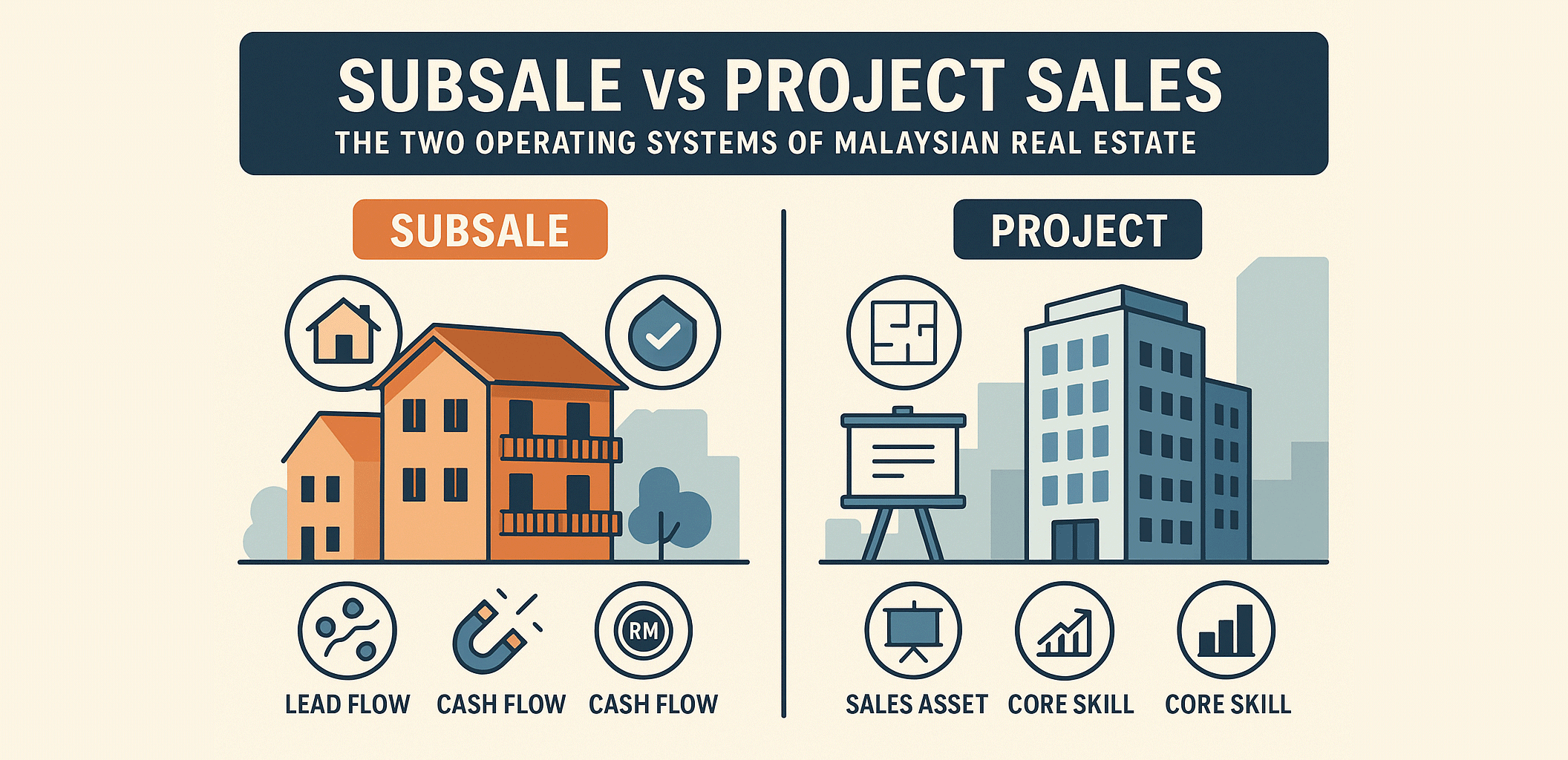

Subsale vs Project Sales: The Two Operating Systems of Malaysian Real Estate

For Malaysian property agents, the market splits into two distinct worlds: subsale (secondary market) and project sales (new launches). Both lead to a sale — but they demand completely different skills, workflows, and mindsets.

Long-term success isn’t about choosing one side. It’s about understanding the rules for each game and building the professional “muscles” to win in both.

