The Loan Trap: Why Agency Bosses Should Never Lend Money to New Agents

(And How Economic Desperation Destroys Professionalism Long Before Training Can Fix It)

There is a quiet crisis inside Malaysian real estate agencies — one so common that most principals don't even question it anymore.

By Month 3, most new RENs begin to starve. No deals yet. No pipeline. No savings left.

Then comes the inevitable WhatsApp:

"Boss, can I borrow RM500? Petrol problem. Commission coming soon."

Every boss faces the same emotional conflict:

Your heart says yes. Your experience says no. Your business logic screams: This is a trap. Because the moment you lend money, you don't just lose the cash. You lose the agent, the leadership dynamic, and eventually the entire culture. And underneath all of it is a deeper truth:

Economic desperation destroys professionalism — long before training, ethics talks, or compliance rules can repair it.

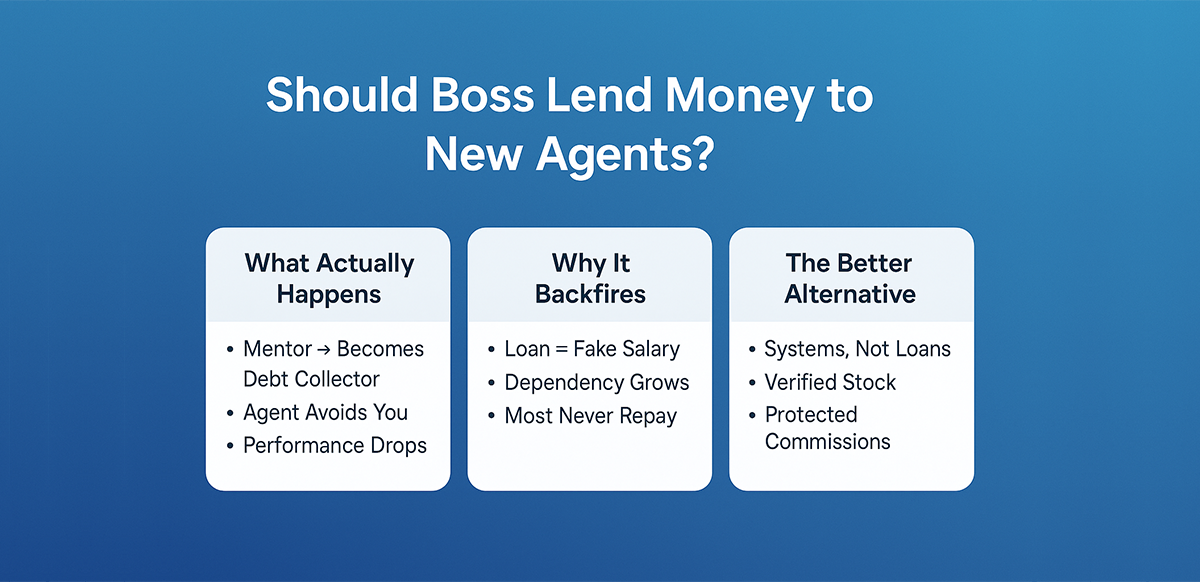

1. When You Lend Money, You Stop Being a Leader and Become a Creditor

Before the loan: The agent sees you as a mentor — someone who can guide them, coach them, help them close.

After the loan: They avoid your calls out of shame. They stop attending meetings. They disappear for days. Not because they are lazy — because they feel like a debtor.

You did not support them. You changed the relationship. And once the leader becomes the creditor, the team collapses from the inside.

2. The Starving Agent Cannot Be Professional — No Matter How Much You Teach Them

You can teach ethics. You can preach integrity. You can enforce rules. You can run CPD classes. But none of that survives contact with:

- an empty wallet

- an empty petrol tank

- an empty fridge

- a family asking for money

Professionalism is impossible when survival is at stake. A desperate agent:

- cuts corners

- hides defects

- lies about availability

- bait-prices listings

- bypasses co-broke partners

- steals buyers ("sailang")

- fakes listings

- submits ghost offers

Not because they are unethical. Because the economics force them into survival mode. As long as the industry demands white-collar behavior from people living on zero-collar income, desperation will win every time.

3. Lending Money Creates a Fake Salary — and Kills Performance

The moment a boss gives RM500–RM1,000 "just to help them survive," the agent subconsciously shifts from:

Hunter → Employee.

They relax. They slow down. They lose urgency. They rely on the boss instead of the market. Instead of fixing their:

- prospecting

- pipeline

- listings

- follow-ups

- discipline

...the loan becomes a psychological safety net. You are not helping them survive. You are subsidizing the failure of their current habits.

4. The Loan Creates the Perfect Escape Route: Quitting

This is the cycle 80% of borrowing agents follow:

- Month 1: Borrow RM500

- Month 2: Borrow RM1,000

- Month 3: Borrow RM1,000 (total RM2,500–3,000)

Then reality hits: Their first commission will go entirely to repaying you. Instead of motivation, they feel resentment and fear. And the easiest way out?

Quit the agency. Reset to zero debt elsewhere. Start fresh with a new boss who hasn't "lent" them anything. You loaned money to retain them — but the loan is exactly what pushes them out the door.

5. Lending One Agent Money Corrupts the Entire Team Culture

If Agent A gets a loan…

- Agent B feels left out.

- Agent C starts hinting for help.

- Agent D stops working because "Boss will assist anyway."

Suddenly the agency is no longer performance-driven — it becomes complaint-driven. The loudest or most desperate REN gets rewarded. The disciplined REN gets ignored. This destroys your culture more effectively than fake listings or unethical behavior.

6. You Are Funding the Behavior That Will Eventually Damage Your Brand

It is a brutal irony: When you lend money to a starving agent, you are financing the desperation that will create:

- fake listings

- misleading ads

- unethical shortcuts

- buyer theft

- seller manipulation

- BOVAEP complaints

- brand damage

- lawsuits

You are literally paying for the future problem. A financially panicked agent is a compliance bomb waiting to explode.

7. Good Leadership Is Not About Lending Money — It's About Engineering Stability

The correct question is not: "Should I lend them money?"

The correct question is: "Why do they need money in the first place?"

Agents borrow because:

- The open listing market is chaotic and unpaying.

- They spend months chasing stock they don't control.

- They waste petrol on dead leads.

- They lack verified, exclusive inventory.

- Their closing cycles are too long.

- There is no commission protection.

- Their workflow is random.

- Their training is inconsistent.

- Their pipeline is non-existent.

No loan can fix any of these. But infrastructure can.

8. The Only Real Solution: Replace Loans With Systems

Instead of lending money, give agents:

- Verified, Exclusive, Protected Listings

So they work on stock that actually pays. - ListingMine's ACN Infrastructure

So "sailang," guesswork, and fake listings disappear. - Written co-broke agreements

So commissions are guaranteed. - Structured lead generation

So velocity improves. - SOP-driven prospecting and verification

So professionalism becomes operational, not moral.

With systems:

Ethical behavior becomes profitable. Pipeline becomes predictable. Closing cycles shorten. Agents stop starving. Because agents who eat regularly behave professionally.

The Rule Every Agency Should Adopt Today

"We do not lend money to agents. We provide systems that help them make money."

This is not cold. It is responsible.

A boss who loans money creates dependents. A boss who builds infrastructure creates professionals.

Strategic Bottom Line

If an agent needs a loan to survive, they are already failing — you are just delaying the reality.

Fix the economics. Fix the velocity. Fix the structure.

Stop being the Bank of Boss. Start being the Builder of Systems.

That is how real agencies scale.

That is how the profession matures.

That is how you protect your team — and your sanity.