MLS vs ACN: The Two Models of Cooperation — and Which One Fits Malaysia

Introduction

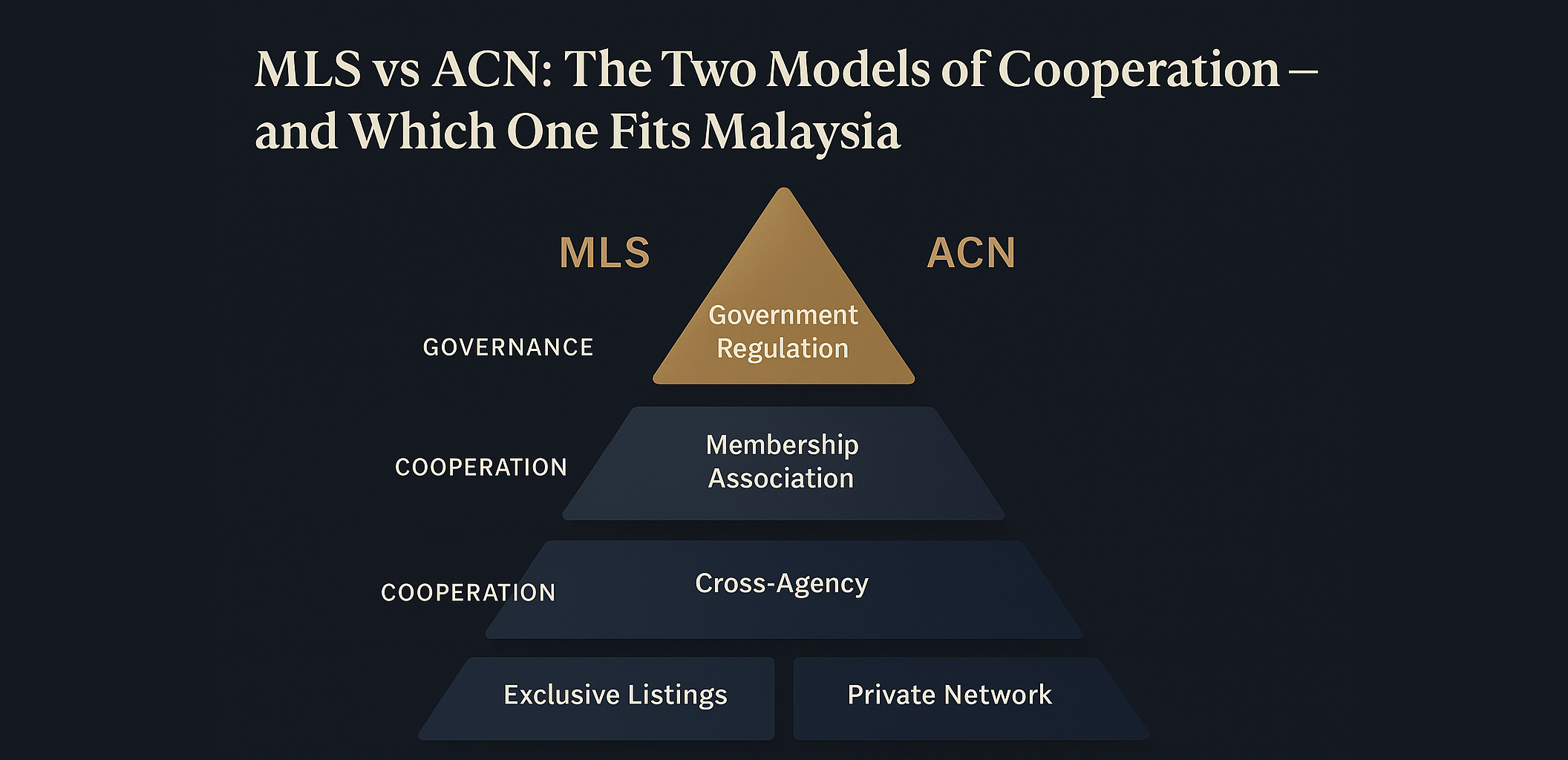

Every property market needs a framework for cooperation. Globally, two dominant models exist:

MLS (Multiple Listing Service) — a listing-centric, non-profit cooperation system.