Subsale vs Project: Two Operating Systems

| Dimension | Subsale (Secondary Market) | Project (New Launch) |

|---|---|---|

| What You Sell | A specific, existing unit with real condition, ownership history, and tenant profile. | A future product — lifestyle, concept, and standardized floor plans from a developer’s inventory. |

| Lead Flow | Mostly inbound — built on referrals, past clients, or listing inquiries. | Mostly outbound — campaign-driven, using events, digital ads, and team prospecting. |

| Sales Asset | The real unit itself — physical viewings are essential. | The concept — presented through a sales gallery, visuals, and 3D tours. |

| Cash Flow | Faster payment cycle — commissions released soon after S&P signing. | Slower progressive payouts tied to the developer’s billing stages under the HDA. |

| Core Skill | Realism — pricing, valuation, negotiation, defect handling, tenancy know-how. | Engine — pipeline discipline, strong presentations, clear KPIs, teamwork and follow-up routines. |

What Each Market Teaches You

Each side trains different abilities — and the best agents borrow from both.

Subsale Builds Realism and Trust

Subsale agents are market interpreters. They live and breathe real prices, defects, and human expectations.

- Market Sense: You develop an instinctive understanding of fair value per square foot within your area.

- Negotiation Power: You learn to handle owner expectations, defects, timing clashes, and valuation issues.

- Tenancy Know-How: You master how landlords operate — short-term tenancies, deposit rules, vacancy cycles, and renovation costs.

Project Builds Scale and Systems

Project agents are campaign builders. They work in structured, repetitive systems designed for volume.

- Pipeline Discipline: Daily calls, follow-ups, and list-building become second nature.

- Presentation Power: You learn to explain value with visuals, calculators, and simple investment logic during previews.

- Process Clarity: You operate with defined caller-closer roles, weekly KPIs, and teamwork that keeps the campaign engine running.

Cross-Training Advantage: How Each Side Strengthens the Other

The most successful agents borrow the “missing muscles” from the opposite camp.

Why Subsale Agents Excel in Projects

You bring credibility and realism to project sales because you understand the secondary market.

- Investor Trust: You can back your pitch with actual transacted data and rental yields from surrounding areas.

- Grounded Comparison: You show buyers what nearby resale options cost, proving that the project is competitively priced.

What to Add: Adopt the project agent’s pipeline rhythm — learn early loan screening, organize client previews, and manage high-volume follow-ups efficiently.

Why Project Agents Excel in Subsale

You bring structure, marketing polish, and CRM habits to a field where most agents operate alone.

- Listing Generation Engine: Your project-style calling and tracking habits help you consistently secure fresh listings and find new stock before competitors.

- Professional Owner Briefings: You apply presentation discipline — explaining pricing, marketing plans, and timelines with clarity and data.

- Speed Through Systems: Your CRM mindset shortens viewing turnaround and reduces days-on-market dramatically.

What to Add: Build realism — learn property valuation, manage owner relationships, handle defects, and set up proper tenancy workflows.

Common Pitfalls and Practical Fixes

| Pitfall | Market | Practical Fix |

|---|---|---|

| Listing Wars | Subsale | Stop fighting over the same open stock. Focus on relationship-based trust and deliver a superior marketing experience. |

| Loan Fallout | Project | Pre-screen early. Use DSR estimates and confirm loan eligibility before collecting booking fees. |

| Referral Droughts | Subsale | Add a light outbound routine — geo-farm your area, send monthly updates, or host local property briefings. |

| Solo Habits | Project | Enforce caller–closer pairings and weekly pipeline reviews to ensure consistent follow-up. |

| Generic Pitches | Both | Separate your pitch logic for “Investor” versus “Own-Stay” buyers — the maths and emotions are different. |

| Attention Drift | Both | Focus on one proven tactic at a time. Measure weekly before layering new strategies. |

Choosing Your Focus

- Lean Subsale if you: Prefer tangible assets, enjoy one-to-one negotiations, and want faster S&P-to-commission cycles.

- Lean Project if you: Thrive on structured teamwork, enjoy mass prospecting, and want to master campaign-driven selling.

But for the truly ambitious agent, the answer is both — with separate pipelines, scripts, and weekly targets for each. By respecting each market’s playbook and deliberately building the “missing muscles” from the other side, you become a complete professional — adaptable to any market cycle.

System Tip: Manage Both Worlds Seamlessly

Whether you’re handling a subsale unit or running a project campaign, ListingMine ERP keeps your listings, documents, and commissions organized in one place — so your business runs smoothly, no matter which side you’re playing on.