The "Lelong" Myth: Why Losing Your House in Malaysia Doesn't Mean You're Debt-Free

Ask any Malaysian what happens if they can't pay their housing loan, and they'll likely say: "The bank will lelong (auction) the house, and that's the end of it."

This is the most dangerous financial myth in the country.

The reality is terrifying: In Malaysia, losing your house does not mean you are free from debt. Our system is fundamentally different from what many see in American movies or on the news, and this misunderstanding can lead to financial ruin.

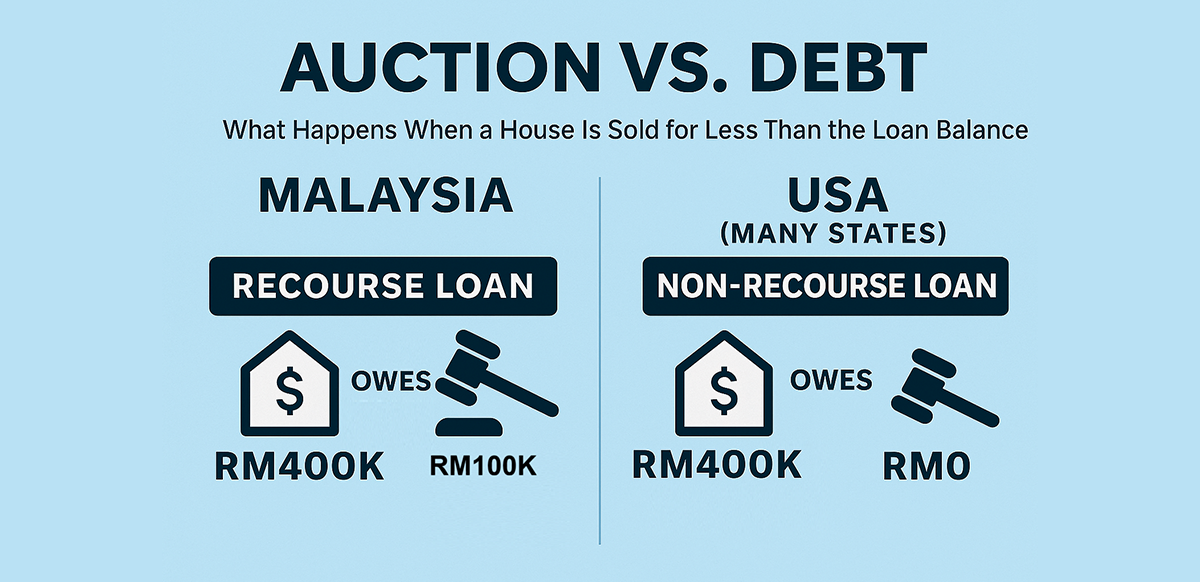

1. The Life-Changing Difference: Recourse vs. Non-Recourse

The entire problem boils down to one word: Recourse.

Non-Recourse (Many US States): The loan is secured only by the property. If you default, the bank seizes the property. Even if it's auctioned for less than the loan, the bank absorbs the loss. You, the borrower, can walk away.

Recourse (Malaysia): The loan is secured by the property and by you, the borrower, personally. If the auction proceeds are not enough to cover the loan, the bank has the legal right to pursue you for the remaining balance (the "shortfall").

| Country | Loan Type | If Auction Price < Loan Outstanding | Who Pays the Shortfall? |

|---|---|---|---|

| Malaysia | Recourse | Borrower is still personally liable | The Borrower |

| USA (Many States) | Non-Recourse | Borrower walks away after foreclosure | The Bank (absorbs the loss) |

2. A Simple Example of the Shortfall

Imagine you default on your RM500,000 loan. The property market is bad, and the bank can only auction your unit for RM400,000.

| Location | Loan Outstanding | Auction Sale Price | Shortfall (What's Still Owed) |

|---|---|---|---|

| Malaysia (Recourse) | RM500,000 | RM400,000 | The borrower still owes RM100,000 |

| USA (Non-Recourse State) | RM500,000 | RM400,000 | The borrower owes RM0 |

The US borrower walks away with a bad credit score. The Malaysian borrower walks away with a bad credit score and a RM100,000 personal debt.

3. The Nightmare After the "Lelong": The Shortfall Recovery Process

For the bank, the auction is just Step 1. For the borrower, it's the start of a new legal battle. Here is what the bank can (and often will) do to recover that RM100,000 shortfall:

- Issue a Letter of Demand for the shortfall amount, which now includes accrued interest, penalties, and legal fees.

- File a Civil Suit against you. If you don't or can't pay, they will obtain a court judgment.

- Execute the Judgment by:

- Garnishing Your Wages (taking a portion of your salary).

- Seizing Other Assets (like your car or bank savings).

- Initiate Bankruptcy Proceedings against you if the total debt exceeds the RM100,000 threshold.

You can lose your house and be forced into bankruptcy, remaining in debt for years.

4. Why This Risk Is Higher Than Ever

This is no longer a rare, theoretical scenario. It is now a systemic risk due to:

- Negative equity — loan balance higher than property value

- Market stagnation — auction prices are low due to oversupply

- High-rise depreciation — many units are worth less than their launch price

- Income instability — retrenchment, shrinking disposable income, job fluidity

Many owners in distress believe they can “just let it lelong.” They are walking into a financial trap.

5. The Agent's Duty: From Promoter to Protector

For decades, an agent's job was to sell the "dream." In today's market, their job is to explain the risk.

A new generation of buyers, armed with internet research, is no longer just asking, "Can I afford the installment?" They are asking, "What happens if I can't?"

Agents who can't answer this, or worse, give the wrong answer ("Don't worry, the bank just takes the house"), will lose all credibility.

| The "Old" Agent (Promoter) | The "New" Agent (Advisor) |

|---|---|

| "Don't worry, property always goes up." | "Let's review the real financial risks and your exit strategy." |

| Sells a lifestyle. | Explains the legal contract. |

| Avoids the topic of default. | Uses the risk of recourse to build trust. |

| Loses credibility with savvy buyers. | Becomes a trusted, long-term advisor. |

Agents who can explain this recourse risk will instantly stand out. You stop being a salesperson and become an essential advisor. You build trust, convert hesitant clients, and protect them from financial ruin.

This knowledge is no longer a "bonus"; it's a professional necessity.

Final Message

Do not mistake Malaysia's property laws for America's. There is no "walking away." A housing loan is not just a loan against your house; it's a loan against you.

The debt follows you long after the property is gone.

Agents who understand this protect their clients. Buyers who understand this protect their future.