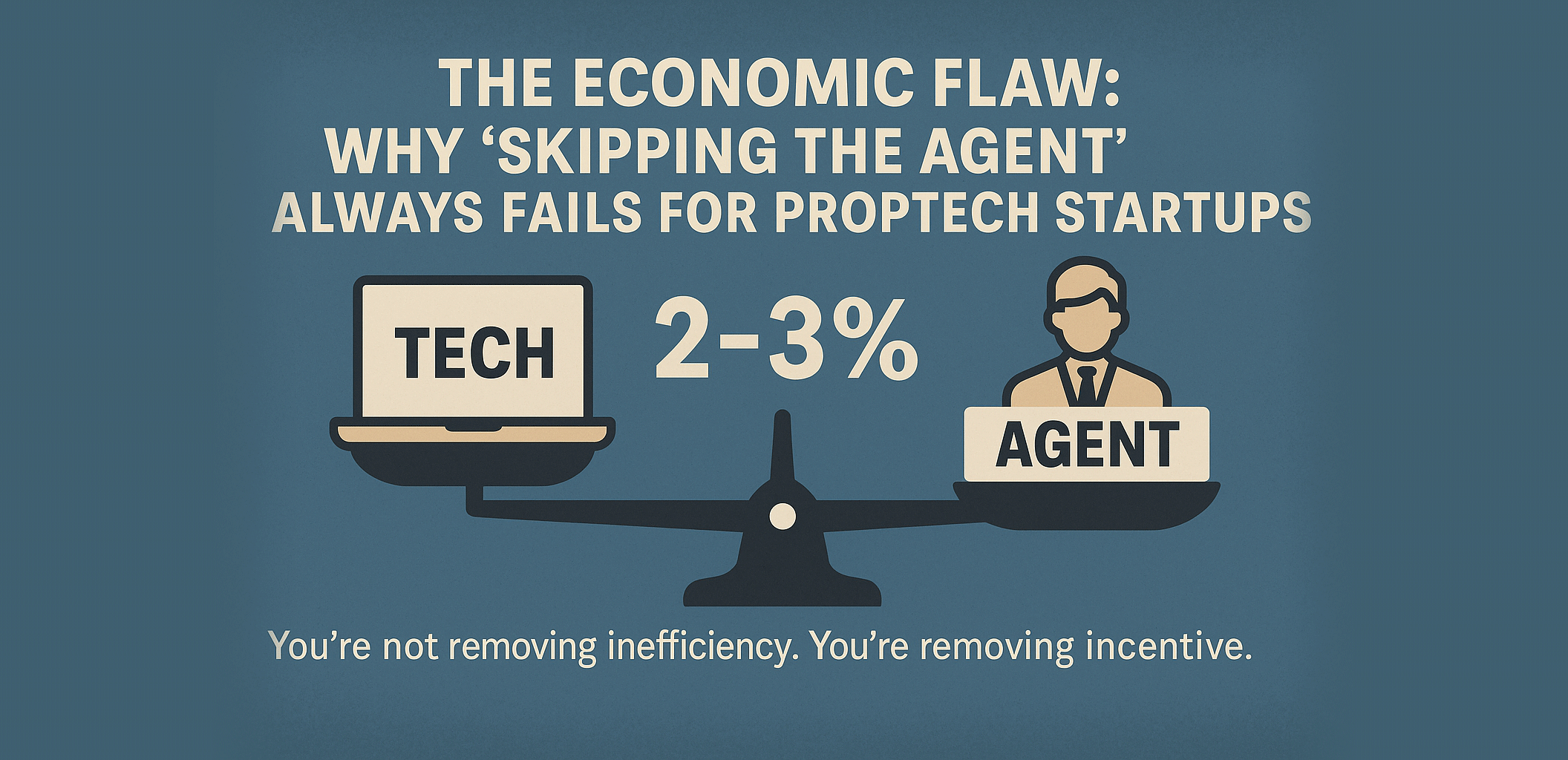

The Economic Flaw: Why "Skipping the Agent" Always Fails for Proptech Startups

Every few years, a new wave of startups enters the property market with the same seductive promise: “Skip the agent. Save the 2%−3% commission. Sell direct and pocket the fee.”

