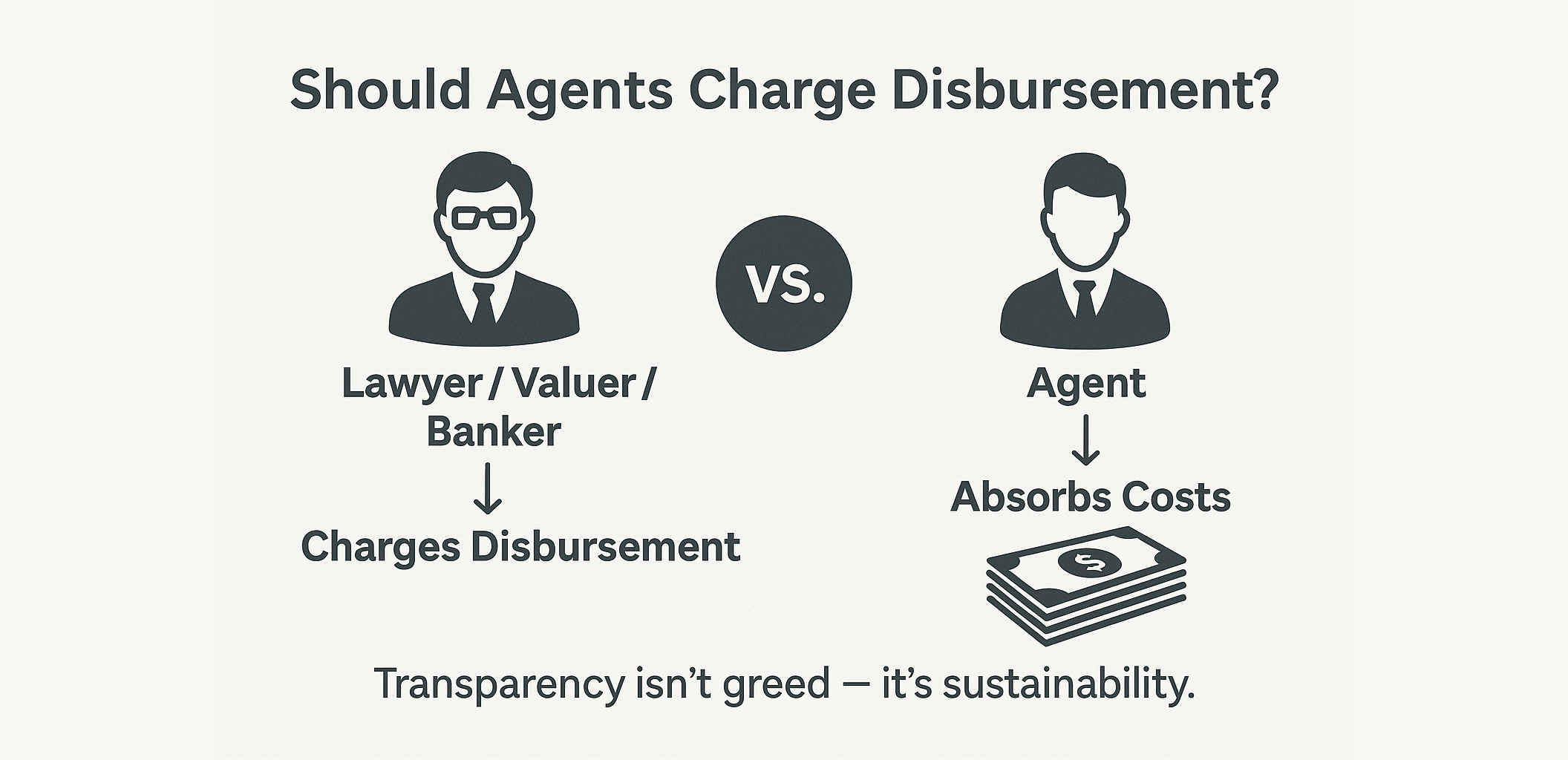

Should Agents Charge Disbursement?

In most professions, disbursement fees are normal.

Lawyers, bankers, valuers, and even conveyancers itemize every third-party expense — from stamping to courier, photocopying, and transport.

Yet in the property agency world, disbursement fees are almost unheard of.

Most agents work as if the 3% commission must cover everything — every photocopy, fuel trip, parking ticket, and courier envelope — often inclusive of SST.

It’s a silent tradition that no longer makes sense in today’s professional economy.

1. What is a Disbursement Fee?

A disbursement is not profit — it’s a reimbursement. It covers expenses an agent pays upfront on behalf of the client to complete the transaction.

Typical examples include:

- Printing and couriering tenancy agreements.

- Transportation to hand over keys or collect documents.

- Parking and toll charges during property viewings.

- Minor document or photo processing costs for submissions.

In other industries, these are recorded and billed transparently. In real estate, they’re quietly absorbed — and forgotten.

2. Why Agents Rarely Charge It

There are several reasons why most Malaysian agents don’t charge disbursement:

- a) Fear of Losing the Client

Agents already face competition from hundreds of others. Asking for extra fees feels risky — especially when others are willing to “absorb everything.” - b) Informal Market Culture

Unlike law firms or valuation offices, property agencies rarely have standardized billing systems. Everything is “all-in” for simplicity. - c) Misunderstanding of Professional Norms

Many agents confuse disbursement with double charging. They worry clients might think they’re “charging extra,” when in fact, it’s a legitimate recovery of actual costs.

3. The Hidden Cost of Free Service

Every small “favour” adds up.

A single deal may involve:

- Five trips to the property for viewings and handovers.

- Printing and couriering agreements twice.

- Paying for parking, petrol, tolls, and phone bills.

When you total that, it’s not unusual for an agent to spend RM100–RM300 out-of-pocket — before even seeing the commission cheque.

And if the deal collapses?

Those costs are never recovered.

4. Why Other Professionals Don’t Work This Way

Lawyers charge RM10 for a letter.

Valuers charge report preparation fees.

Bankers charge processing and stamping fees.

All of them recognize that professional work involves time + disbursement + liability — not just outcome-based reward.

Agents, on the other hand, carry equal liability (sometimes more) but are still expected to bear every incidental cost in silence.

5. How Agents Can Charge Fairly

Charging disbursement isn’t about squeezing clients. It’s about formalizing professionalism.

Here’s how to do it responsibly:

- a) Itemize Transparently

Include a “Disbursement Clause” in your Letter of Appointment or Offer to Let/Sell, clearly stating what is claimable — e.g., transportation, courier, document printing, etc. - b) Use Actual Receipts

Avoid blanket charges. Keep receipts or e-wallet records for all disbursement claims. - c) Set a Cap

Agree on a maximum limit (e.g., RM150–RM200) to keep expectations clear. - d) Clarify What’s Not Included in Commission

Your commission covers professional service and negotiation — not third-party expenses.

6. The SST Confusion

Many agencies assume they can’t charge disbursement because their 3% commission already includes SST. That’s incorrect — SST applies to the professional fee itself, not to third-party expenses.

Disbursement items, when properly recorded and evidenced, are non-taxable reimbursements.

In short: you’re not “double taxing” anyone — you’re reclaiming what you’ve already spent.

7. The Bottom Line

The question isn’t whether agents should charge disbursement — it’s why they don’t.

In a profession where results are uncertain, and expenses are real, transparency is not greed — it’s sustainability.

Because while the 3% commission looks big on paper, by the time you deduct petrol, parking, phone bills, courier costs, and time — you’ll realize most agents are quietly subsidizing their clients.

It’s time to make professionalism measurable, and that starts with charging like every other profession does — fairly, clearly, and confidently.