ACN (Agent Cooperation Network) — an agent-centric, for-profit workflow ecosystem.

Both connect agents and enable co-broking. But their logic, revenue model, and legal foundations are very different — and those differences explain why ACN works where MLS cannot.

1. Core Logic and Structure

| Aspect | MLS (Multiple Listing Service) | ACN (Agent Cooperation Network) |

|---|---|---|

| Philosophy | “Share listings to expand exposure.” | “Verify cooperation to build trust.” |

| Core Unit | Property / Listing | Agent / Workflow |

| Ownership | Central database owned by association | Distributed ERP-based network owned by agencies / agents |

| Legal Foundation | Requires exclusive-listing law, disclosure statutes, and antitrust governance | Operates under existing agency licensing, PDPA & AMLA |

| Data Control | Association or MLS operator | Agent / Agency (decentralized, PDPA-compliant) |

| Trust Mechanism | Institutional + membership rules | Event-proof + audit trails |

| Profit Model | Non-profit; funded by membership fees | For-profit; sustained by ERP subscriptions & coordination fees |

| Scalability | Slow – requires national standardization | Fast – bottom-up through technology adoption |

2. MLS — The Listing-Centric Model

How It Works

Agents upload exclusive listings into a shared database. Buyer’s agents access those listings; cooperation and commission splits follow association rules.

Pros

- High listing transparency and consumer visibility

- Strong governance and standardization

- Improves market data accuracy

Cons

- Requires laws to enforce exclusivity (agency disclosure, RESPA, antitrust etc.)

- High cost to operate and audit

- No profit mechanism — depends on membership dues

- Weak fit in markets with independent or unlicensed agents

Bottom Line

MLS works only where law and association power enforce discipline. China and Malaysia both lack those legal foundations today.

3. ACN — The Agent-Centric Model

How It Works

Each agent or team operates within an ERP (like ListingMine). Roles are assigned per deal — Lister, Buyer Agent, Verifier, Finance PIC — and every contribution is timestamped. Commissions are auto-split according to proof-of-work.

Pros

- Compatible with fragmented, mobile agent markets

- Transparent and fair — role-based commissions

- Self-funded and profitable — sustainable without government grants

- Compliant with PDPA and AMLA (data stays with agents)

- Scalable — each agency can build its own ACN and connect nationally

Cons

- Needs digital adoption and workflow discipline

- Less public visibility than MLS (works best when linked to PropertySifu.com)

- Standardization still evolving between agencies

Bottom Line

ACN builds trust, traceability, and revenue — the three things MLS lacks in emerging markets.

4. Profit & Governance Difference

| Dimension | MLS | ACN |

|---|---|---|

| Institution Type | Non-profit association | For-profit platform |

| Revenue Source | Membership & tech fees | ERP subscriptions, transaction fees, data services |

| Governance | Board / Union rules | Smart-contract / event logs |

| Economic Outcome | Cost center (maintained by dues) | Profit center (aligns with agent success) |

Key insight:

MLS survives on regulation. ACN scales on incentives.

5. Which Model Fits Malaysia

Malaysia’s property ecosystem is:

- Fragmented (thousands of micro-agencies)

- Low-loyalty (agents switch firms often)

- Privacy-driven (PDPA compliance required)

- Lacking exclusive-listing or disclosure laws

That makes ACN the only realistic model. Each agency can operate its own ACN inside ListingMine ERP, then link into a National ACN Network — achieving cooperation now, and preparing for a legal MLS later.

Conclusion

| MLS | ACN |

|---|---|

| Exposure | Verified Cooperation |

| Non-profit | For-profit sustainable |

| Legal & Institutional | Proof & Technology |

| Regulator-led | Market-led |

| ✖️ Not yet feasible | ✅ Already practical and compliant |

MLS improves exposure. ACN builds trust — and pays for itself. That’s why Malaysia’s real estate future starts with ACN inside ListingMine ERP — a bottom-up bridge to a national MLS when the law is ready.