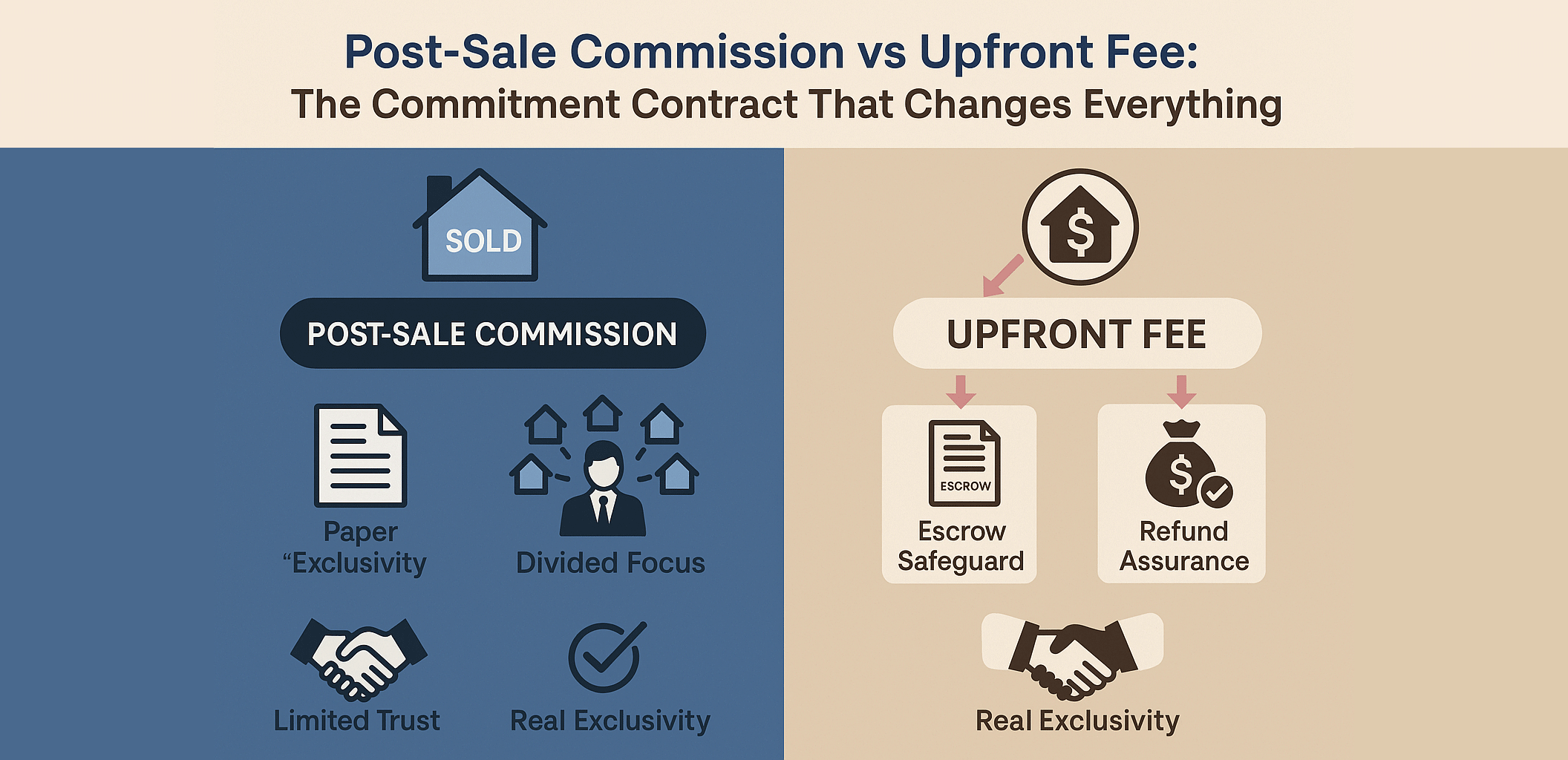

Post-Sale Commission vs Upfront Fee: The Commitment Contract That Changes Everything

In a cooling market where listings pile up and buyers hesitate — or in a hyper-competitive market where every unit starts to look the same — the old “spray and pray” model of real estate agency is breaking down.

The agents still closing deals today aren’t the ones working harder; they’re the ones working smarter — those who have shifted to a professional, accountable partnership with their clients. And at the center of that shift is a new standard of engagement: the Commitment Contract — powered by upfront fees instead of post-sale commissions.

1. The Post-Sale Commission Model — Exposure Without Ownership

The “no win, no fee” structure has long defined real estate.

It sounds fair: if the property doesn’t sell, you don’t pay.

But fairness and effectiveness aren’t the same thing.

