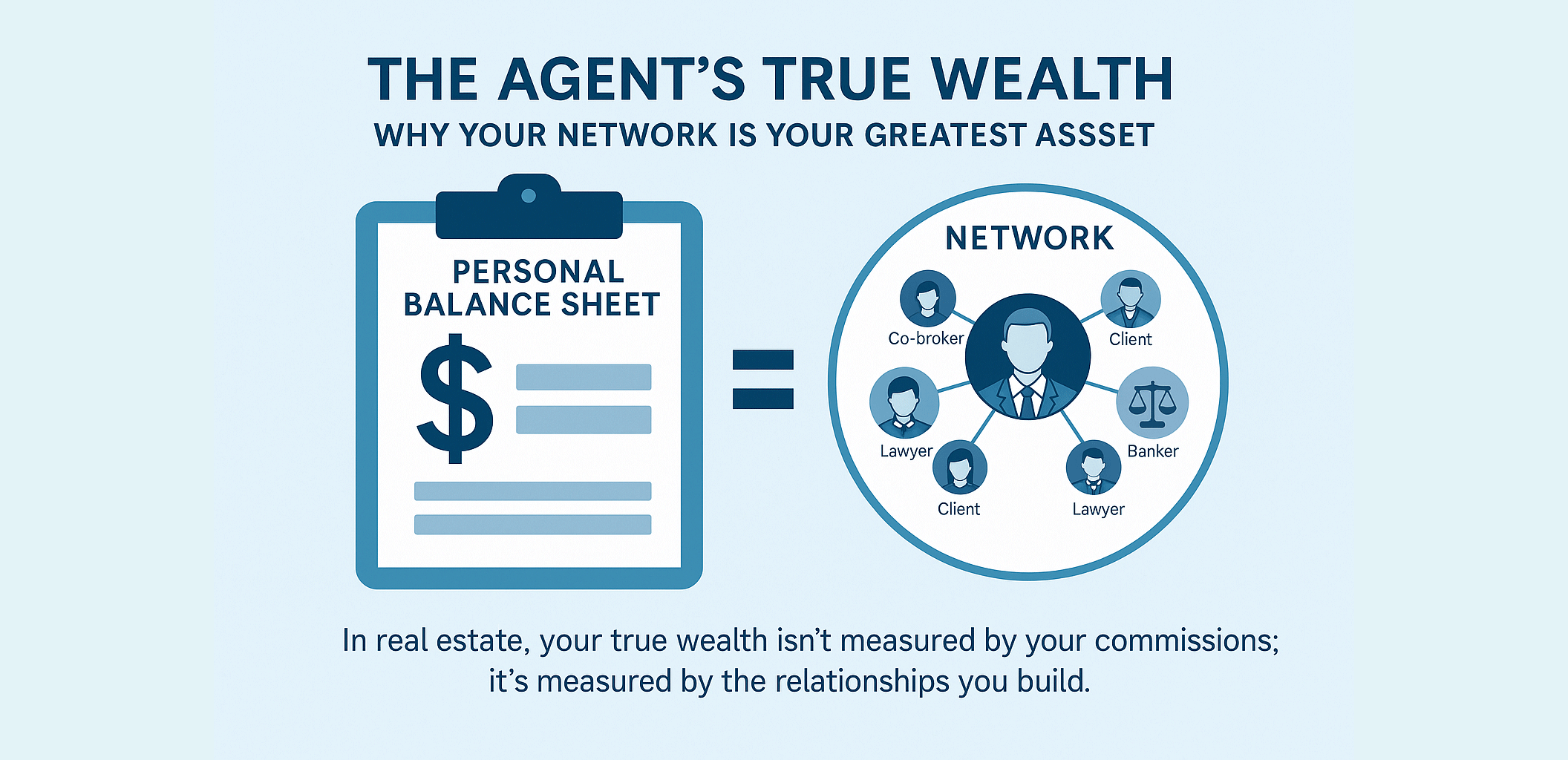

The Agent's True Wealth: Why Your Network Is Your Greatest Asset

In real estate, your true wealth isn’t measured by your commissions — it’s measured by the relationships you build.

Every client, co-broker, lawyer, and banker you’ve ever worked with sits quietly on your Personal Balance Sheet. Unlike your agency’s CRM, this asset moves with you — and it compounds over time.

1. You Own the Relationships, Not the Brand

Many agents mistakenly believe they are building the agency’s business. In reality, they’re leveraging the agency’s brand to build their own personal network.

When you switch brokerages — or even industries — the only thing that stays is the people who trust you. A database of loyal clients and industry contacts is worth far more than any short-term commission.

That’s why top performers invest in Relationship Equity: remembering birthdays, sending market updates, and connecting buyers and sellers even without a deal in hand. Every act of trust adds value to your personal balance sheet.

2. Your Network Compounds Like Capital

Think of each connection as an investment. At first, a single co-broker or first-time client may seem small.

But networks don’t grow linearly; they grow exponentially. A well-maintained network generates referrals, introductions, collaborations, and exclusive access to off-market deals.

The compounding effect begins when you become a connector, not just a closer. Every time you help two people achieve something together, your reputation as a trusted node in the network grows — and opportunities start finding you.

3. The Network Is Your Insurance Against Downturns

When the market slows, listings dry up and buyers hesitate.

But agents who’ve built strong networks rarely struggle. They receive private calls, quiet co-broking invitations, and partnership offers that never appear on public portals.

Your reputation becomes a form of insurance — a defense against market volatility. The most resilient agents aren’t the loudest marketers. They’re the ones whose phones still ring when everyone else goes silent.

4. Manage Your Network Like a Portfolio

Your network, like a financial portfolio, demands structure and consistent attention:

- Diversify: Don’t rely only on developers or one co-broking circle. Build deep ties with lawyers, bankers, and long-term owners.

- Audit Regularly: Who adds value? Who drains time? Keep your relationships strategic.

- Reinvest: Follow up, send value, attend events, and stay visible. Dormant contacts lose value over time.

Your phonebook is your equity. The more intelligently you maintain it, the more future income you unlock.

5. Protect Your Relationship Equity with Independent Tools

A major risk of agency-owned CRMs or shared platforms is that your data and relationships vanish when you leave.

A smart agent builds independent infrastructure — a private CRM, verified listing vault, and lead-tracking system that remain theirs for life.

That’s exactly why ListingMine exists: to help agents protect their personal database while still collaborating within agency groups. It ensures your relationships remain your property, not your employer’s.

Conclusion: The Asset That Outlasts the Commission

Every commission you earn pays the bills.

Every relationship you build pays dividends for life.

Your agency might change. The market might fluctuate. But your network — if protected and nurtured — becomes your lifelong business partner.

When you start managing your career like a Personal Balance Sheet, you stop being just an agent. You become an asset owner.