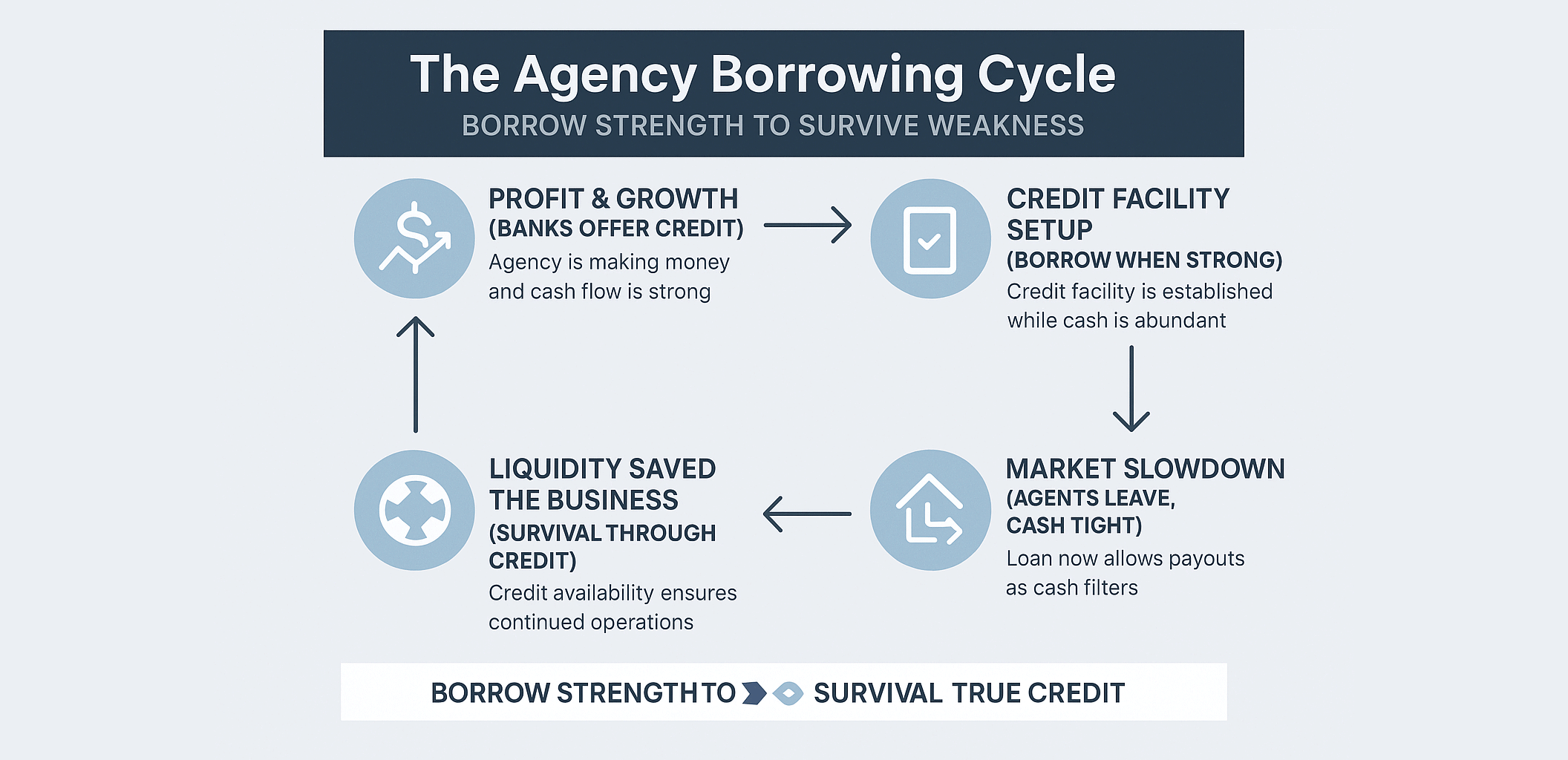

The Agency Borrowing Cycle: Why You Must Secure Credit When You Don’t Need It

In the property agency business, a dangerous illusion often takes hold during boom times: the belief that abundant cash flow makes external borrowing unnecessary. When banks call offering facilities, many agency owners proudly respond, “No need. We have enough cash.”

This is usually a critical mistake in financial planning. Borrowing is not just about debt; it’s about strategic timing and preparedness.

When You’re Strong, Banks Offer You the Best Terms

The best time to establish working capital lines, revolving credit, or bridging facilities is precisely when you least need them.

During high-growth periods, your agency possesses the ideal profile for lenders:

- Positive Cash Balances and strong reserves.

- Predictable Revenue Cycles and steady project pipelines.

- Clean Financials and a strong reputation.

It's like building a financial lifeboat when the sea is calm—not when the storm hits and the panic sets in. At this stage, you can negotiate:

- Better Rates (lower interest and margin).

- Larger Limits (sufficient to weather multiple market cycles).

- Flexible Terms (standby facilities with partial or zero drawdowns).

You secure the capacity while you have the power to dictate the terms.

When You’re Weak, Nobody Lends

Fast forward to a cash crunch. Maybe the market slows, top agents leave, or a major developer project is delayed, trapping millions in commissions for a year.

Your agency still needs to pay rent, salaries, and crucially, maintain its Fast Commission program to retain morale and prevent a mass exodus of agents.

The problem? When you desperately need capital, almost every bank will say no.

Credit risk models are backward-looking. They only extend trust when your recent financials (the last 12 months) show strength. Once your numbers dip, you are immediately classified as high risk—even if your fundamentals and pipeline are solid long-term. Agencies that rejected credit during the boom often face collapse during the inevitable downturn.

Liquidity is the Agency’s Oxygen

For modern real estate agencies, especially those offering fast commission payouts, liquidity is non-negotiable—it is oxygen.

When your firm promises to pay agents within days of an SPA signing, you are acting as an internal financier. This means:

- You advance the commission months or years before the developer pays you.

- You temporarily carry the financial risk for hundreds of concurrent deals.

Without pre-approved, unused credit lines, a sudden market slowdown or a single developer delay can choke your entire cash flow overnight. Securing these lines during strength ensures business continuity during weakness, allowing you to keep paying agents, protecting your brand, and buying crucial time for recovery.

Think Like a CFO, Not a Salesman

Most agency owners excel at sales but struggle with capital planning. They mistakenly equate immediate profit with long-term safety.

The companies that survive and thrive over the long term are those that use leverage intelligently, not emotionally.

- Secure Early: Set up facilities now. Do not wait for the market to signal distress.

- Use Strategically: Only draw down on the facility when necessary, not just because it's available.

- Treat Credit as Insurance: View the credit line as a form of business insurance—it's there to protect continuity and solvency, not to inflate your operational budget or lifestyle.

Final Thought: Borrow Strength to Survive Weakness

When your agency is profitable and feels invincible, that is the exact moment to plan for your future vulnerability.

Credit is an extension of trust in your future earnings, and banks only extend that trust when your present financial health is undeniable.

The next time a banker calls offering a facility, do not reject them out of pride. Set it up. Keep it ready. When the market inevitably shifts, that pre-approved facility could be the sole reason your agency survives while others around you collapse.

In the real estate world, the best time to borrow is when you don’t need to.