The 6 Valuation Methods Every Malaysian Real Estate Professional Must Master (MVS-Aligned)

To move beyond being a typical salesperson to a credible advisor—to sellers, buyers, and bankers—you must understand how a property's Market Value is determined under the Malaysian Valuation Standards (MVS).

This guide clarifies what “value” means and breaks down the six main methods professional valuers apply in Malaysia.

1. What Is "Market Value"? (Official MVS Definition)

Market Value is “the estimated amount for which a property should exchange on the valuation date between a willing buyer and a willing seller in an arm’s-length transaction, after proper marketing, where both parties act knowledgeable, prudent, and without compulsion.” - MVS

What This Means for Agent Advice:

| Principle | Practical Interpretation |

|---|---|

| Exclude abnormal sales | Bank auctions, distress, insider or related-party deals are not true Market Value. |

| Valuation Date matters | Yesterday’s price is not today’s value. All value is time-stamped. |

| Your role changes | Your price is based on evidence, not emotion or seller “hope price”. |

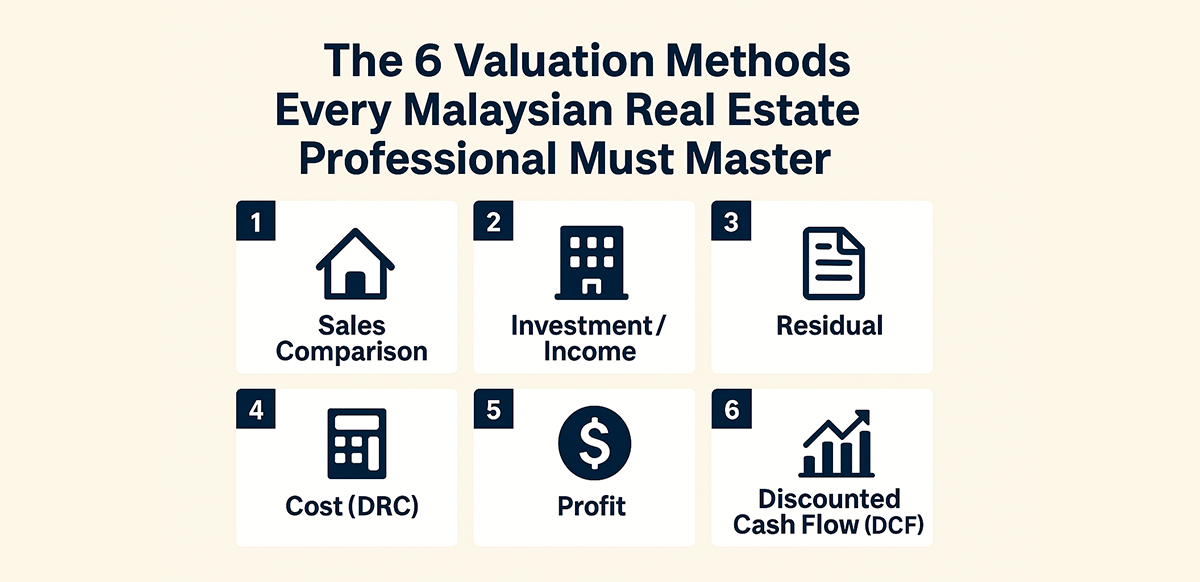

2. The 6 Core Valuation Methods in Malaysian Practice

Valuers use one or more of these MVS-aligned methods based on the type of asset and the availability of data:

| No. | Method | When It's the Primary Choice | Typical Assets |

|---|---|---|---|

| 1 | Sales Comparison | Ample recent, comparable transactions are available. | Subsale condos, landed homes, standard commercial units. |

| 2 | Investment / Income | Value is driven by stabilised, reliable rental income and market yields (Cap Rate). | Tenanted offices, retail lots, multi-let industrial units. |

| 3 | Residual | Valuing land based on the finished development's potential minus costs and profit. | Development land, redevelopment sites. |

| 4 | Cost (DRC) | Used primarily for unique assets, but also for insurance and cross-checking all properties. | Specialized properties (schools, utilities), new constructions. |

| 5 | Profit | Property is inseparable from the operating business; rent is not the primary driver. | Hotels, petrol stations, golf courses. |

| 6 | Discounted Cash Flow (DCF) | Value is dependent on multi-year cash flows, leasing cycles, and future capital expenditure. | Large investment assets (REITs, Grade-A offices, logistics parks). |

3. How Valuation Methods Affect Lending

Agents must anticipate the bank's valuation method to prevent loan rejections. Banks prefer methods that offer transparency and are anchored by market evidence:

| Asset Type | Likely Valuation Method | Implication for Agent |

|---|---|---|

| Standard Residential | Sales Comparison | Use 3-5 clean, recent comparables; exclude insider/distress deals. |

| Stabilised Shop/Office | Investment (Cap Rate) | Have the tenancy agreement and verifiable Net Operating Income (NOI) figures ready. |

| Development Land | Residual | Be prepared to justify the potential selling price and construction cost assumptions. |

Final Takeaway for Professional Agents

A real estate negotiator cannot issue a valuation, but a high-level agent must understand how valuers think.

Mastering these six methods allows you to:

- ✅ Set realistic seller expectations

- ✅ Anticipate loan valuation outcomes before submitting cases

- ✅ Communicate intelligently with valuers, bankers, and investors

- ✅ Shift from “agent” to advisor — the role clients truly pay for