In practice, this model spreads agent effort too thin — creating more listings than results.

The Agent’s Dilemma

- Diluted Focus – Agents juggle 30–50 listings and chase whichever deal looks easiest to close.

- Bypass Risk – After months of effort, owners sometimes close privately with a buyer the agent introduced, leaving the agent unpaid.

- Internal Competition – Even within the same agency, negotiators compete rather than collaborate. Lead protection replaces teamwork.

The Owner’s Reality

Your property gets exposure — but rarely gets ownership.

The marketing is broad, not deep. The focus is wide, not sharp.

You’re not hiring a partner. You’re hiring hope.

2. The Upfront Fee Model — Turning Listings into Projects

The upfront commitment model changes the entire equation.

Instead of an open-ended promise, you and your agent enter a defined partnership.

A small upfront payment — a retainer, marketing deposit, or partial commission — becomes a financial signal of seriousness on both sides.

The Agent’s Transformation

- Priority Mandate – The property is flagged as a paid project, not just another listing. Dedicated time, content, and follow-ups are now guaranteed.

- Trust Restored – With fear of bypass removed, the agent invests confidently in advertising, staging, and co-broking.

- Collaboration Unlocked – The fee transforms competition into cooperation. Colleagues share buyers, not guard them. Everyone wins when the property closes.

The Owner’s Advantage

You’re not pre-paying for risk. You’re pre-paying for focus.

You turn a passive listing into an active campaign, backed by accountability and structure.

3. Why Paper Exclusivity Isn’t Real Exclusivity

Most “exclusive appointments” exist only in theory.

Owners routinely sign multiple “exclusive” letters — or casually allow another agent to bring a buyer when things seem slow.

The reality is, without a financial commitment, exclusivity is a grey area.

We’ve seen countless cases where an impatient owner informally allows a second agent to step in, creating conflict, confusion, and resentment.

The original agent loses motivation — and the property loses momentum.

The Financial Bond Makes Exclusivity Real

When money changes hands, commitment becomes tangible.

An upfront fee establishes a clear financial bond between both sides:

- The agent is now accountable to deliver.

- The owner is now contractually bound to respect the agreement.

If the owner breaches the contract, the agent can deduct damages from the prepaid commission.

If the agent fails to perform, the fee is refunded in full.

Escrow and Refund Protection

To protect both parties:

- Funds can be parked in the agency’s client account, or

- Held by an appointed lawyer in escrow, pending successful sale.

This structure gives both sides confidence:

The owner risks nothing. The agent gains permission to perform.

4. How the Commitment Model Elevates Every Segment

| Segment | Post-Sale Commission | Upfront Fee (Commitment Contract) |

|---|---|---|

| Residential | Agents upload and wait. | Agents prioritize, stage, and drive results. |

| Developer Projects | Agents jump across projects. | Developers secure loyalty with structured retainers. |

| Commercial | Long cycles drain motivation. | Retainers sustain research, prospecting, and follow-up intensity. |

Whether residential, project, or commercial — the principle is identical:

shared risk creates shared results.

5. The Commitment Contract in Practice

The modern agency no longer relies on blind trust.

It relies on transparent, performance-based governance.

A proper Commitment Contract defines:

- The duration of exclusivity (e.g., 3–6 months).

- The refund condition if the property is not sold.

- The fee-holding mechanism (client account or escrow).

- The marketing plan and deliverables.

- The commission structure upon success.

This transforms a simple appointment letter into a professional service agreement — one that both sides can trust and enforce.

6. Why Now — And What You Should Do Next

The Malaysian property market is entering a new phase: slower absorption, more cautious buyers, and smarter owners who demand transparency. Agents who still rely on the “upload-and-wait” model will soon be replaced by those who can demonstrate accountability and governance.

If you’re an agent:

- Use ListingMine ERP to set up your ACN (Agent Cooperation Network) system.

It standardizes collaboration, commission splits, and proof-of-work. - Educate your sellers using this framework.

Explain why exclusivity matters, and how focus improves saleability. - Collect the upfront deposit together with the exclusive appointment.

Park it securely under your client account or lawyer escrow.

Build confidence that if you don’t perform, you refund it in full.

You’ll quickly find that once owners see a system with structure, transparency, and refund assurance, they’re more than willing to commit. And when owners commit — your team performs.

Conclusion: You’re Not Paying Early — You’re Paying for Certainty

Post-sale commission buys exposure.

Upfront commitment buys performance.

In an age where time kills deals and attention drives value, the future belongs to agents who turn their listings into governed partnerships.

The Commitment Contract isn’t a trend — it’s the new professional standard.

When both sides commit financially, both sides win decisively.