The Acquisition Mindset: How to Value and Integrate a Small Real Estate Agency

The industry maintains a cynical truth:

“Agencies have no value; once the top agents leave, everything collapses.”

This perception exists because most agencies are built for commission volume, not enterprise value.

However, this doesn't mean an agency can’t be acquired. It means professional buyers must value the firm not by its transient profit, but by its structural replacement cost and integration readiness.

1. Why Traditional Valuation Fails the Agency Model

| Metric | The Flaw in Real Estate Agencies |

|---|---|

| P/E Ratio | Earnings are highly volatile and transactional. There is no recurring revenue base like a software subscription. |

| DCF | Cash flow depends on agent activity and market timing, making projections hard to justify beyond 6–12 months. |

| Book Value | The assets (furniture, signboards) are negligible. The real value—relationships and knowledge—is intangible. |

The smart acquirer realizes they aren't buying past profits; they are buying acceleration. The core question is:

“How much time, effort, and risk would it take to build this same asset from scratch?”

2. The Real Formula: Valuing Acceleration and Infrastructure

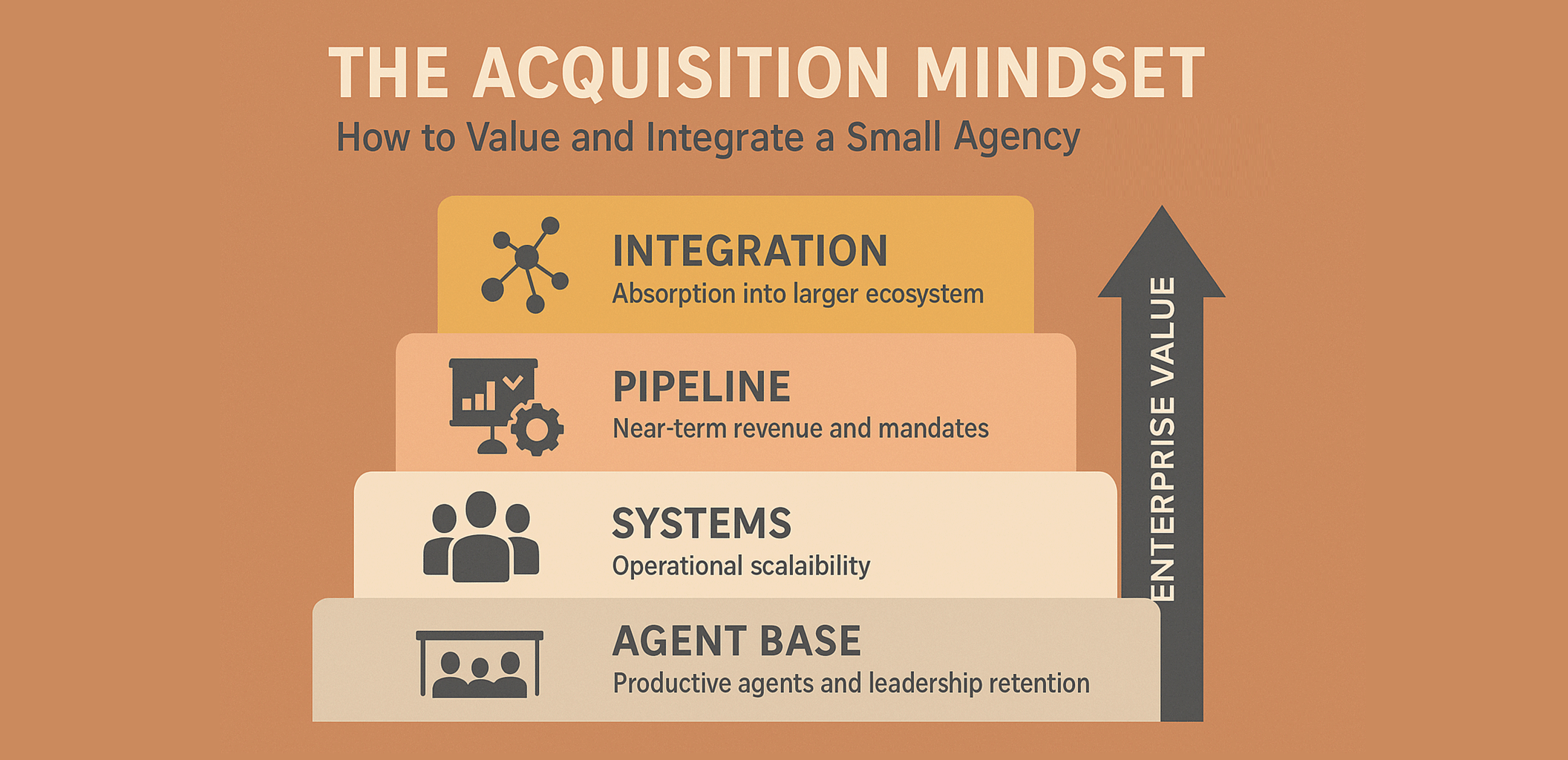

Acquisition value must be viewed as the cost to replace the target agency’s speed and operational base. We quantify this value in four layers.

A. Agent Base & Leadership Value (The Risk Premium)

This is not a simple cost-per-agent; it’s primarily a risk assessment of how many active, productive agents and irreplaceable team leaders can be retained.

For minimal-value transactions (typically RM20k–RM30k), the purchase is often just for the Principal’s REA Licence (which allows immediate operation) and the administrative transfer of the existing agent register. As a baseline, the cost to transfer an active agent is typically valued between RM500 to RM1,000 per active agent.

Valuation Focus: The true, higher-tier value lies in the team leaders (those who control 80% of the production).

Acquirer’s Measure: Estimate the expected Gross Commission Income (GCI) locked in by the core leaders over the next 12 months. The purchase price will be a small multiple (0.3x to 0.8x) of this retainable GCI, provided strong lock-in agreements are secured.

B. Revenue Momentum & Pipeline Value

This assesses the quality of the immediate business pipeline that transfers over.

Valuation Focus: Developer project authorizations, exclusive mandates, or established commercial leases that generate near-term GCI.

Acquirer’s Measure: Estimate the value of 1–3 months of projected net commission from these secured pipelines. This offers immediate cash flow to offset integration costs.

C. System and Operational Leverage

