Low Cost Is a Result, Not a Strategy: Why Real Coordination Infrastructure Is Expensive Before It Scales Cheaply

Every platform pitch eventually claims the same thing: "We're low cost." It sounds disciplined. It sounds capital-efficient. Most of the time, it is a lie.

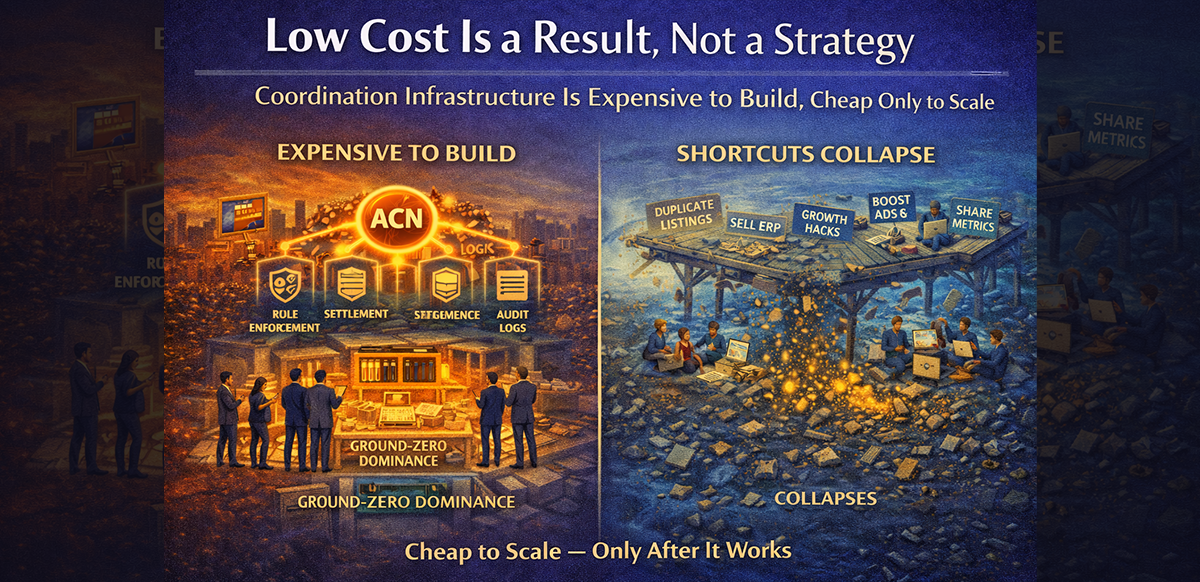

There is no cheap way to build coordination infrastructure. There are only cheap ways to scale after that infrastructure exists.

The Dangerous Confusion: "Low Cost" vs. "Low Effort"

Founders often confuse low marginal cost with low upfront investment. They are not the same.

Real coordination systems are expensive to build because they require:

- Clear Rules: Deciding exactly what happens in every edge case.

- Enforcement Mechanisms: Applying those rules even when it's uncomfortable.

- Audit Trails: Creating a verifiable history of every contribution.

- Overcoming Resistance: Managing the friction that occurs before behavior changes.

If your system has never faced conflict, it has never built coordination.

Why Most "Platforms" Fake Liquidity

Because real liquidity is hard, many platforms take shortcuts. They aggregate listings without verification, allow duplicates, and rely on massive marketing spend to simulate activity.

This creates the appearance of liquidity, not the substance. The moment incentives tighten, participation drops and the platform collapses. Fake liquidity is cheap to create—but it is also cheap to destroy.

Why ACN Cannot Start Cheap

An Agent Cooperation Network (ACN) cannot be bootstrapped with hype. It requires a Ground-Zero Proving Ground. Before expansion, the model must dominate one real environment—one agency in one city.

In this phase, the work is slow and unglamorous:

- The rules must actually work in the field.

- Disputes must be resolved by the system, not the "boss."

- Agents must learn to trust outcomes, even when they lose an argument.

Low cost is the reward for this foundational work, not the entry fee.

The High Cost of Shortcuts

Every shortcut avoids immediate pain, but that avoided pain always returns as:

- Governance Failure: The system breaks when handled by people who don't know the "Why."

- Trust Deficit: Agents realize the rules are flexible, so they stop cooperating.

- Structural Collapse: The system fails at scale, exactly when fixing it is most expensive.

Infrastructure either absorbs complexity early or collapses under it later. There is no third option.

What Real Capital Efficiency Looks Like

True capital efficiency in the Malaysian property market requires a specific trade-off:

| The Startup Approach | The Infrastructure Approach |

|---|---|

| High initial volume / Hype | High upfront discipline / Rules |

| Fast initial growth | Slow, verified growth |

| Political dispute resolution | Relentless, data-driven enforcement |

| Result: Fragile & Expensive to maintain | Result: Defensive & Cheap to scale |

Final Thought

"Low cost" is not a strategy; it is a result. If your coordination system looks cheap at the beginning, it is probably fragile. Real infrastructure is expensive to build, boring to operate, and extremely hard to replace.

But once it exists, it scales cheaper and faster than anything built on hype. That is the price of building something that lasts.