It sounds brilliantly efficient. If the agent's work can be digitized, why pay the premium?

But this belief ignores the fundamental economic reality behind the commission. The 2%−3% isn't a random markup—it's a price discovered by the market through decades of negotiation. It reflects risk, effort, and value, not regulation or habit.

If agents truly added no value, the profession would have died long ago. The market would have already evolved toward zero-fee transactions. Yet, it hasn't—because every attempt to replace the 2%−3% model has collapsed under real-world economics.

Today, agents in tough markets are charging higher commissions than ever. When buyers are scarce, the value of those who can actually close rises. That is supply and demand at work, not cartel behavior.

1. Flat Fees Already Failed (The Market Rejected Fixed Pricing)

Proptech founders love the idea of "fixed pricing." It feels transparent, predictable, and disruptive. But sellers tried that long before your app did.

They offered flat fees—RM400, RM1,000, even RM10,000—and agents walked away. Why? Because fixed fees don't reflect effort or risk.

Agents don't just show listings; they:

- Spend money upfront on marketing, travel, and viewings.

- Take risk with no guaranteed outcome.

- Invest weeks or months nurturing a lead.

When the outcome is uncertain, pricing must scale with success. That’s why the market abandoned fixed fees and adopted percentages.

Look at the flat-fee and direct-deal platforms that have existed for over a decade. Are they dominating, or are they stagnant, niche, or forced to pivot into lead generators? After ten years, agents still close the vast majority of transactions.

These models didn't fail due to poor marketing or funding. They failed because the pricing logic was wrong. Flat fees ignore risk—and any model that ignores risk eventually collapses under it. You’re not reinventing the wheel; you're repeating an experiment the market already rejected.

2. The 2%−3% Commission Is Market Equilibrium, Not Collusion

Proptech critics often claim the 2%−3% rate is "industry collusion." It's not; it’s market equilibrium.

Over decades of bargaining, both sides converged on a sustainable range:

- Sellers won't pay more than 3% because margins matter.

- Agents won't accept less than 2% because cost and risk matter.

This is the same economic logic that prices insurance premiums and loan spreads: risk has a cost, and markets find it.

If your startup tries to "remove" that cost, you're not innovating—you’re shifting the risk back to the seller. When sellers realize the risk-return equation no longer works, they revert to agents.

3. Commission Moves With Market Cycles (Proof It’s Value-Based)

If the 2%−3% were a cartel rate, it would be fixed. But it's not—it moves with the market:

| Market Condition | Buyer Demand | Agent Value | Typical Commission |

|---|---|---|---|

| 🔥 Hot Market (Easy Sales) | High | Low Differentiation | 2% or less |

| 🧊 Slow Market (Hard Sales) | Low | Scarcity of Closers | 4%−10% |

When anyone can sell, commissions drop. When only experts can sell, commissions rise. This is the definition of supply and demand. The agent's value is elastic; it rises when their skill matters most.

4. You’re Fighting Incentives, Not Technology

Every proptech model that promises “no agent” ignores a simple truth: Incentives move behavior, not apps.

A 2%−3% commission aligns effort with outcome:

- Agents work harder because reward scales with price.

- Sellers take zero upfront risk.

Remove the commission, and you remove the motivation to act. No amount of UX design can replace incentive alignment. That's why platforms that eliminate agents often end up reintroducing "verified closers," "premium consultants," or "success fees" under new names. They rediscover the same truth: no one works for free under uncertainty.

Final Thought: Technology Should Clarify Value, Not Cancel It

If your goal is to "save the 2%−3% fee," you’re solving the wrong problem. That fee isn't inefficiency—it's compensation for risk, trust, and execution.

Agents survive because the market keeps hiring them—over and over, even after every "disruption" attempt fails.

Ask yourself honestly: Does your platform have ready buyers? Because unless your technology can reliably generate demand, you’re not replacing the agent; you’re removing the only person still bringing the buyer to the table.

The 2%−3% commission isn't arbitrary. It’s the price the market discovered, tested, and reinforced to move an uncertain, high-value transaction to completion.

If your model can't explain who absorbs that cost once you remove it, you haven’t disrupted real estate—you’ve deleted the incentive structure that makes it work. The future isn't agent-less. It's agent-enabled—where technology clarifies value, not cancels it.