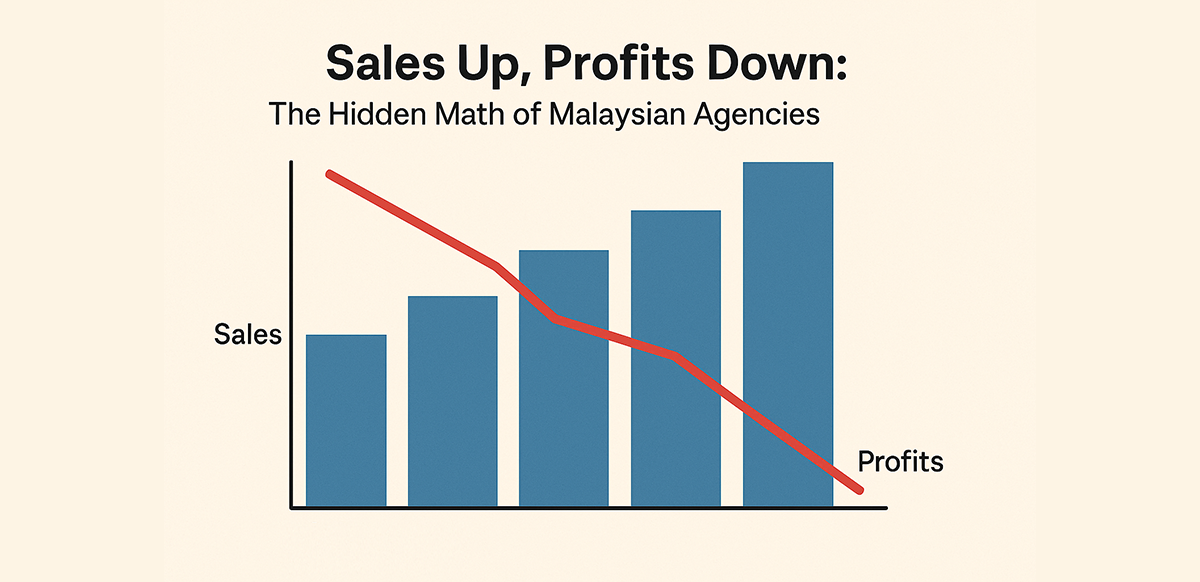

Sales Up, Profits Down: The Hidden Math of Malaysian Agencies

Why growing volume doesn’t always mean growing wealth — and how leadership blind spots quietly erode margins.

1. The Paradox of Growth

It’s the same story across Malaysia’s property agencies every good year — record sales, record headcount, record commissions. Yet, somehow, profits don’t move.

The company closes more cases, spends more on incentives, expands the team… and still ends up with less money at year-end. This isn’t bad luck or market volatility. It’s structural math — an arithmetic mismatch between growth and governance.

You don’t lose profit because you sold less. You lose profit because you scaled wrong.

2. The Hidden Math Behind the Celebration

Let’s unpack a simple example.

| Metric | 2024 | 2025 (After “Growth”) |

|---|---|---|

| Total Sales Volume | RM60M | RM100M |

| Gross Commission Earned (3%) | RM1.8M | RM3.0M |

| Average Agent Split | 70% | 80% |

| Company Gross Profit | RM540K | RM600K |

| Expenses (Office, Ads, Payroll, Events) | RM450K | RM700K |

| Net Profit Before Tax | RM90K | –RM100K |

Sales went up 67%, yet profits went negative. That’s not bad management — that’s commission inflation.

The more you sell under an inflated reward system, the less oxygen your company keeps.

3. The Commission Trap: When Generosity Becomes Debt

In the race to recruit and retain agents, many leaders turn commission splits into weapons of loyalty.

- 80/20 becomes 85/15. Then 90/10.

Eventually, “top agents” keep so much that the agency becomes a cost center serving its own team.

Every new recruit is celebrated, but each one quietly erodes the margin structure. The irony: the very success of the agents — which should strengthen the firm — ends up bankrupting it.

That’s why in mature markets, real profitability doesn’t come from volume; it comes from role-based structure, not ratio-based giveaways.

4. The Inflation of Non-Productive Costs

When volume rises, so do invisible costs:

- Administrative drag — more deals, more payouts, more disputes.

- Compliance burden — more projects, more documentation risk.

- Marketing inflation — more ads needed to compete in a saturated digital space.

- Leadership fatigue — the founder now works in the business, not on it.

None of these costs are visible in the sales report, but they’re embedded in the profit leak. The result: busier months, thinner margins.

5. The Real KPI: Profit Per Agent

The only number that matters isn’t sales volume or headcount — it’s profit per active agent. That’s the true health indicator of any agency.

Here’s what that math often reveals:

- 20% of agents produce 80% of sales,

- 50% are breakeven or loss-making,

- 30% drain resources through admin, support, or lead wastage.

A smart agency doesn’t chase more agents. It chases productive ones — supported by automation, accountability, and scalable systems like ListingMine ERP that make 100 agents feel like 500 without multiplying headcount cost.

6. The Cost of Chaos: When Growth Outpaces Systems

Most Malaysian agencies expand faster than their systems mature. Every file, payout, and commission is handled manually or through WhatsApp.

At 10 agents, that’s tolerable. At 100, it’s financial suicide.

Manual systems hide leakage:

- Missing co-broke receipts

- Misallocated commissions

- Delayed payouts that trigger resignations

- Redundant portal subscriptions

Without automation, growth doesn’t scale — it fractures. Revenue grows arithmetically, but complexity grows exponentially.

7. The Remedy: From Volume Growth to Efficiency Growth

There are only three levers that increase profit, not just sales:

- Commission Discipline: Replace arbitrary splits with role-based or performance-tied logic.

- Systemization: Centralize accounting, co-broking, and ERP workflows to eliminate redundancy.

- Culture Shift: Teach agents that sustainability protects their long-term income; it’s not the enemy of independence.

The goal is not to cut costs — it’s to stop bleeding profit silently. Because in real estate, most companies don’t die from lack of sales. They die from lack of visibility into what those sales truly cost.

8. The Final Equation

Profit = (Commission Logic × System Efficiency) – (Recruitment Chaos × Overhead Inflation)

Until you control all four variables, every RM1M increase in sales risks producing less profit than the year before.

The smartest Malaysian agencies aren’t chasing record-breaking months anymore. They’re building record-breaking margins — powered by governance, not adrenaline.

Bottom Line

Sales can buy you applause. But profit buys you survival.

The agencies that learn this distinction early will own the next decade — while others keep mistaking noise for growth.