The Capital Trap: What Opendoor Got Wrong (And How Malaysian Agencies Can Fix It)

By ListingMine Academy | Platform Strategy & Venture Architecture

If you follow global proptech, you already know the story of Opendoor.

For years, they were hailed as the "Amazon of Real Estate." Their core promise was revolutionary: use algorithms to buy homes instantly with cash, renovate them, and resell for a profit. It was faster, smoother, and more certain than traditional selling.

But the reality has been harsh. Opendoor has lost billions, their stock has collapsed, and their struggles have exposed a structural flaw that threatens anyone who tries to copy them blindly.

To build a smart Malaysian proptech strategy, we must understand exactly what went wrong—and how to avoid the same trap.

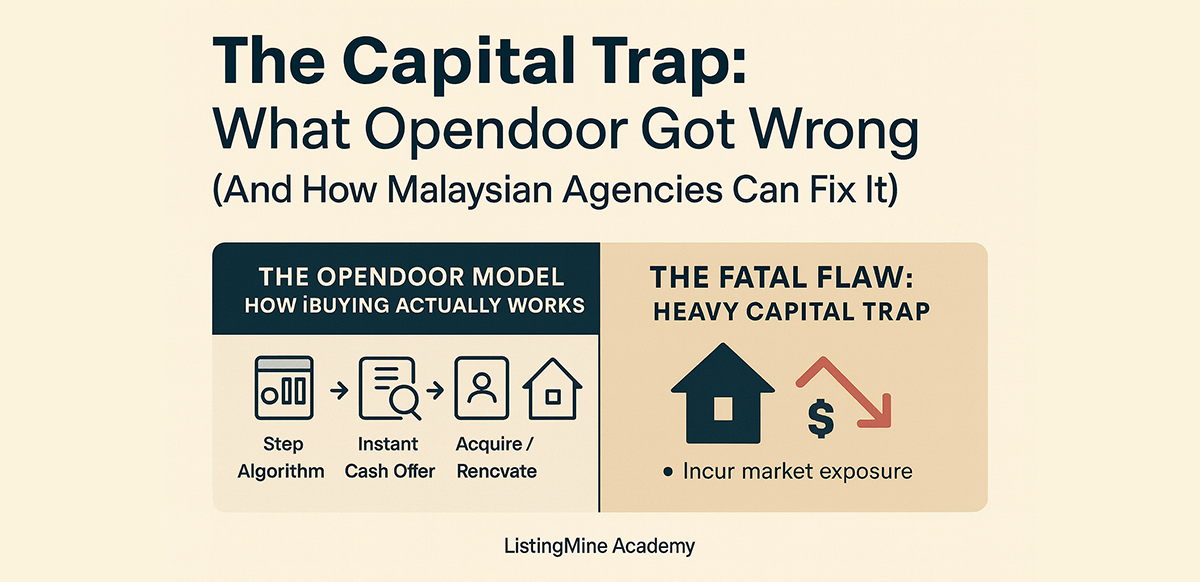

1. The Opendoor Model: How iBuying Actually Works

Traditional agencies are matchmakers: list → market → wait → commission. They take zero financial risk.

Opendoor inverted the model. They became the buyer. Here are the mechanics behind "iBuying":

- Step 1 — The Algorithm: Homeowners enter their address. Opendoor’s Automated Valuation Model (AVM) instantly estimates a price.

- Step 2 — Instant Cash Offer: Within 24–48 hours, Opendoor gives a firm cash offer.

- Step 3 — Inspection: If accepted, they inspect the property and deduct "repair costs."

- Step 4 — Acquisition: Opendoor pays the seller and takes the title.

- Step 5 — Renovation & Resale: They upgrade, relist, hold the inventory, and hope to sell at a profit.

Their Profit Plan:

They aim to make money on a Service Fee (5%–14%) and Appreciation Gains. On paper, it looks like the future. In practice, it hides a structural danger.

2. The Fatal Flaw: The Heavy Capital Trap

Opendoor did not fail because of bad technology. Their algorithms were strong, and their user experience was elegant.

The flaw was structural: They tied their business to the balance sheet.

To scale, Opendoor had to borrow billions to buy thousands of homes. They became a warehouse full of inventory.

When the market goes up: It works beautifully.

When the market turns: It collapses.

The Crash of 2022:

When US interest rates rose and home prices dipped, Opendoor was suddenly holding thousands of homes worth less than their purchase price. Meanwhile, their debt financing costs skyrocketed.

They weren’t killed by real estate. They were nearly killed by the capital.

3. The Core Insight: Market Maker vs. Bank

Opendoor’s ambition was correct. Every market—including Malaysia—needs someone to speed up transactions, provide liquidity, and remove friction. Being a Market Maker is the right goal.

But Opendoor made one wrong assumption: To be the Market Maker, you must also buy the asset.

So if owning the asset is the trap, how do you create liquidity without the liability?

The answer lies in becoming a transaction orchestrator, not a warehouse. This "asset-light" approach is precisely what several Chinese players perfected.

4. The China Model: The “Asset-Light” Market Maker

Several Chinese agencies achieve the same outcome as Opendoor—faster sales, higher quality, upgraded stock— without holding a single unit of inventory.

They separate:

renovation & value creation

from

ownership & financial risk

Below are the three proven models Malaysian agencies can apply immediately.

Model 1: The Owner-Funded Flip (Zero Risk)

Problem:

A run-down unit cannot compete.

Play:

The agency designs and manages the renovation. The owner funds the cost.

Value to Owner:

professional project management

higher sale price

faster turnaround

Risk to Agency:

Zero. You’re selling Upgrade-as-a-Service.

Model 2: The Shared-Risk Flip (Agency/Agent Advances the Funds)

Problem:

The owner has no cash for renovation.

Play:

The agency or agent advances RM10k–RM30k.

Protection:

A legal agreement guarantees:

repayment of renovation cost

plus a premium (e.g., +20%)

deducted before commissions when the unit sells

Benefits:

no title transfer

no RPGT

no stamp duty

minimal holding risk

You align interests without holding the asset.

Model 3: The Menu-Based Bundle (The Smartest Play)

Problem:

Renovating before finding a buyer is risky—buyers have different tastes.

Play:

You list the house unrenovated, BUT market it with 3D design options:

Modern

Industrial

Scandinavian

Execution:

Buyer selects the style →

Sale is locked →

Renovation is bundled into the purchase price (and ideally the loan).

Workflow

Unrenovated Unit → 3D Renders → Buyer Selects Style → SPA Signed → Renovation Starts

Result:

Buyers get customisation

Sellers get faster results

Agents get higher conversion

Agencies take zero inventory risk

5. Why This Matters for Malaysia Now

Why is this strategy urgent for the Malaysian market today?

We are facing a massive inventory of aging secondary properties that cannot compete with new developer launches.

The Gap: New launches offer "Zero Down" and "Fully Furnished" packages. Sub-sale homes require a 10% deposit plus RM50k cash for renovations.

The Opportunity: Malaysian buyers have loan eligibility but are cash-poor.

The Fix: By adopting the Menu-Based Bundle, you allow secondary market buyers to finance their dream home renovation just like a new project. You solve the biggest friction point in the market—cash entry cost—without buying the house yourself.

6. The Real Lesson: Innovation Without the Weight

Opendoor proved that sellers want speed and buyers want quality. Liquidity has value.

But they also proved that you do not win by carrying the asset. You win by orchestrating the ecosystem.

If you want to enable renovations, build the contractor network and legal workflows.

If you want to modernize the transaction, build the coordination and compliance systems.

Become the Market Maker. Just don’t become a Bank.