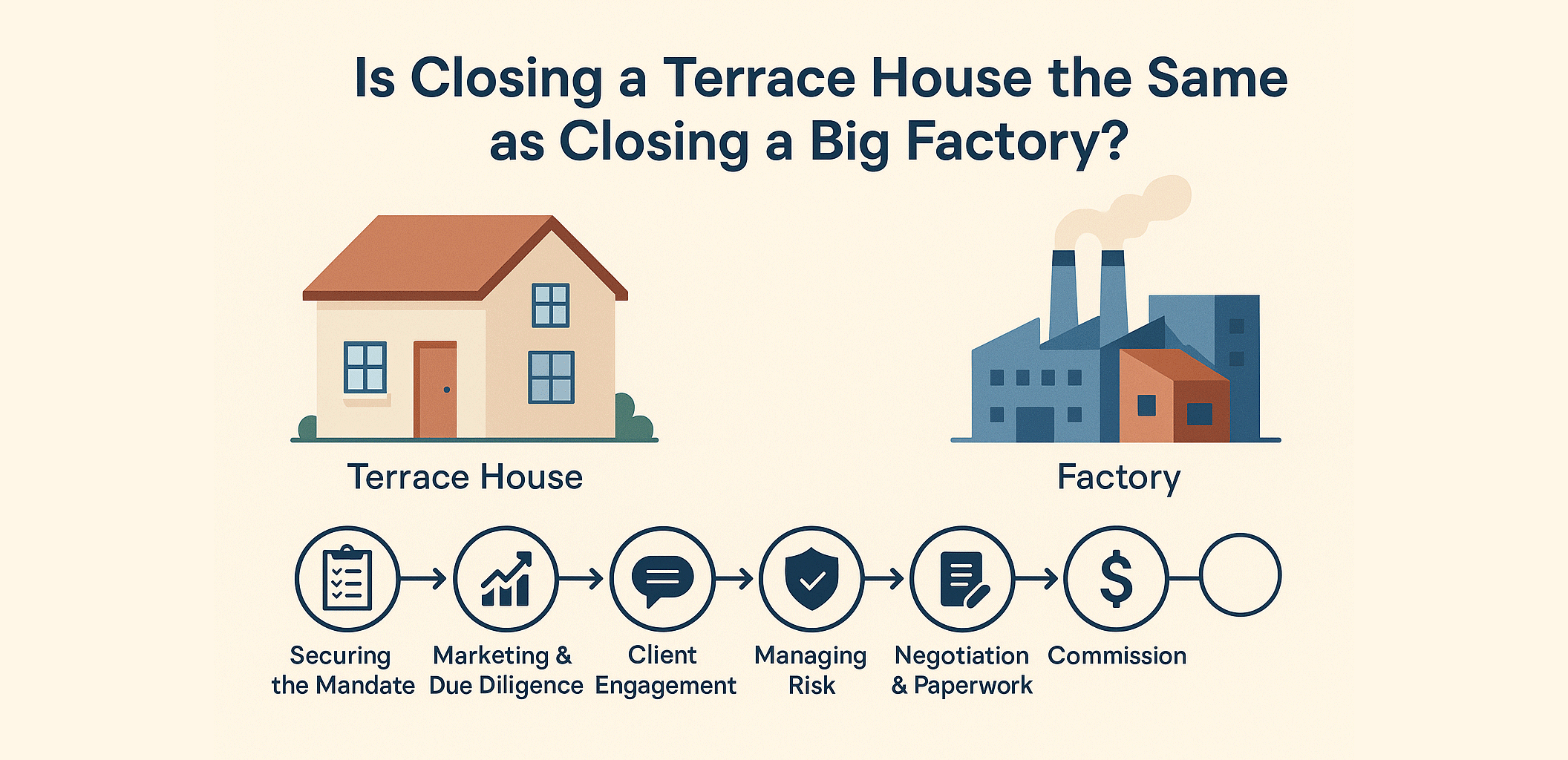

Is Closing a Terrace House the Same as Closing a Big Factory?