This measures the quality of the non-human infrastructure.

Valuation Focus: Does the agency have robust SOPs, a verified inventory listing database, trained admins, and a clean commission structure?

Acquirer’s Measure: The value equals the cost avoidance of building these systems internally. A clean, compliant, and well-documented agency saves the buyer significant migration costs and legal headaches—easily justifying a premium.

D. Brand and Access Value (Zeroing the Brand Equity)

Local agency branding generally carries no acquirable equity, regardless of how long it has existed. Clients follow agents, not agency logos.

Valuation Focus: Exclusive developer access or geographic market share.

Acquirer’s Measure: This should be valued as a direct proxy for the pipeline (Section 2B).

Do not pay a separate premium for the brand name itself—pay for the access that the brand has secured.

3. The Hidden Trap: De-risking Personal Dependency

Most small agencies are personality-driven.

If the principal leaves, the value evaporates.

The acquisition must be structured to mitigate this key risk.

Mandatory Lock-In Terms:

Require all principals and key team leaders to remain for at least 12–24 months, focusing on culture integration and agent retention.

The Earn-Out Clause:

The most critical tool. Structure the payment so that 40%–60% of the price is paid only upon sustained performance (e.g., maintaining 80% of agent count or 90% of revenue for 12 months post-acquisition).

This aligns the seller’s long-term interest with the buyer’s success.

Immediate Tech Audit:

Ensure all listings, deal pipelines, and agent records are digitized and migrated to the buyer’s system.

Buy the data, not just the handshake.

4. The Smart Buyer’s Playbook: Integrating Value

The real ROI comes not from the purchase price, but from the speed and efficiency of integration.

Buy the System, Not the Boss:

Focus due diligence on SOPs and data readiness—not just the principal’s reputation.

Vested Retention:

Lock in team leaders using profit-share deals (shared interest in the combined entity) rather than just cash bonuses. This builds long-term loyalty.

Use Integration as a Weapon:

- Immediately plug the acquired agency into your existing ecosystem:

- Shared verified inventory

- Shared compliance and commission engine

- Shared developer network access

- Unified reporting and KPI tracking

The acquired agency transforms from a transient sales office into a permanent, compounded asset.

Disclaimer

The calculations and benchmarks presented here are for illustrative discussion only and do not constitute professional financial advice. The writer of this post is not a certified business valuation expert or financial consultant. Always consult a qualified financial or legal advisor before making any acquisition decision.