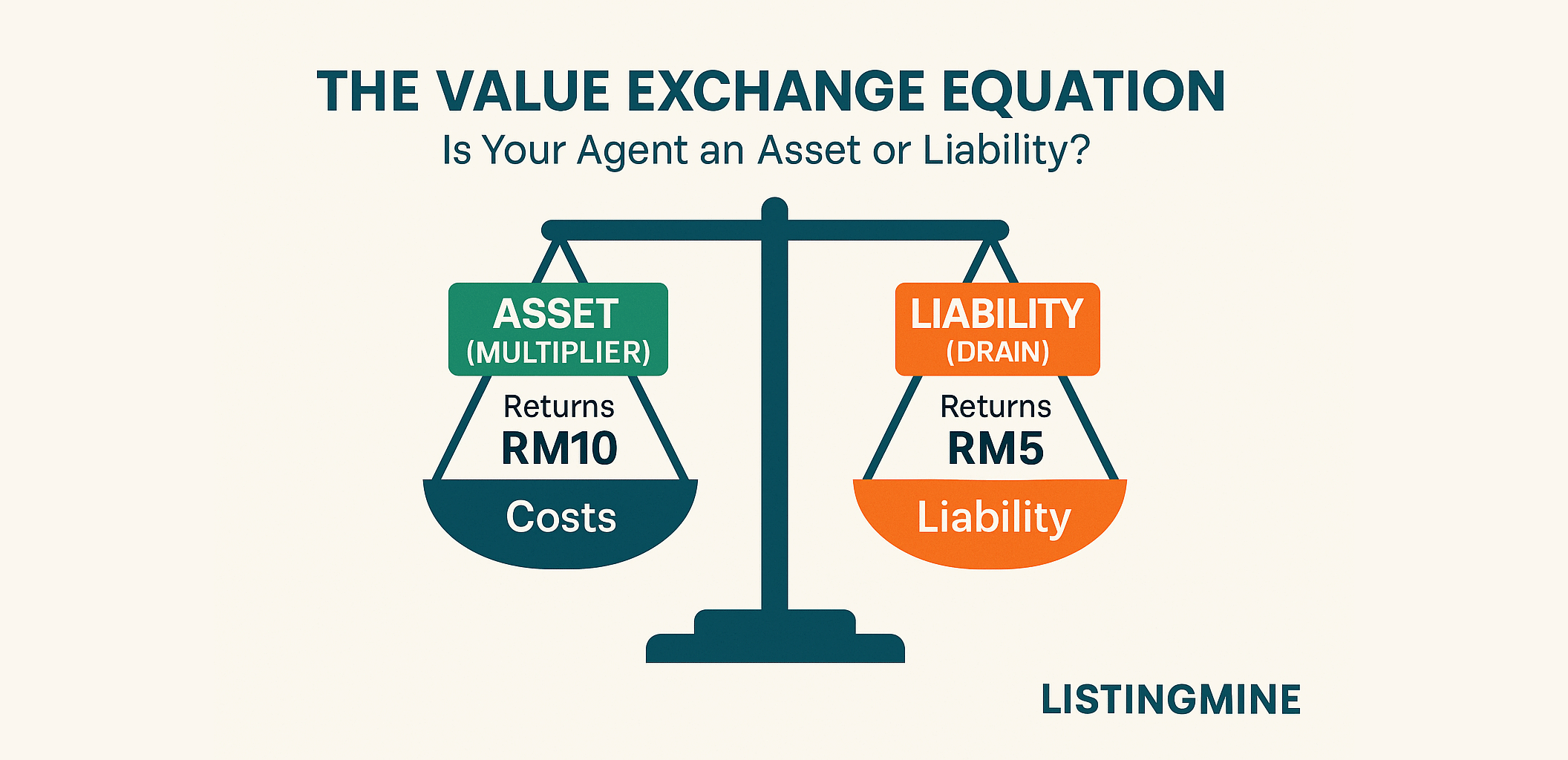

In business, the real question isn’t about loyalty or history — it’s about Value Exchange. Every agent, every team member, must be viewed through one simple equation:

What do they return compared to what they cost?

The Value Exchange Equation

A company exists to generate profit — not to function as a non-profit. The value-exchange lens clarifies an agent’s true role:

| Scenario | Result | Status |

|---|---|---|

| Returns RM10, Costs RM8 | +RM2 net value | Asset (Multiplier) |

| Returns RM5, Costs RM8 | −RM3 net loss | Liability (Drain) |

If an agent costs your company more in resources than they generate in profit, they are a liability — regardless of how friendly, senior, or experienced they are.

The True Cost of an Agent

The “cost” of an agent isn’t just their commission payout. It includes a range of invisible expenses most agencies never calculate:

- Management Bandwidth – Time leaders spend solving the agent’s personal issues instead of building scalable systems.

- Reputation & Compliance Risk – How the agent’s actions (or negligence) affect your brand image and legal standing.

- Operational Cost – Marketing budgets, system access, lead allocation, and office resources.

- Opportunity Cost – What you lose when high-value listings or leads are wasted on poor conversion.

These unseen costs quietly erode your net profit — even when the agent looks “productive” on paper.

Measuring True Value, Not Just Volume

Value isn’t just sales volume. It’s profit after cost, multiplied by leadership impact. True assets demonstrate multiplier traits:

- Cultural Impact – They elevate morale, mentor peers, and strengthen ethics — not poison the environment with ego.

- Recruitment Power – They attract capable agents who enhance your network.

- System Adoption – They use your ERP or CRM properly and influence others to follow.

- Leadership Leverage – They can lead projects or sub-teams that expand profit beyond their own deals.

A veteran agent who closes sales but resists change, undermines culture, or ignores compliance can quickly become a net negative.

The Trap: Mistaking Tenure for Entitlement

Many agency heads overvalue seniority. They assume veterans are “must-keep” because of their years in the business. But over time, some experience mutates into entitlement.

They demand higher splits, reject new systems, refuse to train others, and contribute little beyond personal deals. They stop being multipliers and turn into maintenance costs.

If a company keeps paying for maintenance instead of growth, profit will eventually stall.

The Right Question

Stop asking:

“How long have they been with the company?”

Start asking:

“How much value do they exchange for what they cost?”

The healthiest agencies continuously measure this balance. They build teams of people who:

- Use systems efficiently and ethically.

- Contribute more than they consume.

- Build others while building themselves.

Turning Insight into Action

Modern ERPs like ListingMine make the value-exchange lens measurable. With real data — lead conversion ratios, case closure rates, commission vs. support cost, and system engagement — leaders can finally see who’s an asset, who’s a liability, and who’s trainable.

At the end of the day, a seasoned agent can be your greatest asset only if their experience multiplies team performance, not just their own income.

Value exchange decides everything.