The Short Answer: The Process Is Identical, but Professional Clients Make the Big Deal Smoother.

It seems counter-intuitive. Selling a cozy 22′×75′ terrace house involves neighbourhood schools and family emotions. Selling a 200,000 sq ft factory involves logistics, floor loading, and capital expenditure. They look like two different professions.

Yet, an agent's fundamental six-step workflow—from securing a mandate to collecting a commission—is a carbon copy. The real, impactful difference isn’t the size of the building; it’s the professionalism of the clients. Ironically, the bigger the property, the cleaner the client, and the higher the paycheck.

The 6-Step Blueprint: Same Job, Different Friction Points

Your core routine never changes, but the nature of the challenges you face at each stage shifts entirely.

1. Securing the Mandate: Earning the Right

Whether you're dealing with a residential home or an industrial hub, the first step is non-negotiable: earn trust, prove competence, and secure the Appointment to Sell signed. The language differs—you talk about schools versus power supply—but the objective remains identical: win the mandate.

2. Marketing & Due Diligence: Matching Needs

Your marketing playbook is standard: portals, co-broking, and targeted ads. The distinction is in the buyer’s focus:

- House Buyers focus on immediate lifestyle: schools, neighborhoods, and renovations.

- Factory Buyers focus on core business metrics: power capacity, container access, and zoning compliance.

Different vocabulary, same mission: match a specific need with a specific opportunity.

3. Client Engagement: Why Big Deals Flow Faster

This is the most critical divergence.

| Property Type | Client Profile | Conversion Dynamics |

|---|---|---|

| Large Deals (Factory) | Corporate decision-makers, well-funded investors, legal teams. | High Conversion: Clients value documentation, set clear conditional precedents, and move strategically. Once conditions are met, closure is clean and predictable. |

| Retail Deals (House) | Unprepared, emotional, or financially uneducated individuals. | High Friction: Buyers often over-negotiate, introduce emotional chaos, or fail loan approvals. You spend time educating and hand-holding rather than strictly selling. |

The paradox: The complexity of the factory is easier to manage than the unpredictability of the retail buyer.

4. Managing Risk: Consistency is Your Best Defense

Undercutting is a reality in both markets, though more prevalent in the high-volume residential sector. Your defense remains universal: a tight, professional process.

- Keep everything in writing.

- Confirm viewings formally.

- Watermark all media.

Human nature is constant, whether you’re dealing with a first-time seller or a Datuk. Your protection is the consistency of your system, not the property type.

5. Negotiation & Paperwork: Precedent Over Emotion

The sequence is fixed: Letter of Offer → Deposit → Sale & Purchase Agreement (SPA).

The factory sale adds technical due diligence: floor loading, power supply, security, and zoning. Crucially, these are established upfront as conditions precedent. In contrast, residential friction often stems from emotional or financial uncertainty—factors that no legal clause can fully control.

6. Commission: Same Steps, Exponential Reward

You perform the same six steps, but the financial scale is profoundly different:

| Property Type | Typical Commission Range |

|---|---|

| Terrace House | RM8,000 – RM15,000 |

| Factory | RM80,000 – RM300,000 |

Industrial deals reward your professionalism with dramatically higher returns and, thanks to the corporate clientele, fewer messy surprises.

The Real Difference is Your Mindset

The greatest barrier for agents isn't the technical complexity of industrial property; it's the fear of that complexity.

Once you realize the job is 95% identical, and that corporate clients actually make your work easier by demanding and providing professional documentation, you find a clearer path to higher margins and better time efficiency.

If you can successfully close a terrace house while managing unpredictable loans and emotional buyers, you already possess the skill set to close a factory with strategic, well-funded partners.

Final Thought

Stop seeing boundaries, and start seeing bigger opportunities. The question isn't how far you can go, but how soon you're ready to start playing the bigger game.