Profit Pools vs. Revenue Streams: Finding Your Agency's Unbeatable Advantage

Most property agencies measure success by tracking revenue streams—the various channels where money flows in. You monitor sales, lettings, and fees, and you celebrate when the top line grows.

But here is the hard truth: revenue is a vanity metric. Profit is sanity.

The most valuable agencies don't just see streams; they map their profit pools—the specific, high-margin intersections where unique competitive advantages combine to create truly defensible, superior returns.

Understanding this distinction separates the agencies that merely make a living from those that build lasting wealth.

The Critical Difference: Where Money Comes From vs. Where Profit Stays

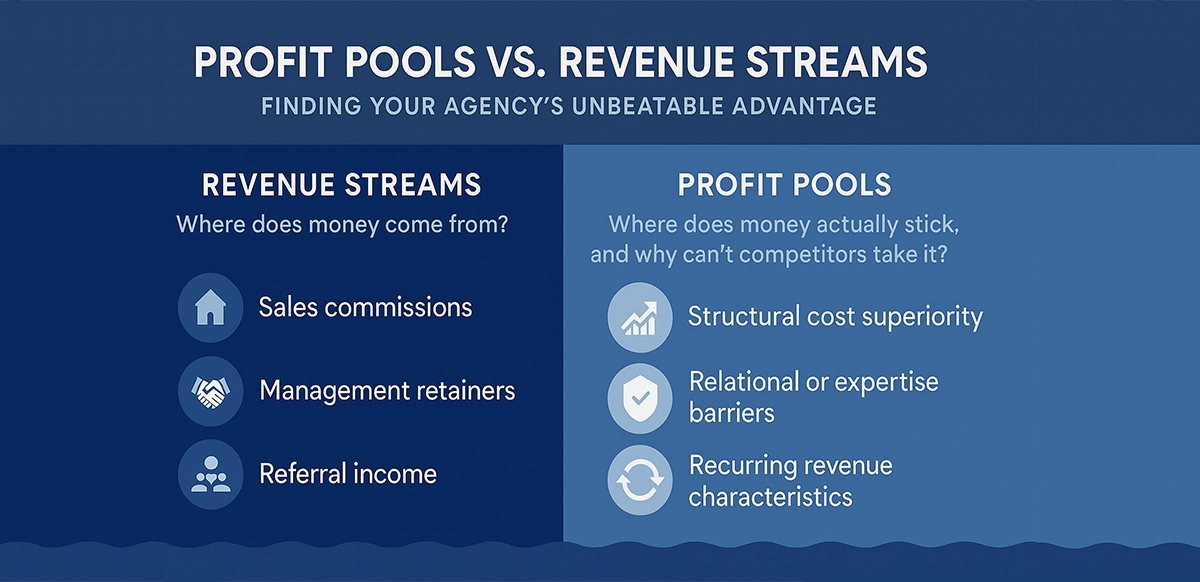

A Revenue Stream answers: "Where does money come from?" (Sales commissions, management retainers, referral income). This money is often transient—easily copied or undercut by competitors.

A Profit Pool answers: "Where does money actually stick, and why can't competitors take it?"

Your profit pools emerge where revenue streams meet your expertise, technology, or relationships. They are the places where you don't just earn money, but earn it more efficiently and sustainably than anyone else.

Mapping Your Agency's True Economic Landscape

While most agencies share similar revenue streams, their defensible profit pools tell radically different stories:

| Agency Archetype | Revenue Stream | Profit Pool | Defensibility Source |

|---|---|---|---|

| The Volume Specialist | High sales commissions | First-time buyer transactions under RM500,000 | Systemic efficiency that executes transactions 40% cheaper than competitors. |

| The Relationship Expert | High-value sales | RM5M+ off-market landed property in affluent neighborhoods. | Principal's 20-year relational access to wealthy families and discreet networks. |

| The Operations Leader | Property management fees | Management portfolio of 300+ mid-range condos | Proprietary technology that automates 80% of admin at 30% lower cost. |

The pattern is unmistakable: revenue streams represent surface activity, while profit pools reflect deep structural advantages that secure superior returns.

The Three Marks of a Defensible Profit Pool

Not all profitable activities create lasting advantage. Look for combinations of:

- Structural Cost Superiority: Can you deliver service significantly cheaper through specialized systems or technology? (Example: The student rental specialist who has templated everything, cutting costs by 50%.)

- Relational or Expertise Barriers: Do you possess relationships, knowledge, or authority that competitors cannot easily replicate? (Example: The agency led by a former city planner who dominates new development sales due to unmatched authority in approval processes.)

- Recurring Revenue Characteristics: Does the profit pool renew automatically? Property management is the classic example, but so is serving property investors who transact every 2-3 years—creating predictable, recurring transaction cycles.

The Strategic Shift: From Revenue Collection to Profit Domination

Most agencies make the critical error of chasing revenue everywhere. Sophisticated agencies identify their 2-3 genuine profit pools and aggressively reorient everything to dominate them.

The transformation requires disciplined execution:

- Audit Real Profitability: Move beyond gross margins. Calculate true net profit per service after allocating all costs—especially principal time. You'll often discover that "prestigious" high-revenue work actually delivers mediocre returns.

- Identify Structural Advantages: Pinpoint where your agency possesses an unbeatable advantage. If you're the only one with certified sustainability expertise, the high-margin "green premium properties" pool is yours to dominate.

- Reallocate Resources Strategically: Shift your best talent, marketing budget, and technology investments toward deepening your profit pool position. De-prioritize or exit revenue streams that add complexity without contributing defensible profit.

- Build Protective Moats: Once identified, make your profit pools structurally defensible. Document proprietary systems, deepen exclusive client relationships, and develop custom tools. Transform temporary advantages into permanent barriers.

The Essential Question: Where Are You Fishing?

Revenue flows everywhere in competitive markets. Defensible profit pools remain rare and precious.

The question for agency leaders shouldn't be "How can we increase revenue?" but rather:

"Where does our agency have—or can build—unbeatable advantages that allow us to extract superior, sustainable profits?"

That is your deep water. That is where you should concentrate your fishing.