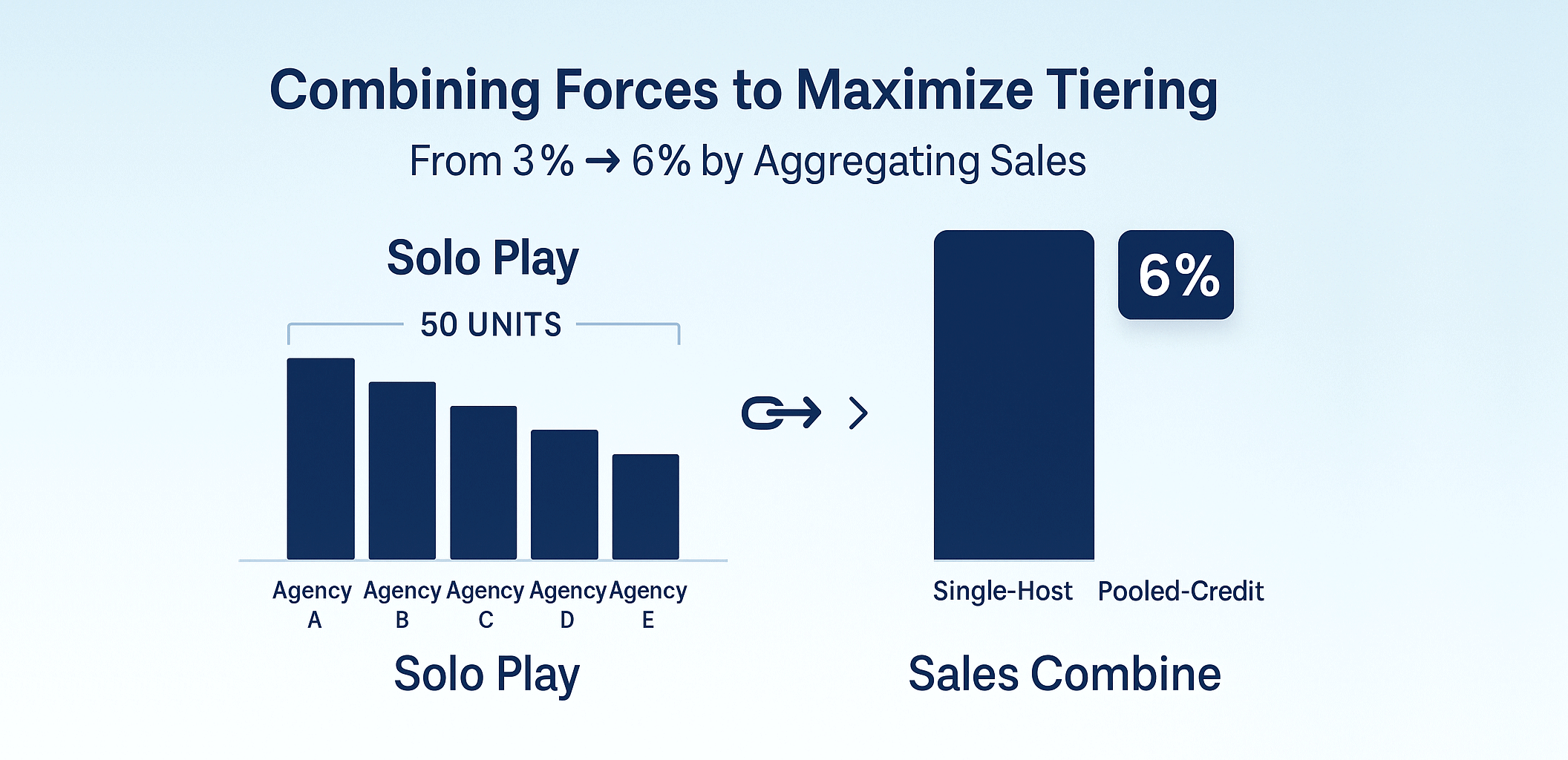

The Developer Commission Playbook: Combining Forces to Maximize Tiering

A new launch drops. To “minimize risk,” the developer appoints 4–5 agencies and offers tiering: 3% base rising to 6% at a high target (e.g., 50 units). Competition is supposed to drive sales. In reality, it fragments effort—and most agencies never reach the top tier alone.

The Solo Trap

Split across multiple appointments, a 50-unit target is steep. A typical outcome:

- Agency A: 15 units

- Agency B: 12 units

- Agency C: 10 units

- Agency D: 8 units

- Agency E: 5 units

Everyone remains stuck at 3% while the developer still gets velocity.

The Shift: Compete on Execution, Collaborate on Tier

Experienced bosses coordinate. They aggregate bookings under one credited channel to cross the top tier, then share the upside privately. The developer sees one high-performing channel; the agencies convert fragmentation into margin.

The Math (RM500,000 unit; top tier at 50 units → 6%)

| Scenario | Units | Rate | Per-Unit | Total |

|---|---|---|---|---|

| Solo (49) | 49 | 3% | RM15,000 | RM735,000 |

| Combined (50) | 50 | 6% | RM30,000 | RM1,500,000 |

Difference: +RM765,000 unlocked by crossing the final threshold. Per unit, moving from 3% to 6% adds RM15,000—a decisive premium worth coordinating for.

Two Valid Structures

- Single-Host (Fastest)

All bookings are credited to one agency code (“Consolidator”) until the tier is reached. Contributors route confirmed deals under that code. Simple for the developer; fastest path to tier. - Pooled-Credit (Cleanest)

The developer issues a brief side letter confirming that bookings from the named agencies are counted together toward one ladder and the tier rate applies to all pool units. Lower trust friction; needs the developer’s written nod.

Positioning to the Developer (30-Second Script)

“We’re forming a sales pool to hit your top tier within the launch window. You get velocity and simpler reconciliation. Either credit under one code or issue a pool side letter. Apply the top-tier rate to all pool units booked in the window.”

Bottom Line

Tiering rewards volume. Cooperation turns fragmented appointments into collective scale—and scale into margin. Combine forces, align counting rules with the developer, and unlock the difference between 3% and 6%.