Lifetime Overriding — The Hidden MLM Layer in Agency Recruitment

Introduction: The Recruitment Race

Across Malaysia’s real estate industry, agencies are in a constant race to recruit more agents. Every principal or team leader knows the formula: more agents mean more listings, more closings, and higher overall volume.

To accelerate recruitment, many agencies encourage their existing agents to invite friends, ex-colleagues, or other agents to join the company. In return, recruiters are promised a lifelong “thank-you”—a lifetime overriding commission whenever someone in their network closes a deal.

It sounds brilliant. But beneath the surface lies a structural and legal grey zone that few talk about openly.

How Lifetime Overriding Works

The concept is simple:

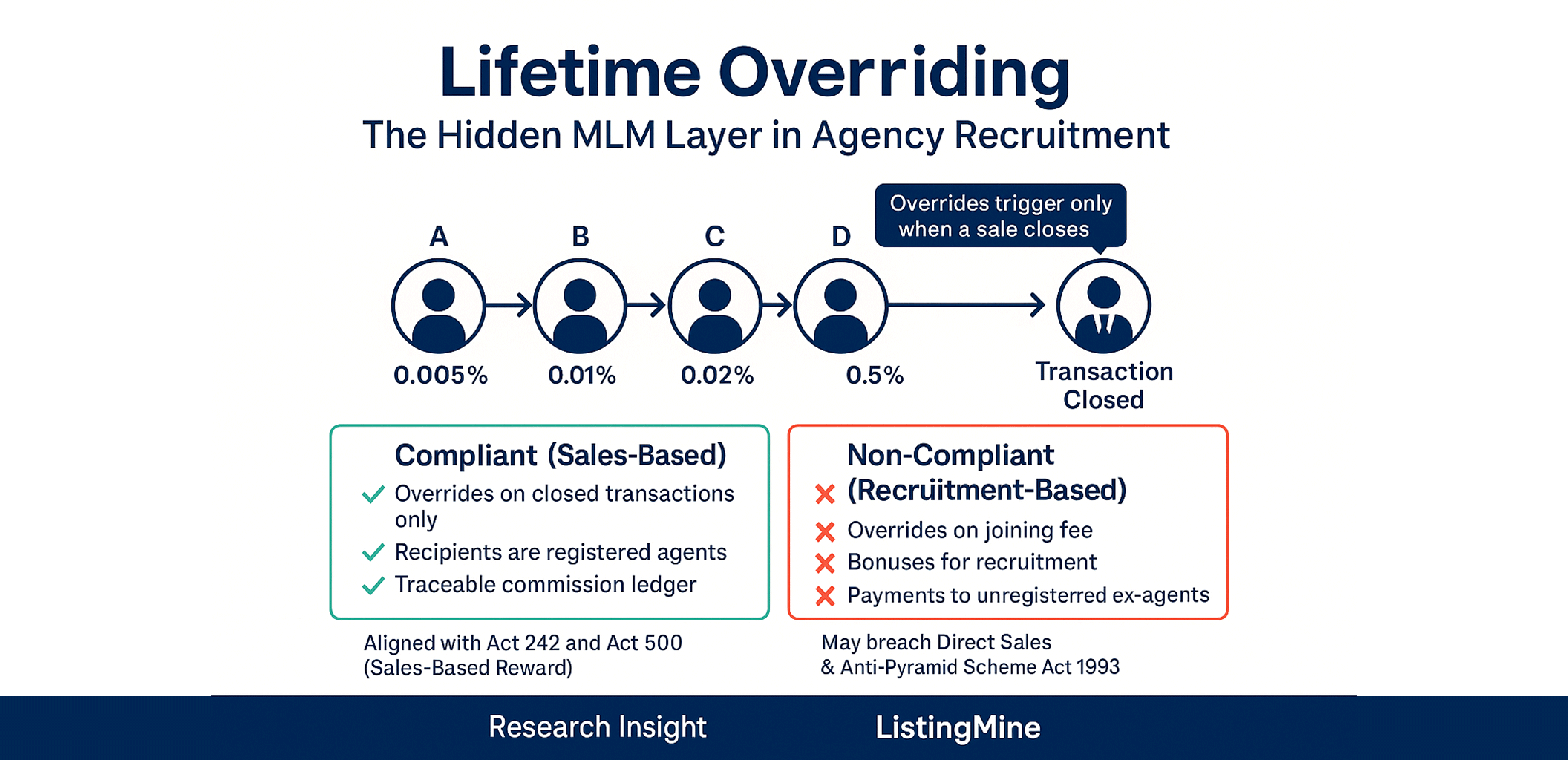

If Agent A recruits B, and B recruits C, and so on, every agent up the chain earns a small percentage whenever a deal closes at the bottom.

Example of a five-level chain:

A → B → C → D → E

When E closes a deal with a RM20,000 commission:

- A might receive 0.005% (RM100).

- B, C, and D each receive a small cut as well.

RM100 per deal may not sound like much, but with many active downlines, these overrides can add up to a steady passive income. That’s why agencies quietly market it as a “lifetime income opportunity,” even for agents who no longer sell actively.

The Attraction: Passive Income Without Selling

Lifetime overriding appeals because it turns recruitment into long-term reward.

- It builds network loyalty—once you’ve built a downline, you’re unlikely to leave.

- It creates retirement-style income, even after you stop selling.

- It drives organic growth, allowing agencies to expand through relationships rather than advertising.

Importantly, because overrides are only paid when a transaction closes, it naturally motivates everyone in the chain to help deals happen. Unlike typical MLM structures, no one earns from recruitment alone.

The Grey Area: Legal or Not?

Here’s where the uncertainty begins.

Under the Valuers, Appraisers, Estate Agents and Property Managers Act 1981 (Act 242), commission distribution is regulated. Agents may share commission only within licensed entities and among authorised individuals.

However, multi-layer, lifetime overrides are not clearly addressed anywhere in Act 242 or in BOVAEP circulars. The Act focuses mainly on:

- Maximum commission caps,

- Who may receive or share commission, and

- Restrictions on unregistered persons sharing in professional fees.

It says nothing about how many levels an internal override structure may have, or how long such overrides may continue.

Several agency principals have sought clarification from BOVAEP (the Board of Valuers, Appraisers, Estate Agents and Property Managers). To date, no formal reply or circular has confirmed whether layered lifetime overrides—especially beyond one level—are permissible.

Until that clarification arrives, agencies and recruiters remain in a compliance limbo.

The Real Risk: Lifetime Payments to Retired Agents

While multi-layer structures themselves aren’t inherently problematic, the lifetime element can be.

If overrides continue to flow to agents who have retired or are no longer registered under Act 242, it may breach the rule against unlicensed persons receiving commission. That’s where BOVAEP’s jurisdiction applies, not the MLM law.

⚠️ Regulatory Warning: Stay Clear of Act 500

Malaysia’s Direct Sales and Anti-Pyramid Scheme Act 1993 (Act 500) prohibits reward systems based on recruitment instead of genuine sales.

To stay compliant and avoid being classified as an MLM or pyramid scheme:

- Never pay overrides on recruitment or joining fees.

- Overrides must be tied only to legitimate property transactions that generate an agency commission.

- Ban any override or bonus for sign-ups, training kits, or “onboarding packages.”

- These are recruitment-based and risky under Act 500.

- Link every override to a real deal.

- Each override should trace back to a specific transaction ID, client, property, and corresponding commission entry.

If overrides are paid only after a deal closes, and not for recruiting, the model remains sales-based and generally falls outside the definition of a pyramid scheme.

⚖️ The Real Compliance Split: Act 242 vs Act 500

| Law | Purpose | Key Test | Relevance to Lifetime Overrides |

|---|---|---|---|

| Act 242 – Valuers, Appraisers, Estate Agents and Property Managers Act 1981 | Governs professional practice and commission sharing | Are recipients licensed/registered at payout time? | ⚠ Risk if overrides go to retired or unregistered persons |

| Act 500 – Direct Sales and Anti-Pyramid Scheme Act 1993 | Prohibits recruitment-based reward systems | Are overrides linked to sales or recruitment? | ✅ Safe if overrides are transaction-based only |

| Income Tax / SST | Ensures proper income classification | Are overrides recorded and taxed properly? | ⚙ Administrative duty, not legal breach |

The Practical Limitation: Sales Frequency and Network Fragility

While the multi-layer override model looks powerful on paper, real estate transactions are low-frequency events. Many agents close only one property a year—and some none at all.

That means:

- The override flow is sporadic, not continuous.

- The chain often breaks when an agent resigns or goes inactive.

- The downline productivity must remain high to make the structure worthwhile.

Because of this, building a sustainable override network purely on sales commissions is challenging. The model suits rental markets better—where deals happen more frequently, provide faster cash flow, and keep the override chain active.

In other words:

- For property sales, lifetime overriding is appealing but slow-burning.

- For rentals, it becomes a scalable, recurring-income ecosystem.

Conclusion: Volume Strategy, Legal Caution

The lifetime overriding model is a clever way to reward recruitment and scale agency networks, but it must be structured with legal precision.

If every override stems from a closed transaction, recorded within a licensed agency, and paid only to registered personnel, it remains within professional boundaries.

But once recruitment bonuses, joining-fee overrides, or lifetime payments to ex-agents enter the picture, the structure edges into Act 500 or Act 242 territory—and that could expose agencies to regulatory action.

Bottom line:

- Build your network, not a pyramid.

- Overrides belong on transactions, not on people.

Disclaimer

This article is provided for general informational purposes only and does not constitute legal advice.

References to the Valuers, Appraisers, Estate Agents and Property Managers Act 1981 (Act 242), the Direct Sales and Anti-Pyramid Scheme Act 1993 (Act 500), and related subsidiary legislation are based on publicly available Malaysian laws as at 2025.

Readers should seek professional legal counsel or written guidance from BOVAEP before implementing any lifetime or multi-layer override structure in practice.